October 14, 2016

Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

– Sir John Templeton 1912 – 2008

Prior to the end of the quarter, we raised our Risk Pulse® to reflect what we perceive as an elevated risk level. We cited several reasons for our concerns, and it is worth taking some time to review our rationale, and consider how those factors should affect the last quarter of the year.

The uncertainty over the presidential election was reaching a fevered pitch, and we are concerned that the market is too complacent over the prospects of a Trump victory. Much as the British voted to exit the European Union (EU) as a protest against the status quo, votes for Mr. Trump could also be seen as support by people who are “mad as hell, and not going to take it any more.” While it is hard to dispute that globalization has helped all countries grow at a faster rate, it is undeniable that there are winners and losers. Some of those losers are the factory workers in the rust belt who have seen their jobs shipped overseas. One political commentator suggested that there are many angry voters out there who want to throw a Molotov cocktail into the system to watch it explode, and Mr. Trump may just be that cocktail. His lack of political experience and political correctness are seen as the consummate anti-establishment credentials that are attractive to a significant number of American voters.

Markets abhor uncertainty, and the prospects of a Trump victory is just the kind of uncertainty that can unsettle an otherwise stable environment. Secretary Clinton, for better or worse, is a fairly known quantity. She was part of the current administration, and her policies are fairly well-known and well-understood. Trump’s policies are more unknown and less consistent. Will he institute a trade war with China to offset what he sees as that nation’s blatant currency manipulation? Economists recognize that the tariffs enacted following the stock market crash of 1929 were actually a significant reason for the Great Depression and the decade of despair that followed the crash. Will Trump’s policies cause a similar economic response? And which companies will be most vulnerable to such actions? Companies that import a significant amount of their goods from China seem like ground zero for such action. We do have to consider what other companies are most vulnerable to the prevailing political winds. It is ironic that the working class people who benefitted most from the lower prices of goods made in China, are likely to be the ones whose jobs were lost as companies imported more goods from there.

As Clinton slipped in the polls we did see a pick-up in stock market volatility, but following the first debate the stock market moved up as Secretary Clinton regained her lead in the polls. Open Presidential elections, that is an election with no incumbent running, are different animals, and we would not be surprised to see markets remain volatile until just before the election when the outcome becomes somewhat more certain. We also remain nervous that polls are not properly reflecting the anti-incumbent fervor that has driven the Trump campaign to such unanticipated success.

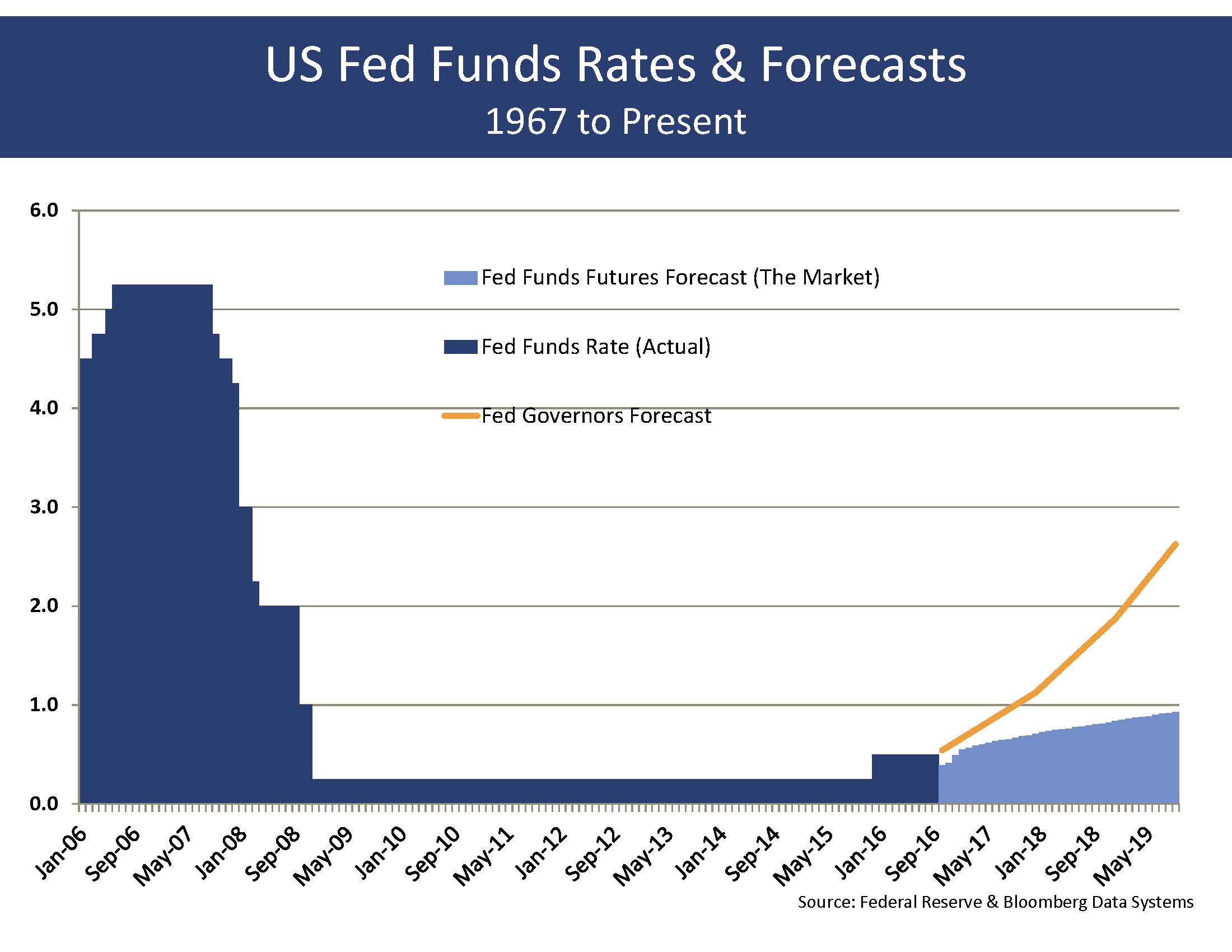

The second reason for the increase in the Risk Pulse® is the uncertainty surrounding any potential changes in interest rate policy by our Federal Reserve. The Fed raised interest rates for the first time in more than a decade last December. At that time they articulated the need for additional interest rate increases this year. Despite their admonition, the Fed has found reasons to postpone any additional interest rate hikes at every opportunity so far. In September they said “the case for an increase in the fed funds rate has strengthened but” the committee has “decided, for the time being, to wait for further evidence of continued progress towards its goals.”

Like a small child afraid of the dark, the fed has continued to find reasons not to take action. The Fed may be starting to lose credibility as they are worried about raising interest rates from ½ of 1% to ¾ of 1%. What harm could possibly come to the economy by raising the fed funds rate to ¾ of 1%? Is that a rate that is so high as to prevent any business from making an investment or productive improvement? Any investment that was profitable when interest rates were ½% but is no longer profitable should probably not be made under any circumstance.

