January 19, 2017

Come Senators, Congressmen, Please heed the call

Don’t stand in the doorway, Don’t block up the hall

For he that gets hurt, Will be he who has stalled

There’s a battle outside, And it is ragin’

It’ll soon shake your windows, and rattle your walls

For the times they are a-changin’.

– Bob Dylan, 1964

As a young trainee at one of the nation’s preeminent investment banks, we were frequently subjected to rules-of-thumb and guidelines to help us become wiser investors. One of those tools-of-the-trade was the idea that the four most dangerous words in the investment universe are “this time it’s different.” Over the several decades that have passed since those training sessions, I have come to understand that change is more prevalent than we were led to believe. While Benjamin Franklin was famous for saying “there were only two things certain in life: death and taxes,” I prefer to believe that there are, in fact, three certainties: death, taxes, and change. As 2016 came to a close, it is clear that the most significant theme as we look ahead to the New Year is change.

The visibility of that change seemed to occur before our eyes on election eve. Following the announcement that many Midwestern states had gone for Trump, the futures market signaled a very significant decline for the stock market. The market looked like it would open down nearly eight hundred points. It was clear that the election of Donald Trump as president of these United States was unanticipated, and markets seemed quite unsettled.

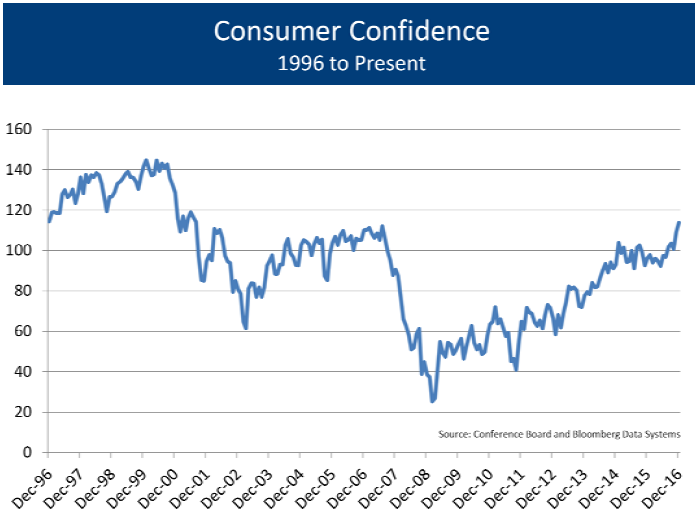

By morning, the market’s direction had changed, and the stock market actually opened higher. The market continued to show strength and support for the President-elect and his cadre of republican-dominated lawmakers. While many prognosticators suggested that no President has the ability to meaningfully change the direction of the country, it seems apparent that the outcome of the election has helped alter the mindset of many investors.

To be fair, it is likely that the market may have responded positively to either candidate since a clear victory by either candidate diminished the uncertainty that had cast a pall over the market for the months leading up to election night. Additionally, it is also apparent that the economy was showing signs of improvement even before the election. The strong economic growth of the third quarter and the improved employment picture that were reported had little to do with the election and more to do with an economy that was improving even as the election uncertainty crescendoed.

Some of the changes that are expected from the new Trump administration have been well-telegraphed in the campaigning that led up to the election. With the Republicans gaining control of the Senate and maintaining control in the House, it was quickly apparent that many of the promises made during the election would likely become legislation. Investors who saw the previous administration as being anathema to improved corporate profitability and higher growth rates were delighted to see a more pro-business administration prepping to take office.

