July 19, 2016

There are decades where nothing happens; and there are weeks where decades happen.

– Vladimir Ilyich Lenin 1870 – 1924

The last week of the first half of 2016 seemed like one of those weeks that Vladimir Lenin was referring to. In a non-binding resolution, the British people voted to exit the European Union (EU) after 20 years as part of the one of the world’s largest trade organizations. In many ways, this was a self-inflicted wound as Prime Minister David Cameron had called for a vote to quell complaints over membership in the EU.

To be fair, the European Union is seriously flawed. It represents an organization that has been very successful at promoting free trade among its members. Most of the members, however, embraced a single currency, and that decision prevents weaker countries from using their currencies as a way to increase competitiveness. Countries have not only given up their own currency, but they also must accept regulatory rules that are dictated to member states from the EU headquarters in Brussels. Those regulatory rules include policies on immigration which is was one of the points that drove the British away from the rest of the Continent.

In the lead-up to the vote, the polls were showing British voters were likely to vote to leave, an act described as “Brexit” which is short for a British exit from the EU. The uncertainty of the potential exit caused markets to weaken as markets hate uncertainty. Following the murder of a British member of Parliament, the polls seemed to reverse. Markets and pollsters alike embraced the idea that Britain would stay in the EU and the uncertainty of such a move would be contained.

The early results showed how wrong the markets and pollsters had been. Even before the actual results were known, markets began to weaken. By the time the results were known, markets around the world were reeling. Stock prices fell and money rushed to the safety of government bond markets, driving interest rates to record lows in many global markets. British Prime Minister David Cameron, who had called the bluff of the British people, did what he felt was the honorable

thing and resigned as Prime Minister. Citing the need for a new Prime Minister to lead the British exit from the EU, Cameron indicated he would call a new election by the fall.

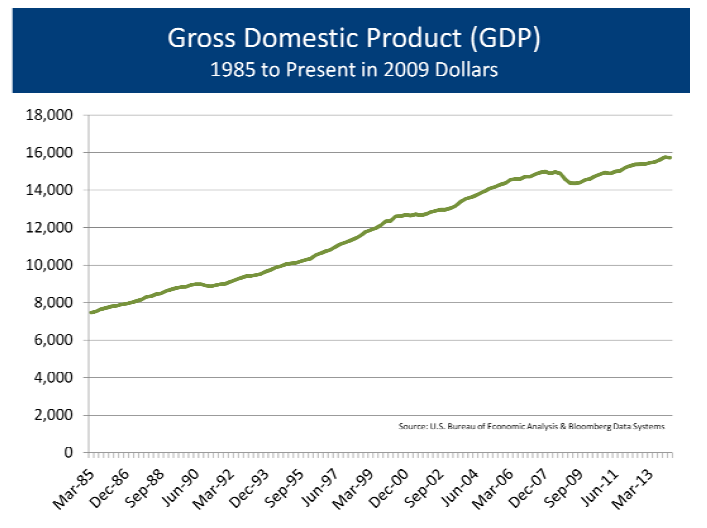

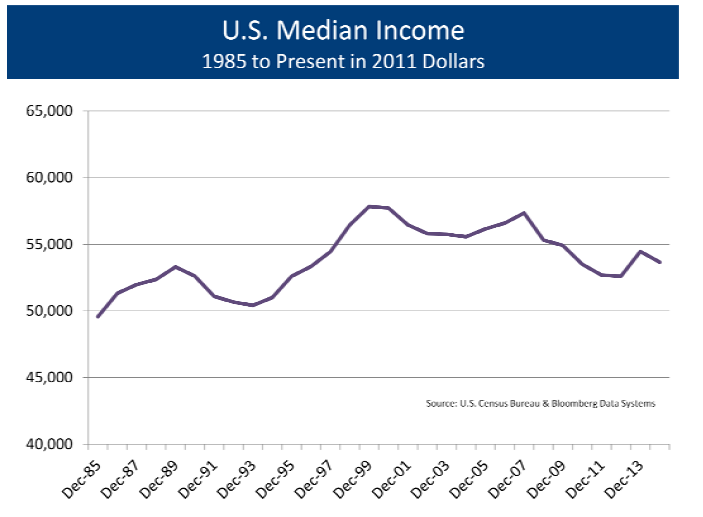

It seems that many Brits voted to leave as a vote to express their dissatisfaction. Politicians have often shown themselves to be untrustworthy, and though globalization may have helped broad economic growth, it is easy to see why average folk do not believe that they have been helped by global trade or by liberal immigration policies. Older, more rural people were the ones who voted to leave the EU while the younger and more urban voters were the ones who felt it beneficial to stay.