The Fed reduced interest rates to all-time low levels in response to the dire consequence of the Great Recession. This was seen as an emergency move to help prevent the economy from spiraling lower. Seven years after the end of the actual recession, why do we still have interest rates at emergency levels? We will look at the prospects for economic growth later, but even with anemic growth, there is little justification for interest rates remaining at near-record emergency lows.

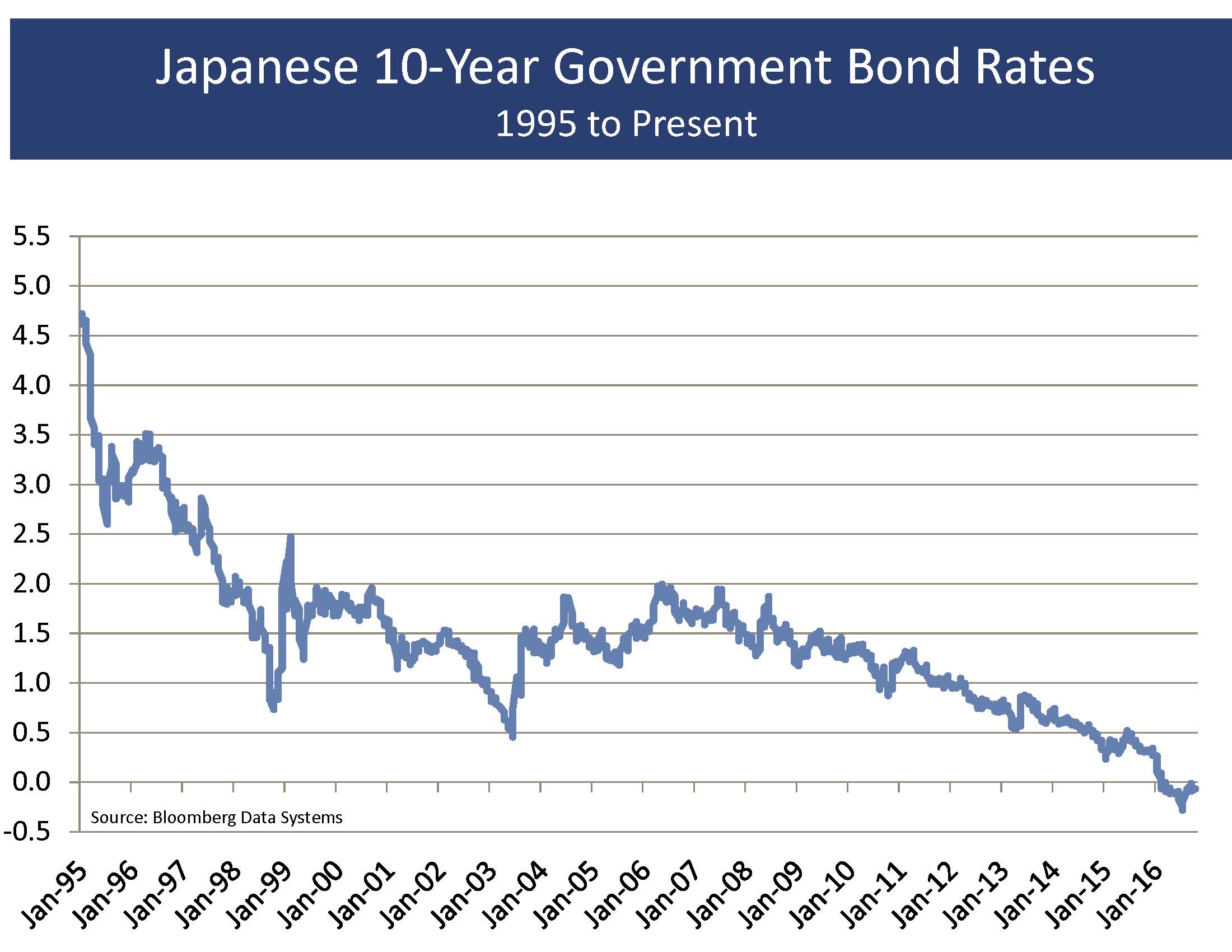

Admittedly, Central Bankers around the world must be scratching their heads wondering why the low level of interest rates for so many years has not generated the hoped for improvement in economic growth? The Japanese were the first to embrace near-zero interest rates, and rates in Japan dropped below 1% for the first time in history back in 1998, 18 years ago. Japanese rates dropped below ½ of 1% for the first time in June of 2003, more than 13 years ago, and Japanese rates dropped below zero in January of this year. If low interest rates are the key to sustainable economic growth, why then doesn’t Japan have the strongest growth on the planet? Isn’t one definition of insanity continuing to do the same thing but expecting a different result?

To be fair, the Fed knows that premature interest rate increases in the late 1930’s caused the economy to fall back into recession. They believe they should err on the side of being too easy, and only increase interest rates when inflationary pressures are rising. They are risking inflation, but they see that as a reasonable trade-off – create more inflation rather than push the economy back into recession. Still, the impact of low or negative interest rates should not be underestimated. Consider an investor who is planning for retirement. Assume they are trying to create $50,000 worth of income from their savings. If interest rates are 5%, then they must save $1 million in order to have $50,000 worth of retirement income. However, if interest rates drop to 1% then that same investor must save $5 million in order to have sufficient retirement income. Low interest rates may be providing the fed with some confidence that they are erring on the side of caution, but these same low interest rates are penalizing savers and forcing them to save even more. Why would we not expect this to have a negative impact on economic growth? Also consider that many government bonds are actually providing negative interest rates. It is impossible to calculate how much savings the investor must set aside to generate their needed retirement income when interest rates are negative. This problem is mathematically unsolvable. Talk about an uncertain environment.

Savers are not the only ones suffering with the very low level of interest rates. Every insurance company that must invest the premiums received until payments are made to claimants are suffering with the low level of interest rates. Every pension plan that must securely invest funds to provide for worker retirement benefits is suffering from the very low level of interest rates. By some estimates, for every dollar that a borrower must pay due to higher interest rates there are three dollars of extra income that is earned by savers and investors. With interest rates so low, it seems that somewhat higher interest rates are likely to help more than they hurt. With this in mind, it is hard for us to understand why the Fed is so reluctant to raise rates. What do they see that we do not see??