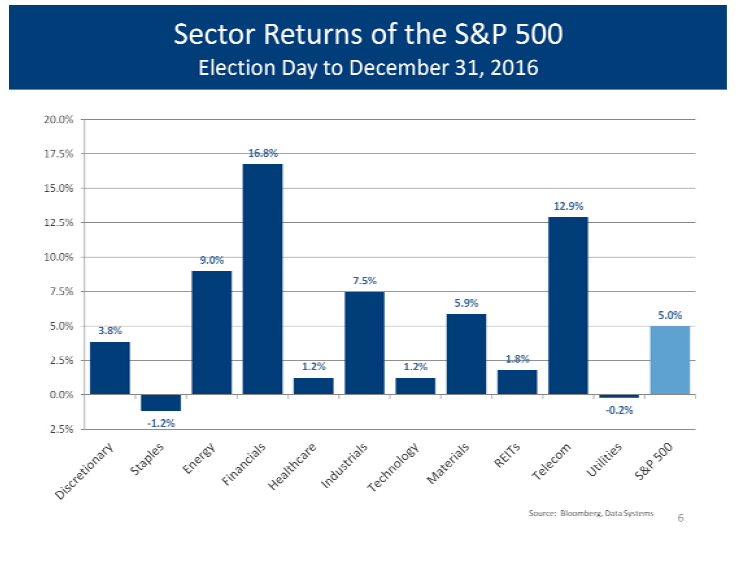

There is clearly low-hanging fruit that can be enacted quickly to enable businesses the opportunity to grow more rapidly. Among those changes are the prospects for reduced regulation at the nation’s banks and financial services firms. Following the Great Recession, significant regulation was enacted to help protect taxpayers from the banks and financial institutions that were deemed “too big to fail.” The impetus behind these regulations was the belief that the failure of any one of these “systemically important financial institutions,” or SIFI’s for those acronym-loving Wall-street types, would put the entire economy in jeopardy. Banks were encouraged to improve their capital reserves, and they have done that. Banks were also prevented from proprietary trading that could put significant reserves of the bank in jeopardy. While these regulations probably made banks less profitable, they also served to help reduce the risks of a failure of any of these SIFI’s.

Regulation is one of those very divisive political topics. Certainly it is true that no one sits around and tries to create regulation out of thin air. Child labor laws were created to protect children from abusive practices. Lead was removed from paint to prevent young children from being poisoned by consuming fallen paint chips. The Clean Air and Clean Water acts were passed in response to unbreathable air and lakes and rivers that were literally on fire.

Still, it is also true that regulation creates a costly burden for many businesses. Investment Advisors, such as our firm, are subject to strict and costly regulations. Some regulation, however, is necessary after dastardly people like Bernard Madoff took advantage of trusting clients, even as the majority of Advisors take their responsibility for assisting their clients very seriously. How then do we find the correct level of regulatory interference?

One suggestion is for all regulation to have a sunset provision so that it expires after 10 years or so. This would mean that new regulations could be enacted that would adapt to changes in the environment, and regulations that were no longer necessary would be vanquished from the system.

It is certainly clear that the incoming Republican administration will reduce the regulatory burden facing many financial institutions. The irony of regulation is that the largest banks that pose the greatest risks to the financial system are also those that can most easily afford the added cost of that regulation. In contrast, the smaller, more regional banks that pose a much smaller risk to the system are those for whom those regulatory costs represent a prohibitive expense . The reduction of financial regulation will help all financial institutions, and the smaller, more regional banks are likely to see an outsized reduction in their costs and a commensurate greater increase in profitability. The Trump election represents a much friendlier political environment, and the financial sector has been one of the best performers since the election. We would expect the financials services sector to continue to be an area that benefits from the changing political climate.