There seems to be a significant amount of British voter remorse. As Google search data showed, the largest number of searches following the results of the vote were questions about what it meant to leave the EU and even questions about what the EU is. One would only hope that voters educate themselves prior to voting and give sufficient consideration to what the ramifications of a particular position might be.

Interestingly, the politicians who were most vocal about the benefits of leaving, including saving some £350 million per week that could be used to fund the British National Health System rather than fund the EU, have already backed away from those promises. Boris Johnson, the former mayor of London and a key proponent of the “leave” campaign, has decided not to run for Prime Minister. The leader of the UK Independence Party has already received a vote of no-confidence. Britain seems to have a leadership vacuum, although some candidates have finally stepped forward over the past few days.

The Lisbon Treaty that created the EU does not have provisions that permit member-states to leave. It is Hotel California-like, in that “you can check-out any time you like, but you can never leave.” Part of the uncertainty about the British vote is the question of whether it will create the proverbial domino effect of members trying to leave the EU. If Britain can leave, why not Greece, the Netherlands, or even France. If the EU dissolves, will free-trade among the 27 EU nations go with it? And what will replace the existing treaties? This creates enormous uncertainty that does not give investors a warm and fuzzy feeling.

According to the Lisbon Treaty, the British must enact Section 50 of the treaty, which gives the members two years to negotiate their divorce. Since David Cameron will not be enacting section 50, the next PM will start the two-year clock following their election. This means that the British will not leave the EU before the end of 2018. And what happens if the next British Prime Minister does not feel compelled to enact Section 50? It is not entirely clear that a British exit from the EU will actually happen. Californians have recalled Governors, and the Greeks have changed their mind on further austerity programs, so why can’t the British call a mulligan (a do-over) about their Brexit vote? Markets have taken solace from the fact that there is ample time to understand the Brexit before it ever happens, or if it ever happens, and most markets rebounded sharply after the first two days of Brexit-related selling pressure.

The one thing that that seems clear is that there is a significant number of voters who are disappointed with the status quo, and who feel that globalization is failing them. The issues that led to the results in the UK are the same issues that gave rise to the Donald Trump and Bernie Sanders campaigns here in the United States. Just as the move to a more conservative government began

in Britain with the election of Margaret Thatcher in 1979, and then followed on this side of the pond with the election of Ronald Reagan in 1980, the move to a more anti-establishment, xenophobic regime has started in Britain and could easily represent the likely results of the election here in November. In some respects, the Brexit vote could be the most important foreshadowing of who may be our next President. Voting to shake things up could have unintended consequences, just as the British are just starting to realize.

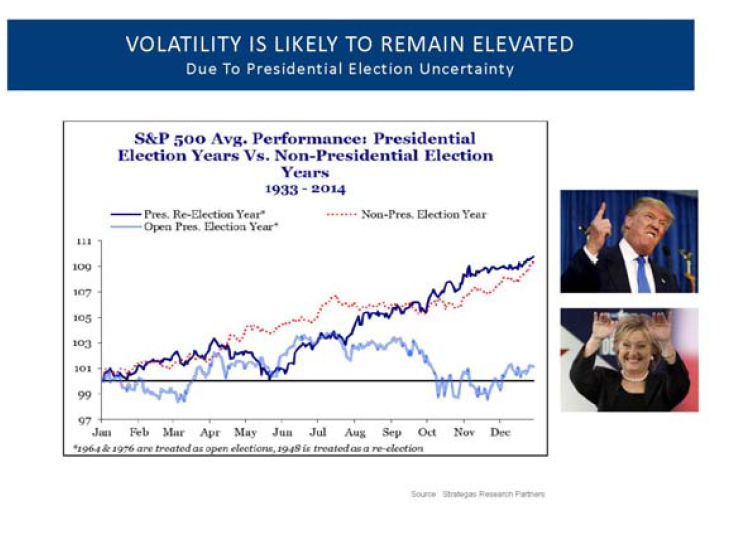

Political uncertainty will remain a factor for the U.S. market through election day. Not only will Americans be selecting a new president from two candidates that are generally unlikeable, but the balance of power in the Senate may also be up for grabs. The House of Representatives seems unlikely to fall into Democratic hands, but some prognosticators believe the probability of a Democratic-ruled house is higher than it was three months ago. Polls will surge for each candidate as their conventions reflect unbridled optimism about their candidates, but the election is likely to be closer than many people believe. This uncertainty will make it difficult for stock markets to show meaningful gains.