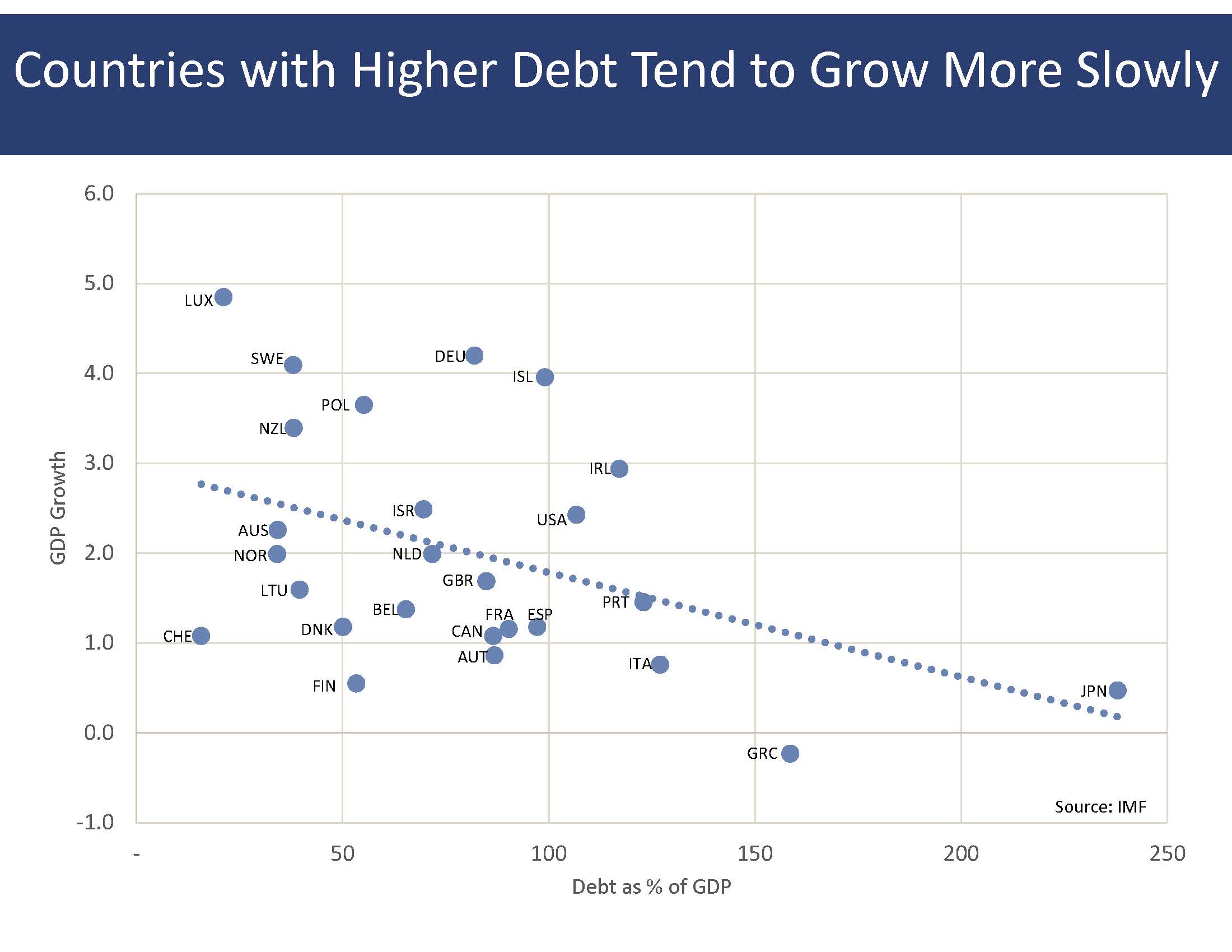

Let’s take a moment to look at the very low level of economic growth. Many economists worry that the very high level of debt held by governments around the world tends to cause economic growth to slow. There is some logic to that assertion. If you have large debt-service payments then you have less income available for spending on other discretionary projects. Countries with lower debt levels have actually grown at faster rates than those countries with higher debt levels. To be fair, low interest rates do act as an offset to higher debt levels. Still, it is likely that governments are less willing to embark on infrastructure spending and other programs to encourage growth when debt compared to the size of a country’s GDP is already elevated.

If one politician had a magic button that could magically improve economic growth, we would endorse that person without reservation. There is no “easy” button, and there is no magic formula. One of the primary economic weaknesses is the lack of capital spending. Companies are loathe to spend and invest, and that is driven by the low level of economic growth. In some respects this is a classic Catch-22. We need companies to invest and grow their production, which will grow the economy, but companies do not want to invest until they see that demand exceeds their current ability to produce goods and services.

Companies have, by most estimates, trillions of dollars of earnings trapped overseas because of our ineffective tax policy. Certainly a simplified tax code would be welcome, and may contribute to stronger economic growth. However, the idea that companies are not spending because these funds are trapped overseas seems without any real economic basis. Corporate balance sheets are in excellent shape as debt levels have been reduced, and as existing debt has been refinanced at lower interest rates. Companies are not spending because they do not see sufficient demand. Few, if any investments in productive capacity are being delayed because of having too much cash trapped overseas.