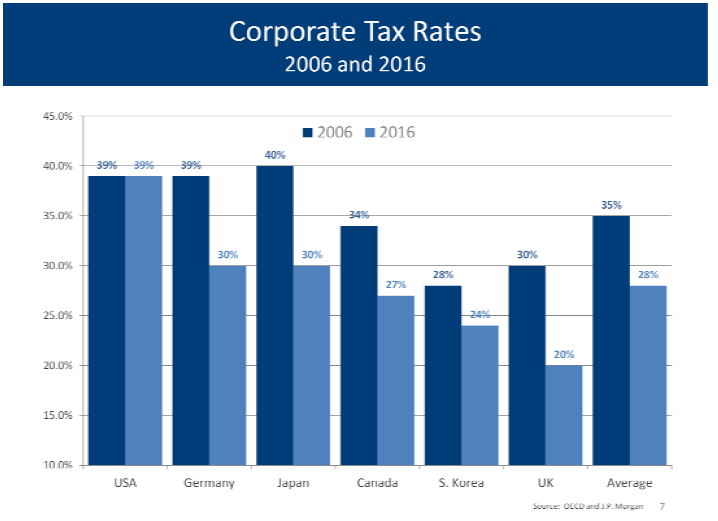

Candidate Trump promised to lower tax rates, and this too is an area where investors can expect some meaningful progress from Congress. U.S. corporate tax rates are the highest in the world although many companies, particularly the large multi-national corporations, pay a much lower tax than the top posted rate. Still, many corporations have moved their domiciles or have merged with foreign competitors in order to obtain a more favorable tax rate. Certainly a lower corporate tax rate would eliminate the need for companies to consider moving offshore.

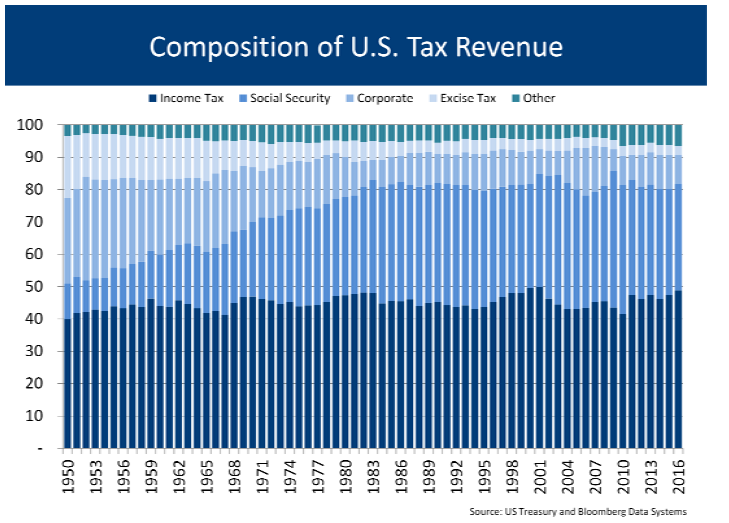

One question that must be answered with respect to corporate tax rates is what is the appropriate tax policy? Corporations represent less than 9% of federal government revenue. That number is down from 32% in 1952. Should lower tax rates be accompanied by fewer deductions so the amount of revenue collected is unchanged? This would lower the tax burden for some corporations although it might raise the taxes on others.

Our complex tax system prevents many domestic companies from bringing significant cash balances held overseas back to the U.S. due to the egregious tax consequences that would be incurred. Changes to the corporate tax system that allowed companies to repatriate funds is also seen as a significant contributor to a changed political landscape, and one that might lead to greater investment and faster growth. Past periods of tax amnesty led to higher dividends and greater share repurchases, but only a very small percentage of those funds were used for capital expenditures. It is unclear whether corporate behavior will be any different this time, but as part of a plan to reduce corporate taxes, it is being seen as a strong positive that will help spur additional economic growth.

Corporate profits will be higher if tax rates are lower, and higher corporate profits should lead to higher share prices. Companies that pay the highest taxes will be the primary beneficiaries of lower rates, and analysts are already trying to determine which companies will see the greatest increases in reported earnings. Smaller companies and companies that do little business overseas are expected to benefit most from lower corporate tax rates.

Both presidential candidates promised to spend heavily to improve our nation’s infrastructure, and that is also a change that is likely to come to fruition. Many economists had argued that the economy needed greater stimulus as we emerged from the Great Recession. They cited the significant spending on World War II that was instrumental in helping America recover from the Great Depression. It now appears that there is a stronger consensus that the U.S. should embark on additional infrastructure spending to help increase the economy’s growth rate. Greater infrastructure spending will increase the demand for tractors and other supplies that are used to build large projects. It will also increase the demand for building materials and supplies. While we do not expect that infrastructure to have a meaningful impact in the early part of 2017, it is likely that late in 2017 and 2018 will benefit from increased infrastructure investments. We expect the industrial and material sectors will be the prime beneficiaries of infrastructure spending, and stocks in these sectors have also been strong performers since the election. We would expect these trends to continue, although we do caution that some of these companies are unlikely to see any meaningful increases in their business for several quarters. We worry that some of these stocks may be ahead of the actual fundamental drivers.