Pay to Play

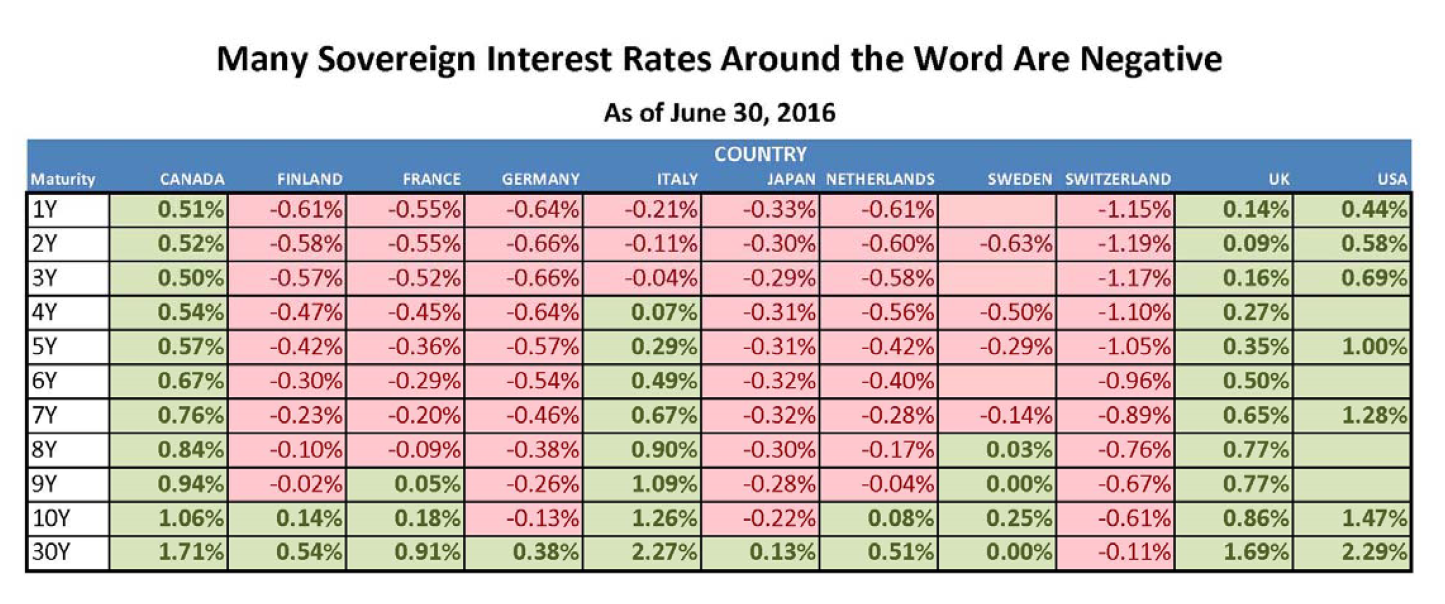

Following the Fed’s interest rate increase last December, the message from the Fed has been that they are looking for the opportunity to raise interest rates further. It is not so much that the economy is over-heating, but the Fed, like many other monetary authorities around the globe, is worried that they have no tools at their disposal should the economy fall into a recession. We do not believe that a recession is likely, but we acknowledge that growth remains weak, and the Fed appears to be out of bullets. After lowering interest rates to zero, many central bankers around the world have continued to lower interest rates to what we call negative interest rates. With negative interest rates, an investor would lend $101.00 to the government for the guarantee to receive $100 at the end of the term. A guaranteed loss. Though this seems absurd, the number of countries offering negative yields continues to grow, and a significant amount of government bond markets around the world are currently providing negative yields.