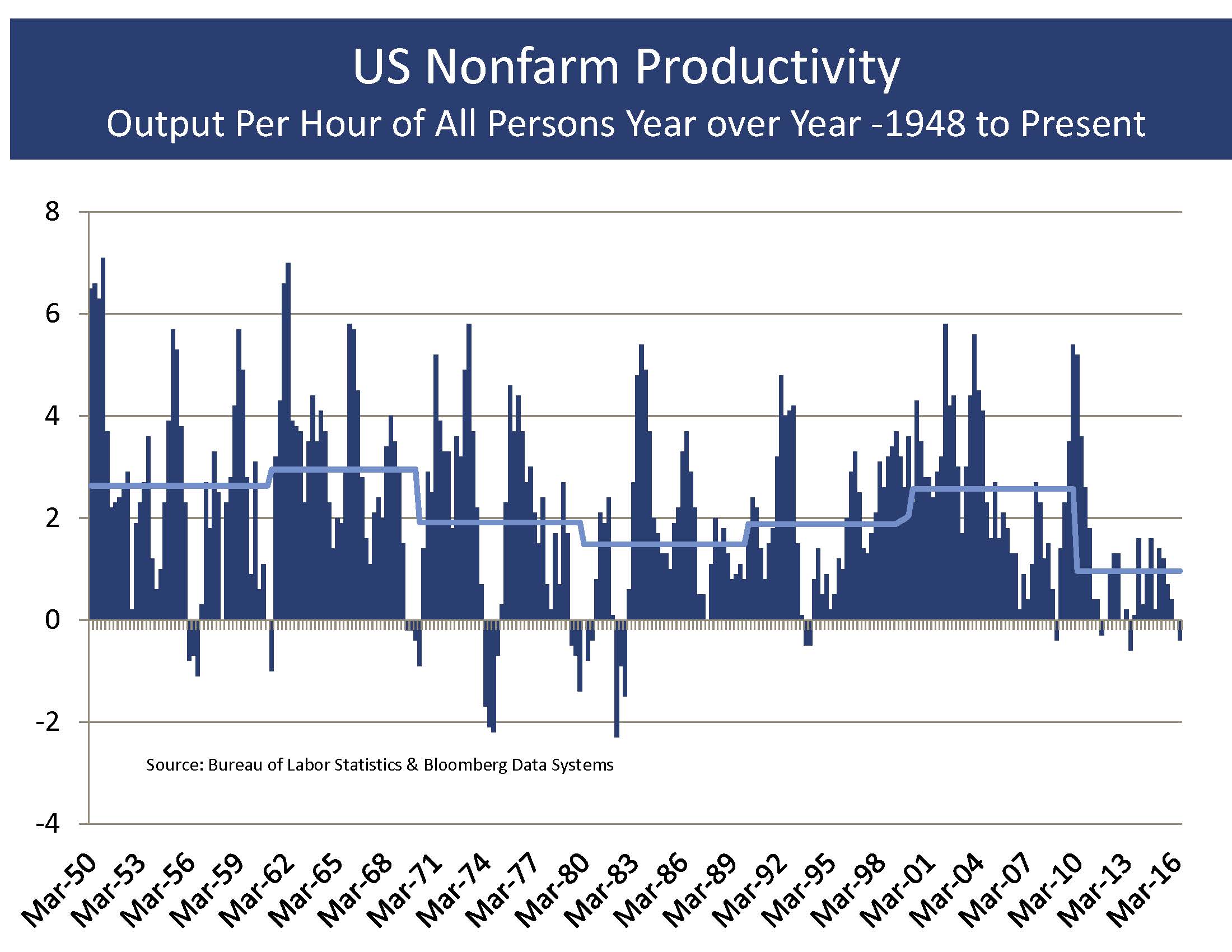

Economic growth in its simplest terms is created by the number of people in an economy, the productivity of those people, and the desire of those people to spend or consume as compared with the desire to save or invest. We have already discussed the fact that low interest rates are creating uncertainty for savers, and that savers must save more to offset the very low level of interest rates. This is having a deleterious impact on economic growth.

The low level of productivity is also a problem for our country. Some aspects of slow productivity growth may be attributed to the way in which productivity is calculated. How, for example, do we calculate the productivity of workers in a service organization when our productivity tools were invented to determine how many widgets were manufactured by how many people over a given amount of time? How too do we measure the productivity of an app on our phones that gets us home to our families faster? Some aspects of slower productivity are also due to demographics. Older employees with significant skills at their jobs typically see very modest gains in productivity. They are already experienced. When those workers retire, they are often replaced with workers who have less experience. Even as those younger workers may see more dramatic improvements in their productivity, the decline in efficiency from a very experienced worker to a less experienced one may be having a negative impact on the way we calculate productivity.

The third part of economic growth is driven by the number of people in the economy. If we want more jobs in America, then we need to create more demand. One way to do this is to encourage immigration. We need to enforce the immigration laws we have, and we also need to consider expanding our immigration to allow students who study here the opportunity to stay and start their businesses here, rather than be forced to return to their countries of origin. Ironically, the way to generate more growth and more good jobs in America is to encourage more people to move to America. We need to tear down the walls that prevent immigration rather than build more walls.

