The story of L&S Advisors begins in the late 70s. From the beginning, my partner, Ralph “Rick” Scott, and I focused on Risk Management. This emphasis on Risk Management initially led us to investments in private equity partnerships. We focused on those partnerships which minimized our clients’ taxable incomes in hopes of preserving more of their yearly income, rather than losing it through tax liability.

In the mid-80s, following major changes to tax laws, L&S Advisors expanded our expertise and offerings. We started a new fund dedicated to risk arbitrage, a hedge fund style of management which took positions in corporations anticipating the successful completion of a merger or acquisition. Through the experience of running this fund, we became deeply knowledgeable in the interplay between risk and investments.

Ralph “Rick” Scott, left, and Sy Lippman in the early days.

In the early 90s, we began to believe the investment industry was overly focused on chasing outsized upside returns. As a result, they left investors exposed to downside losses that could harm portfolios and take years—and sometimes even decades—from which to recover. We wanted to protect our clients from such losses. So, we focused on the risks of losing capital and made downside protection our top priority.

Our specialized evaluation of risk vs. return culminated in the introduction of an investment style with risk management and capital preservation at its core. This was unusual for its time—a time when buy-and-hold was the dominant philosophy, and riding the markets down was accepted as the cost of investing.

In 1993, L&S Advisors acquired the money management arm of Imperial Bank and increased the assets managed to our unique risk-focused investment styles. Then, in 1997, seeing the benefit of our approach and seeking to add our risk management investment styles to their stable of managers, Merrill Lynch acquired the company. Eight years later, in 2005, Rick and I decided to return to our roots as an independent boutique firm. We reformed L&S Advisors as a Registered Investment Adviser dedicated to personalized client service.

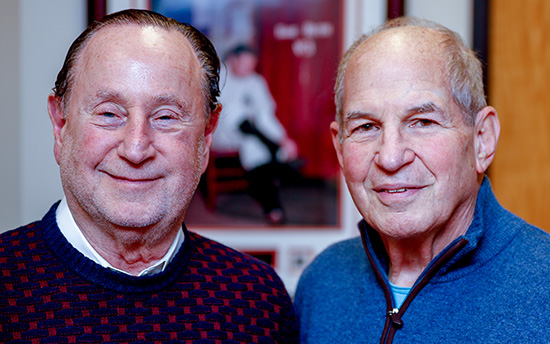

Ralph “Rick” Scott, left, and Sy Lippman present day.

In 2012, Rick’s son, Jason Scott, joined the team launching a new chapter in the L&S Advisors story. During this period, we began to expand upon our views of Risk Management. We introduced the L&S Risk Pulse™, our quantitative and qualitive analysis of numerous data points, to determine risk levels in the capital markets. At this time, we began to incorporate additional risks into our investment philosophy. We saw the need to manage for our ever growing and diverse list of high-net-worth clientele, the risks of not capturing upside, the risks of loss of opportunity, and the risks of not investing fully across asset classes. We thus began a campaign to bring additional seasoned investment portfolio professionals to L&S to help manage these additional risks. This effort led to portfolio managers Craig Weston, Ken Malamed and Mathew Nussbaum joining the L&S family. Not only did Craig, Ken and Matt bring vast knowledge and experience, but they also provided added capability. L&S expanded our product offerings incorporating fully invested equity, passive ETF, investment grade as well as high-yield fixed income strategies to our menu of investment offerings. In 2012, L&S promoted seasoned operations executive Ian Manongdo to Chief Operating Officer to help support our new product offerings and strengthen our commitment to highest standards of customer service.

Stephen Seo joined L&S Advisors in early 2023 as President. With Stephen, L&S further expanded upon our commitment to managing the risks of loss of opportunity. Through Stephen’s numerous relationships within the industry, L&S has introduced unique alternative investment opportunities to our clients. We now have the ability to compliment our inhouse extensive pubic market offerings with a wide array of private products from industry leading fund managers.

As always, we remain committed to our mantra that Risk Management Transcends Everything. We are very excited for the future of L&S Advisors and our continued efforts to help our clients achieve their goals.

—Sy Lippman