The policy thought process around negative interest rates is relatively simple. Since you must pay to hold cash, monetary policy makers hope that this will encourage banks and other investors to make investments in productive projects and investments, and not hold any cash. Academics have often referred to this as

“pushing on a string.” If growth is slow and corporate executives have little confidence that they need to expand, earning a modest return, no return, or even a small negative return will not encourage savvy operators to spend money.

“pushing on a string.” If growth is slow and corporate executives have little confidence that they need to expand, earning a modest return, no return, or even a small negative return will not encourage savvy operators to spend money.

There are likely to be unintended consequences of such a policy, and we are seeing those outcomes in many parts of the world. In Japan, one of the first nations to embrace a negative interest rate policy, the sale of safes has risen dramatically. Earlier this year, the Wall Street Journal reported that safe sales were up 250% in Japan. In Europe, investors are seeking out large denomination banknotes. Regulators have decided to phase out the €500 Euro notes by 2018. These notes are perceived to be used by black marketers, but they are also being held by investors who are unwilling to lose money on their savings. Gold has always had a negative interest rate. In order to hold gold, an investor must pay for a safe or safe deposit box, and must also pay to insure the holdings. These costs, and the fact that gold does not provide a dividend, have always been a disadvantage for gold as compared with other assets. Now that many government bonds provide a negative interest rate, more people are willing to hold gold coins. At least gold coins are interesting especially when compared with government bonds. Why not own shiny objects with pictures of pandas on them?

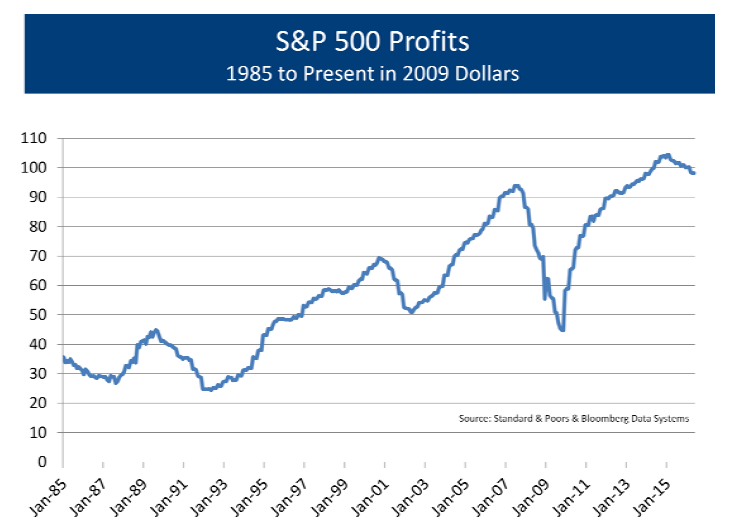

People are unwilling to guarantee a loss on their savings, so they are simply putting their money in the proverbial mattress. This makes government’s negative interest rate policy completely ineffective. Not only have negative interest rates not encouraged capital spending, but, by putting funds in safes or in gold coins rather than in banks, the banks actually have less ability to make loans when the demand for lending finally increases. Banks are actually charged for holding cash, and, with little demand for lending, they have no ability to earn a return on their deposits. This hurts the banks’ ability to maintain or even grow their profits. In a perverse world, negative interest rates may actually be hurting economic growth.

Economic Tea Leaves

At L&S Advisors, we spend significant efforts trying to decipher the economic signals. We know that recessions cause corporate earnings to decline, so we are always on the look-out for signals that might suggest a recession is on the horizon. Our two best signals come from interest rates and the government’s index of Leading Economic Indicators.