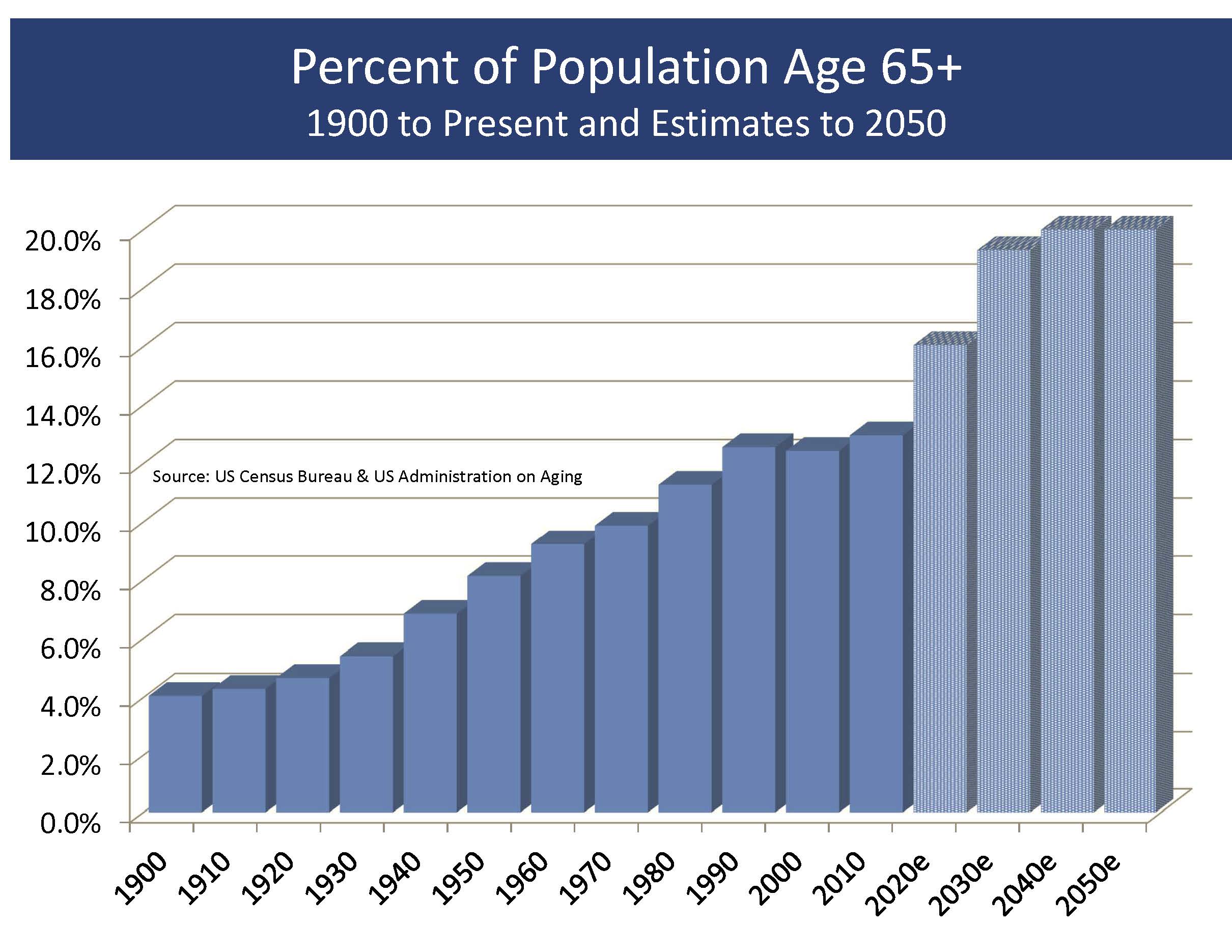

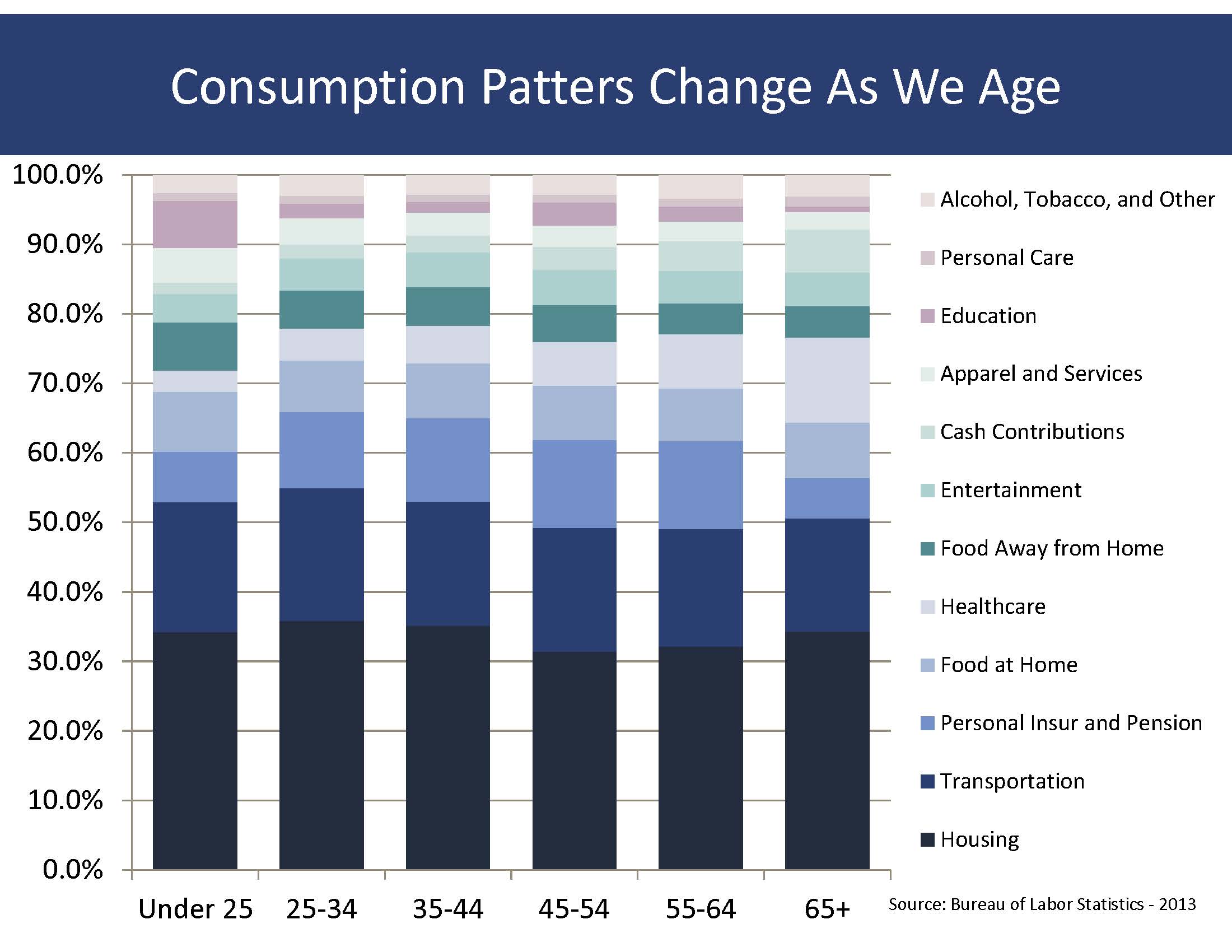

Demographics are also causing a slow-down in growth, and as we all know, “demographics is destiny.” As the baby boomers age, we are seeing dramatic changes in consumption patterns. Most boomers have grown children, and are in or past their best earnings years. Roughly 10,000 boomers per day are turning age 65, so the number of retired boomers will be expanding for the next decade. For example, a 25-year old spends 5% of income on apparel but only 3% on healthcare. In contrast, those over 65 spend 2.5% on apparel but more than 12% on healthcare. These are trends which may be investment opportunities. Still, it is not practical to think that consumption patterns will not be impacted by this dramatic demographic trend. I have often spoken about how difficult it was to purchase a Father’s Day present for my dad. In my home we have more television sets than people. We don’t need more stuff but instead are thinking about downsizing. We are consuming less not just because we need to save more, but because many of our needs have already been satiated.