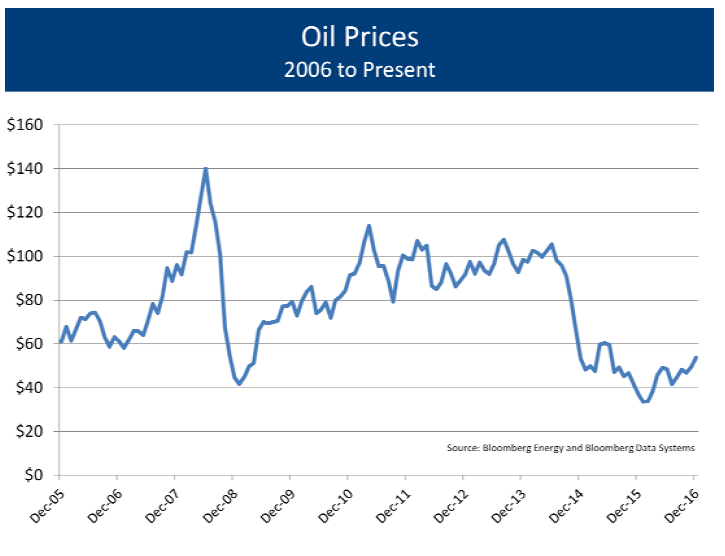

Oil prices have been another area of great change over the past couple of years. From exceedingly high prices and short supplies, technological innovation in the oil patch (hydraulic fracturing of shale formations known as fracking) led to abundant supplies and lower prices. In response to a very painful two year period where OPEC nation’s revenue fell short of social needs and government spending, OPEC has recently agreed to small production cuts that have led to higher oil prices. This too will help corporate profits advance as we enter 2017.

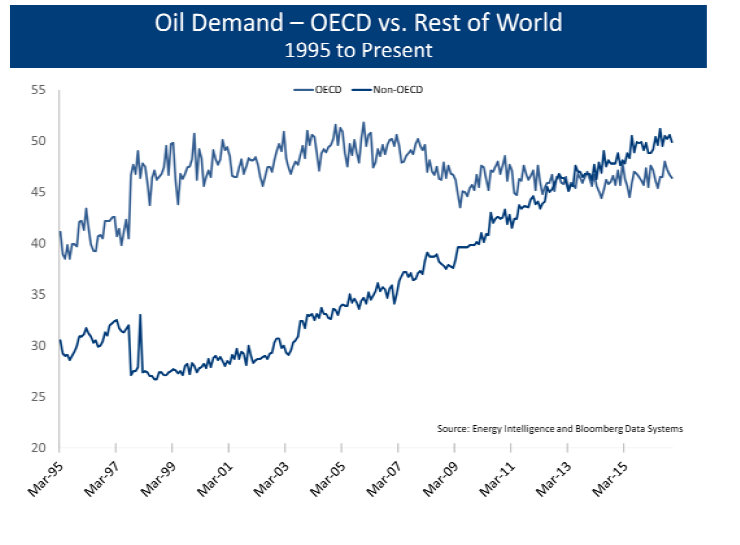

Oil demand has been stable for many years in the developed world, and all of the growth in demand has come from the developing world. Over the short term it is very hard to change one’s energy consumption, but over the longer term users tend to find new and innovative ways to conserve energy. We would expect energy prices to remain firm throughout 2017, although we do worry that higher prices will cause an increase in production in the shale fields. Prices are unlikely to return to $100 per barrel any time soon.