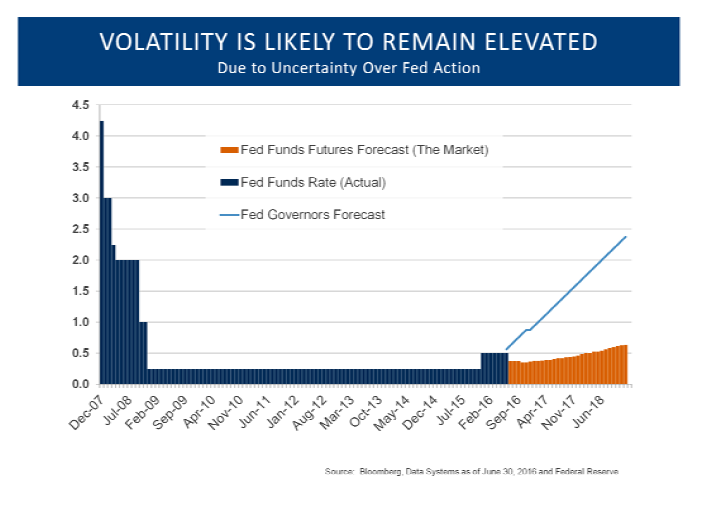

Economic expansions never die of old age. They are generally murdered by policy mistakes. The most common mistake is driven by the desire to squeeze excesses out of the system by increasing interest rates. The Fed started on that path late last year, but with slower economic growth, and the effects of Brexit, the market does not believe that interest rates will be increased any time soon. In fact, the Fed Reserve Governors’ forecast of where they believe interest rates should be, and the market’s forecast of where it believes interest rates will be, are vastly different. This discrepancy of how much interest rates are likely to increase adds further uncertainty to a market struggling for direction.

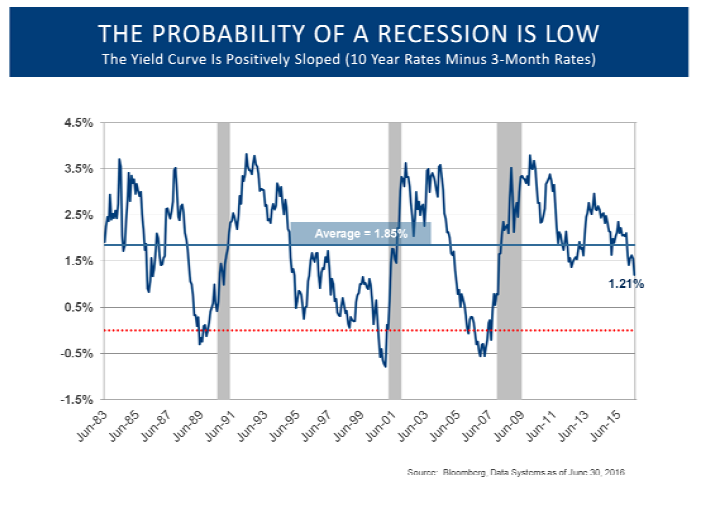

While longer-term interest rates have fallen, short-term interest rates remain well below longer-term rates. When short-term interest are above longer-term rates, it is a sign that interest rates are too high, and a policy mistake is in the making. We call this an inverted yield curve, and this has been one of the best indicators of when a recession is on the horizon. While the spread between short-term interest rates and long-term rates is well-below average, it is not giving us a sign that a recession is pending.

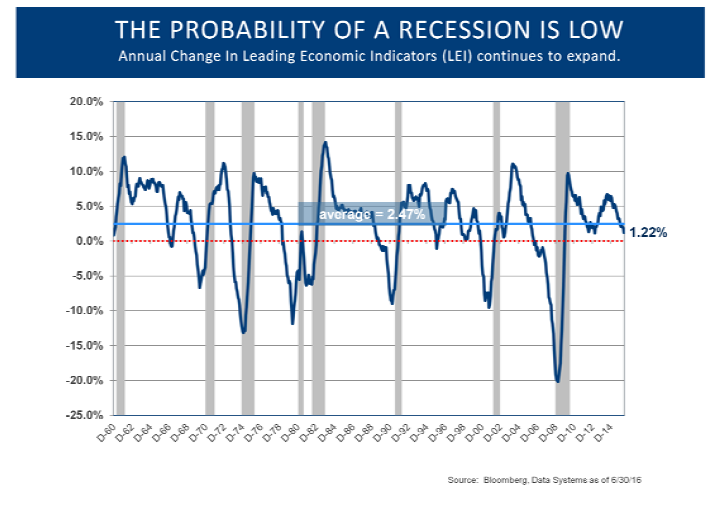

Likewise, the U.S. government’s index of leading economic indicators has also been a good tell of when a recession might be on the horizon. When the index is declining as compared with the level twelve months ago, it is a sign that a recession is likely over the next few quarters. This indicator is not flashing a recession, but it is showing that growth is expected to remain anemic.