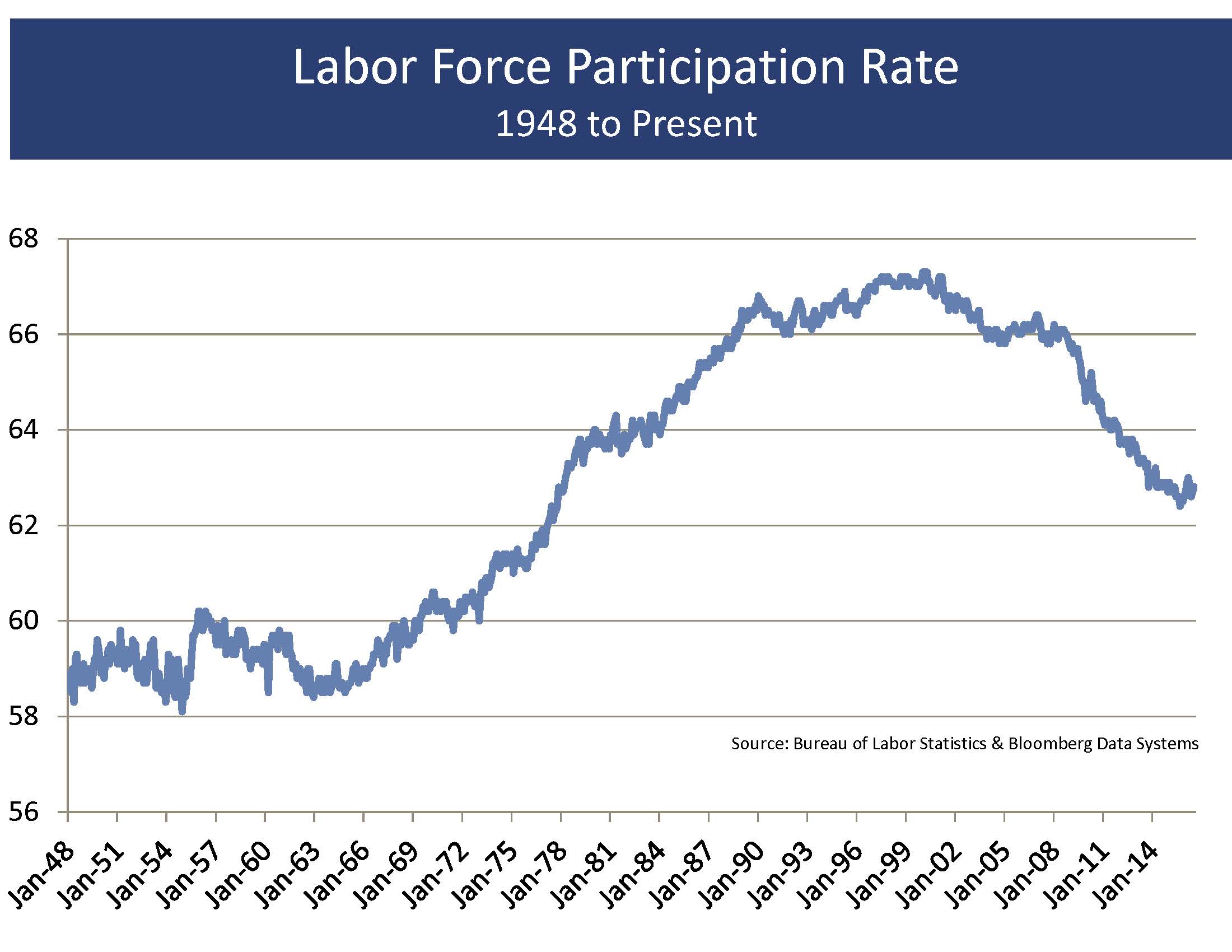

Another demographic trend that may be impacting growth is the fact that women joined the workforce following the end of World War II, and it became more accepted for women to work outside of the home. This helped contribute to a significant change in the percent of working age people who were employed, called the labor force participation rate. It is no longer uncommon for families to have two wage-earners, and that created a significant amount of consumption which was able to grow at a much faster pace than what was possible when a family only had one wage-earner. That trend has largely played out, and while some young families still see one person stay home to help raise the children, families are less willing to give up those earnings. Additionally, young couples are having children later in life, and are having fewer of them. This is trend that is prevalent among working families throughout the world.

Slow growth is being caused by a plethora of trends, and there is no quick and easy political answer. With dramatic demographic trends, with low productivity, and with high levels of debt in the system, it is difficult to see a dramatic improvement in economic growth. Slow growth is likely to lead to slow corporate earnings growth and more tempered returns from investments.

