March 13, 2018

L&S Risk Pulse™ Score

Medium +

Core economic indicators are healthy, but markets indicate potential near-term volatility and/or mild correction. Valuations are trending high.

L&S Risk Pulse™ Insights – “To Inflation and Beyond (with apologies to Buzz Lightyear)”

General Comments

February started with stock markets reeling from concerns over higher labor costs, increasing inflation, and the likely Fed rate hikes that are on the horizon. Markets fell more than 10% at its worst, erasing the gains from January and reminding investors that markets do not go straight up. Corrections are a normal and healthy part of stock market advances. By early March the correction appeared over, and most of the losses were recovered.

Other surprises that took shook the market’s confidence were the announcement of tariffs on steel and aluminum and the resulting departure of economic advisor Gary Cohn. In the past we have identified trade wars as one of those external shocks that could alter the course of economic growth. While the president did temporarily exclude Canada and Mexico from the imposition of tariffs, signaling to some that he seeks a middle ground, it is difficult to identify what good may come from these actions. We are not believers that tariffs will be effective, and history is littered with the destitute remains of nations who thought trade wars could easily be won. To be fair, Mr. Trump was clear about his desire to alter trade disparities, and this was just another campaign promise that he is trying to fulfill. The big question is whether the tariffs on steel and aluminum will be the end of such actions, or will other nations impose their own retaliatory tariffs, which will force us to retaliate with additional tariffs and trade restrictions until global economic activity grinds to a halt? So far the retaliation has been contained and exceedingly modest. What is likely is that policy surprises will keep investors on their toes, and will likely be an additional cause of increased volatility.

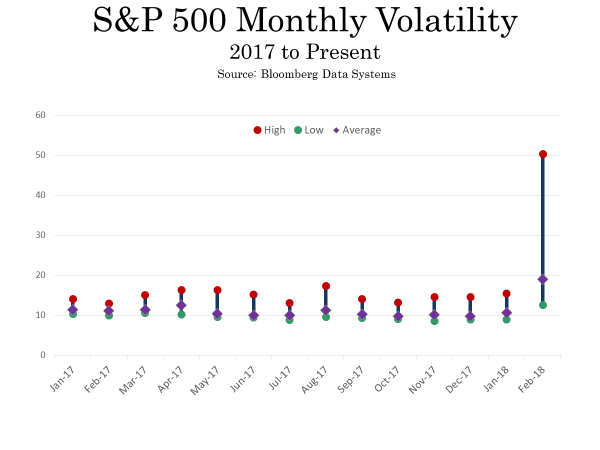

Volatility, which measures the amplitude of swings in stock prices, is shown in the chart below. It is clear that volatility was very low throughout 2017, but February was a different animal altogether. The most volatile days in 2017 hardly compare to the February data. Volatility returned with vengeance, and we expect volatility to remain at a higher level than we saw last year. In many ways, the current level of volatility is more like long-term averages, and the very low levels of volatility seen last year were the aberration. It will take some time for investors to get more acclimated to greater volatility, and this may be another sign that this expansion is entering a later stage.

The recent market correction started with an employment report, and the most recent employment report gave reason to suggest that those fears may have been overblown. The economy created 313,000 jobs in February, with strength in nearly every sector. Further, that job creation occurred without additional pressures on inflation. Average hourly earnings increased only 0.1% for the month and 2.6% for the year, and that number was below the troublesome number of 2.9% reported previously. We are seeing solid economic growth without inflation, the best of all possible worlds, and the market has responded quite positively as we move into the middle of March.

Data Points and Global Economic Indicators

In the long term, markets reflect corporate earnings. When earnings are rising, stock prices are likely to follow. There are times when valuations contract, and growth in corporate earnings do not lead to strong stock price gains. Expectations continue to suggest that corporate earnings growth will be robust in 2018, and that is one of the best reasons to be encouraged that the market will likely work its way higher as this year progresses.

Interest rates continue to trade in a range that is higher than last fall but not materially higher than the end of January. Any significant increase in rates would be a cause for concern.

Global economic growth remains strong, and troubling signs are few and far between. Volatility has increased, but valuations are more attractive then they were at the start of the year. We are hard-pressed to find economic indicators that suggest risks are rising dramatically.

Conclusion

It is important to watch out for increasing risks. The good news is that risk management is part of our culture. We are constantly monitoring economic indicators to see if risks are rising and if investors’ positioning should be adjusted. We do expect higher volatility, but we also expect higher corporate earnings. We have not increased our Risk Pulse™ so far, but we remain on alert for data that suggests the status quo has changed. We do not expect a recession over the next few quarters, and we do believe that higher earnings will lead to higher stock prices even if the road to get there is far more volatile than we would like.