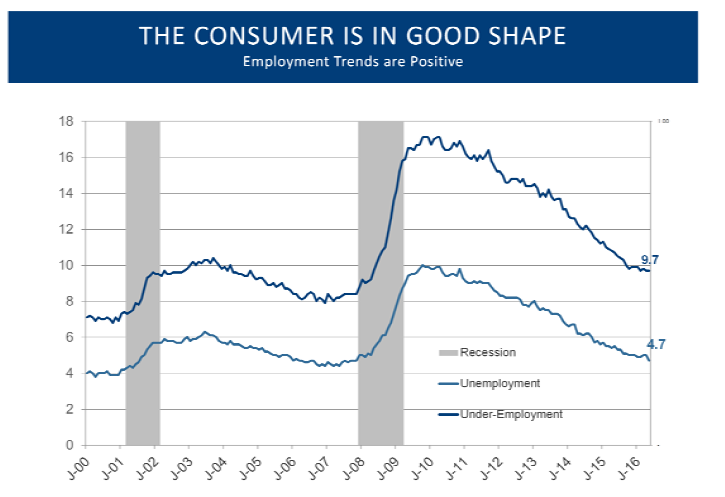

Other indicators can best be described as bipolar. Housing has been strong and consumer spending has held up while corporate confidence and capital spending have been languishing. Our take is that the Risk Pulse is elevated. Many indicators have been weakening for many months, and there are few signs of outright strength. We believe some prudence is required as the future economic direction remains uncertain.

Our read of the data points puts us in an excellent position to take advantage of appropriate investment opportunities as they present themselves.

Investment Themes

As we mentioned above, we remain concerned that low or even negative interest rates make it difficult for financial services firms to maintain or grow their profits. This limits the attractiveness of these stocks, and selecting stocks in this sector needs to be done with care.

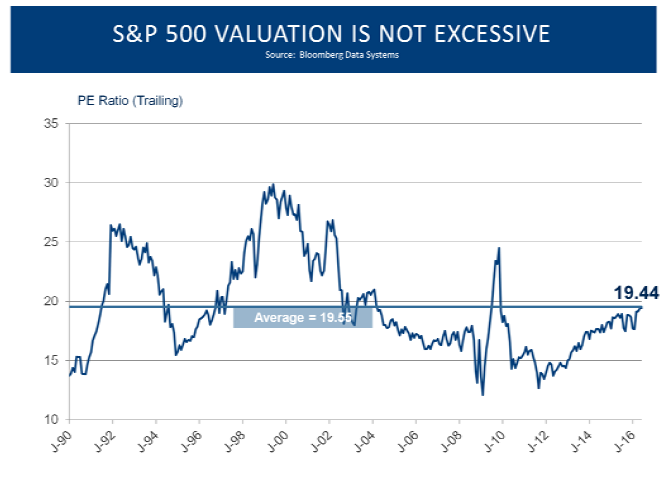

With the low level of interest rates, we expect stocks that provide solid dividend yields to remain attractive. This group includes bond substitutes like utilities and telecommunication stocks, and other large-cap global competitors. We recognize that utilities are getting expensive relative to their historic valuations, and we remain vigilant about any change in sentiment that might suggest this group is vulnerable.

We are interested in the ‘Internet of Things” which will usher in an era of unparalleled connectivity. The world moving from 4G internet speeds to the exponentially faster 5G speeds will hasten this interconnection from driverless cars and smart traffic lights and electric grids to automated homes.

Our country’s infrastructure is crumbling and will have to be repaired and replaced over the coming decades. Hopefully the next administration will bring about fiscal spending to address these areas of need. Commodity prices have been weak, and earnings estimates reflect this steep decline. As some commodity prices stabilize, it may be that earnings estimates have fallen too far, which will create interesting investment opportunities.

We remain encouraged by progress made by new therapies in fighting chronic diseases, including cancer. As we age, we spend more of our incomes on healthcare, which is also driving increased political pressure to control costs. Important breakthroughs in the area of cancer and Alzheimer’s will help drive the needed reduction in the cost of providing healthcare. While valuations are average, demographics suggest health care will continue to capture a greater share of consumer spending. We continue to look for attractive opportunities in the health care sector.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment advisor with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified for the periods October 31, 2005 through December 31, 2015. Upon a request, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.