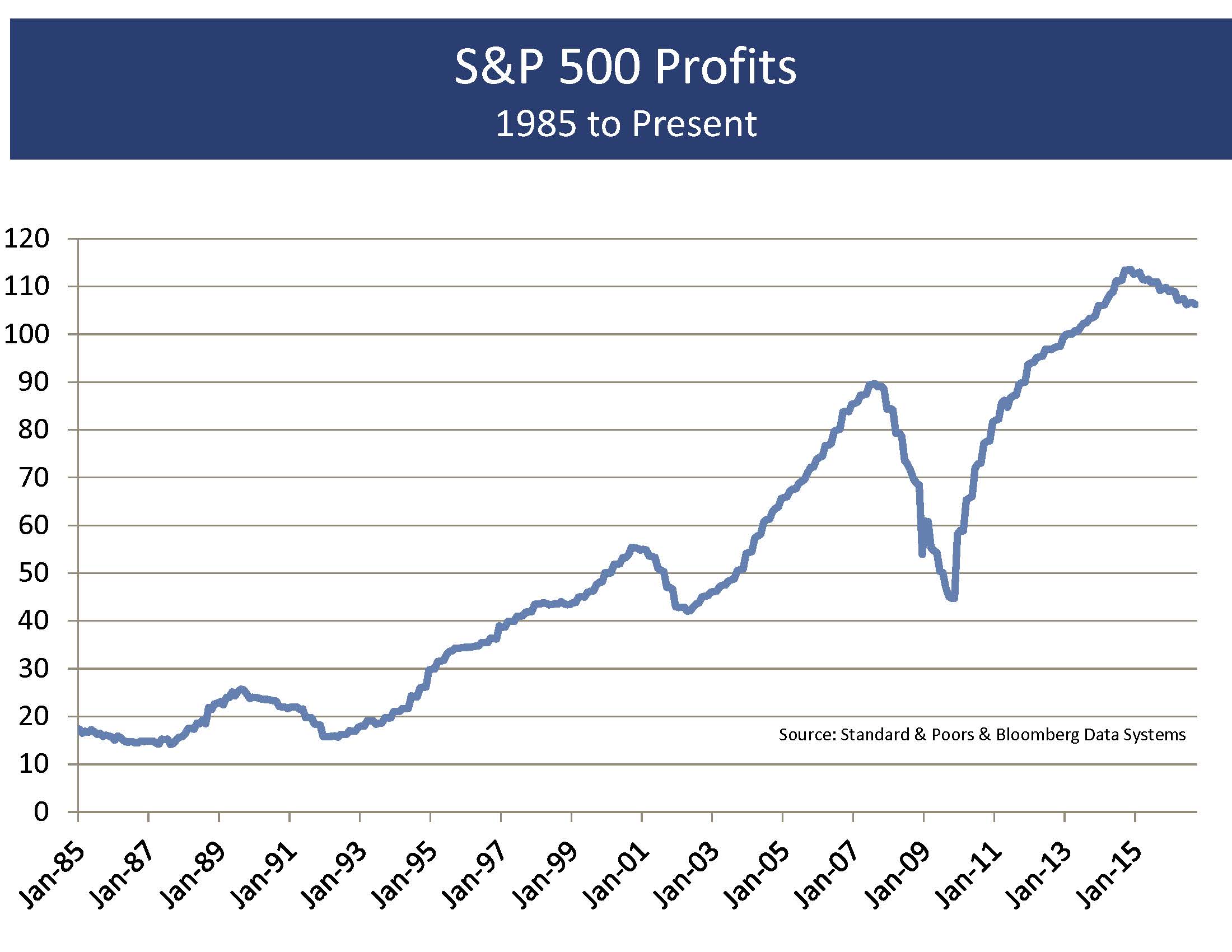

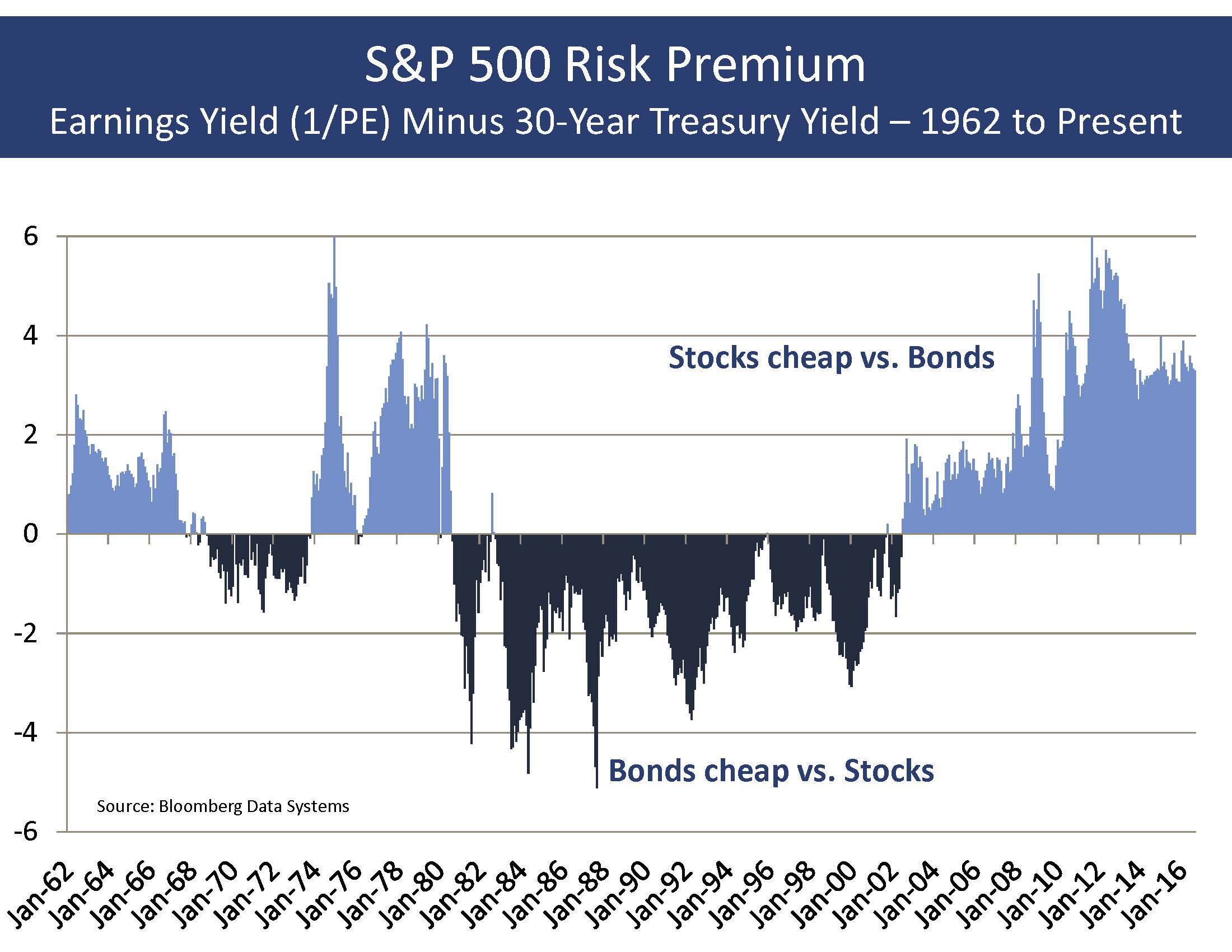

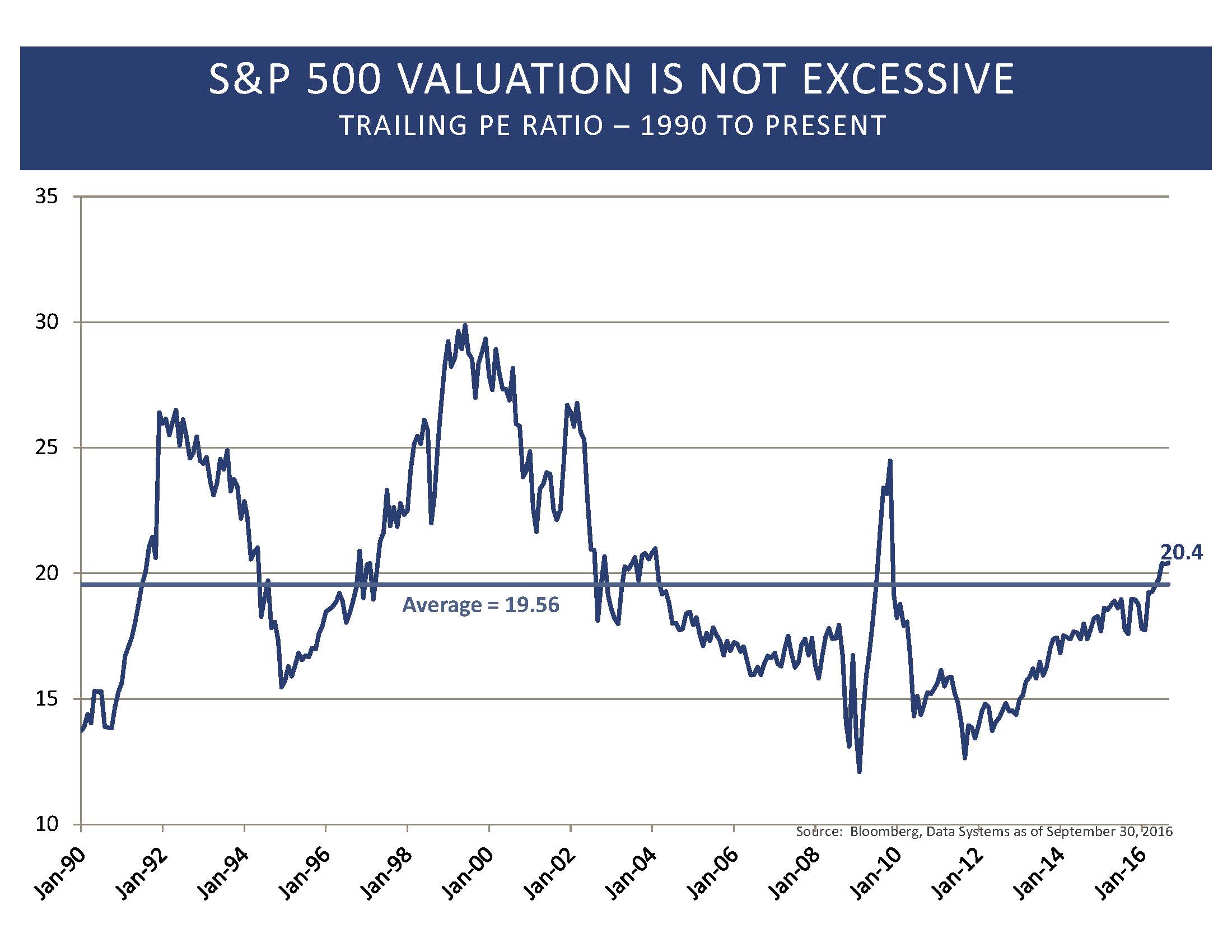

Slow corporate earnings is yet another reason for our increased concern. Corporate earnings declines in 2015 were driven by two factors: weak oil prices and a strong dollar. The good news is that both of those trends have been reversing so far in 2016. The bad news is that slow economic growth has prevented corporate earnings from growing, and earnings likely declined for the sixth quarter in a row. This length of earnings decline is unprecedented without a recession, and with markets up modestly so far in 2016, the only driver of higher stock prices has been richer valuations. We see valuations as somewhat above average, but not unreasonable, especially when compared with the low level of interest rates. Still, without earnings growth, it is difficult for markets to move significantly higher.

Still another reason for our increased level of concern is the inconsistent and weak economic reports. Job growth has slowed, retail sales are weak, the purchasing managers reports have been weak, even as China and other parts of the world are improving. There has been some increase in credit worries, particularly as Deutsche Bank, German’s largest financial institution, has dropped to record-low prices. While credit statistics remain quite favorable, and any increases have been quite modest, we find the change in direction to be somewhat problematic. We do not see a recession on the horizon, but we do worry when more of our data points are showing deterioration, even if it is modest.

One idea that may help to improve growth prospects, and one of the few topics that Mr. Trump and Secretary Clinton agree upon, is the need for infrastructure spending. America needs to improve roads and bridges, but we also have so many needs for spending that will improve productive growth. America needs to modernize its electricity grid. We need to be able to quickly and efficiently move electricity from where it is produced to where it is consumed. More than that, we need to prevent outages from poor weather, and we also need to protect our system from terrorism. A modern electric grid can be expected to improve American productivity for years or perhaps decades to come.

America needs to provide high quality wifi service to all cities. Every student at every school should have access to the internet from every device. Cars on our roads need to be connected to guide travelers away from traffic, and our appliances need to be connected so that electricity usage can be more efficiently managed. America is decades behind in providing fast trains between cities. Why do Japan and France and even China have fast trains when America has none. Infrastructure improvements are not bridges to nowhere, but are tools that will not only improve American productivity, but may also serve to help protect us from cyber-crime, and will also create many good jobs.

Infrastructure spending should help improve growth rates, and that is a good thing. We also need our politicians to reconcile the fact that our entitlement system needs to be modified. Our retirement system was never designed to provide for a population that is living far longer than ever imagined. When retirement ages were first set at 65, the average life expectancy was just over 67. Life expectancies are up more than 15 years, yet the retirement age has only been increased a paltry 2 years. This gap needs to be closed, and retirement ages will need to be increased. The Social Security system is unsustainable in its present form, and neither presidential candidate is being honest with its constituency about the need to amend these programs. The math of entitlement issues is not difficult. It is the politics of these changes that make them unmentionable. Imagine how much uncertainty could be reduced if our politicians made some long-term decisions that would provide a sustainable system for our children and grandchildren.

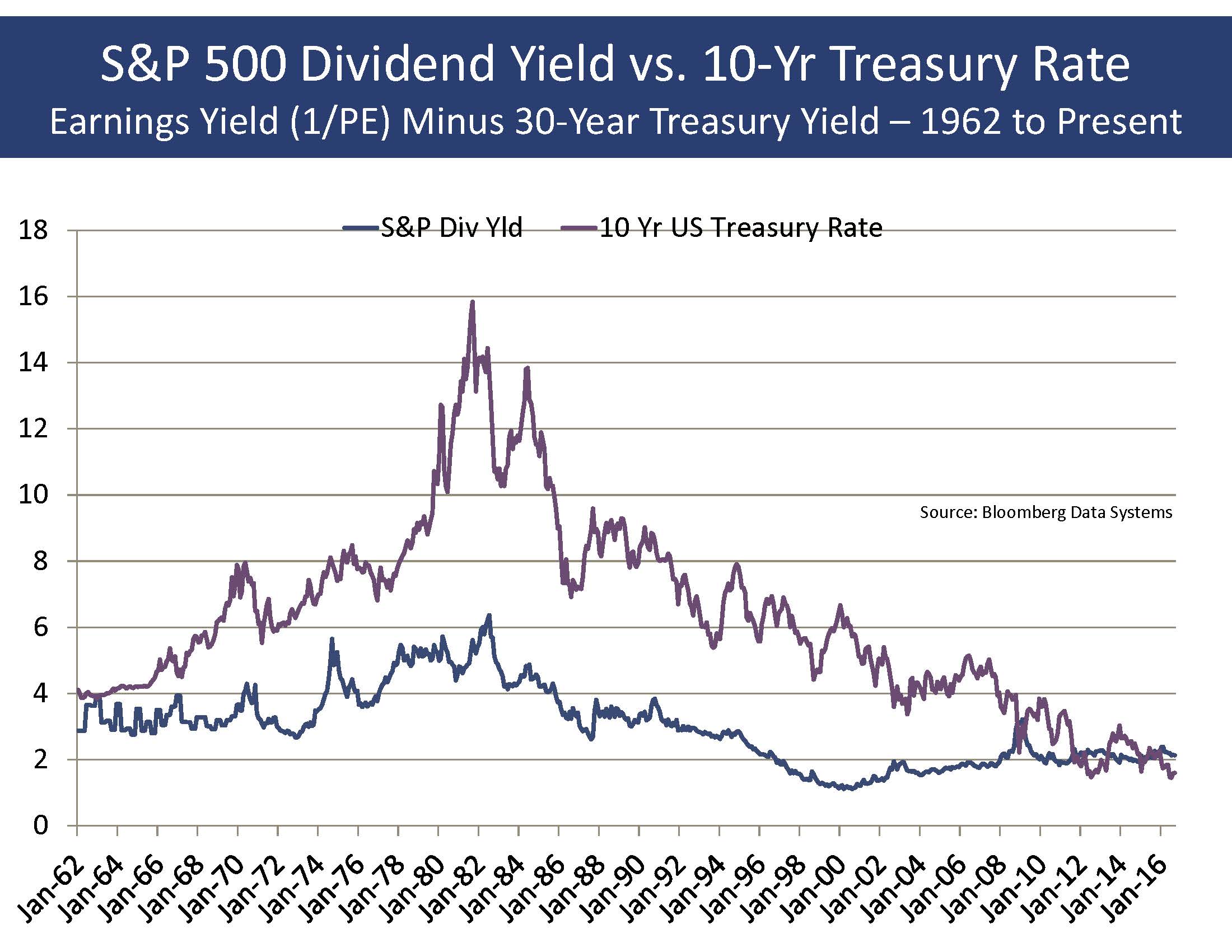

While we acknowledge our genetic disposition to reduce risk when we can, we must also report that there are very few signs that the U.S. economy is slipping into a recession. Certainly we would expect a more dramatic earnings decline should a recession occur, but the fact that we do not expect a recession leads us to believe that the downside risks are likely to be more moderate. In many ways the economy is far less vulnerable as it was. To begin, banks are much better capitalized than they were in 2006. While student loans are a problem for the economy, we have not packaged those loans and rated every one triple-A, and sold them into every pension and retirement account. The dividend yield of the S&P 500, at 2.1%, is well-above the 10-year interest rate, and it has historically been profitable to purchase stocks when dividend yields are above interest rates. As one strategist suggested, “There Is No Alternative” or TINA, and in many ways that is true. With interest rates near record-low levels, it is more attractive to purchase stocks that can grow and dividends that can increase rather than invest in low-yielding fixed income instruments. It is certainly true that stocks carry unique risks, and in no way are we encouraging clients to accept out-sized risks. Still, with stocks relatively attractive as compared with the alternatives, we suggest that any meaningful decline in stock prices should be viewed as a buying opportunity rather than the start of something far more sinister.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment advisor with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified for the periods October 31, 2005 through December 31, 2015. Upon a request, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.