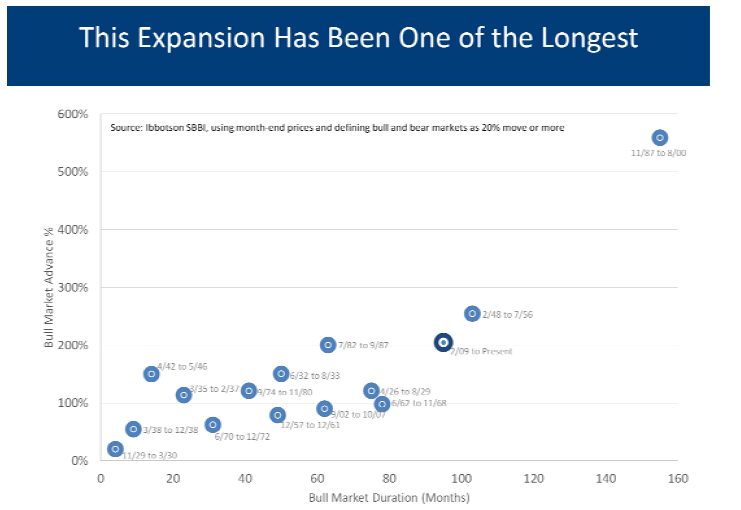

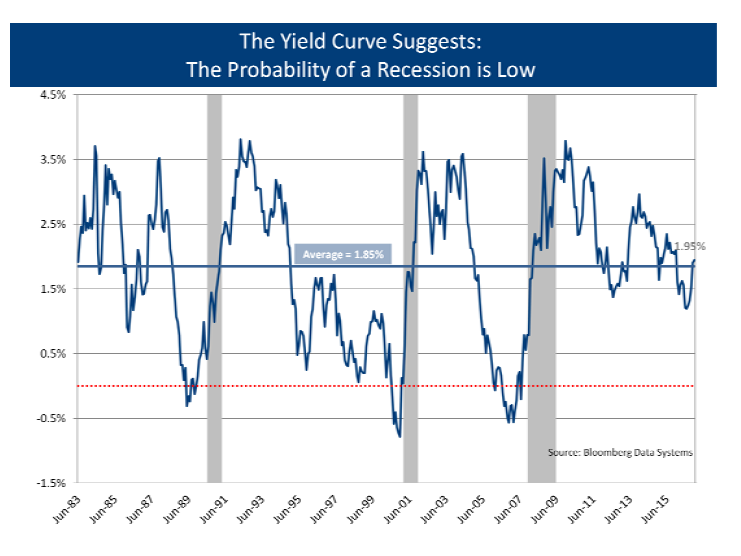

The current expansion and bull market is one of the longest and most profitable in history. Certainly it is true that we are getting into the later stages of the expansion, and that different economic sectors are favored as the economic cycle progresses. It is important to remember that economic expansions never die of old age. They are typically murdered by policy errors. While we do expect the Fed to raise interest rates more aggressively, we do not believe we are near the point where the Fed has made monetary conditions so tight as to kill the current expansion and force us into a recession.

Our best indicators continue to suggest that there is no recession on the horizon for 2017, but we remain vigilant in our need to monitor the potential that policy mistakes will bring an end to the current cycle. Still, as we are later in the cycle, we need to be aware that different sectors are favored in the later stages of an expansion. In particular, we believe that investors should favor the more cyclical parts of the economy, and we believe that the more defensive sectors are likely to underperform until we get closer to a recession. This is clearly a change from our recommendations last quarter when anemic growth seemed more likely to continue.

We have an economic environment that was clearly improving as we approached the election. The Republican sweep suggests that there will be lower regulation, lower taxes, and greater infrastructure spending. All of those policy changes are expected to add to economic growth. Prior to the election there were fears that economic growth was stuck in a permanent malaise. Now with the new administration ready to enact legislation that is expected to increase the growth rate of the economy, we find ourselves in a situation where growth is likely to be somewhat more robust than previously thought. While this is a good thing, there are always some unintended consequences of faster growth.

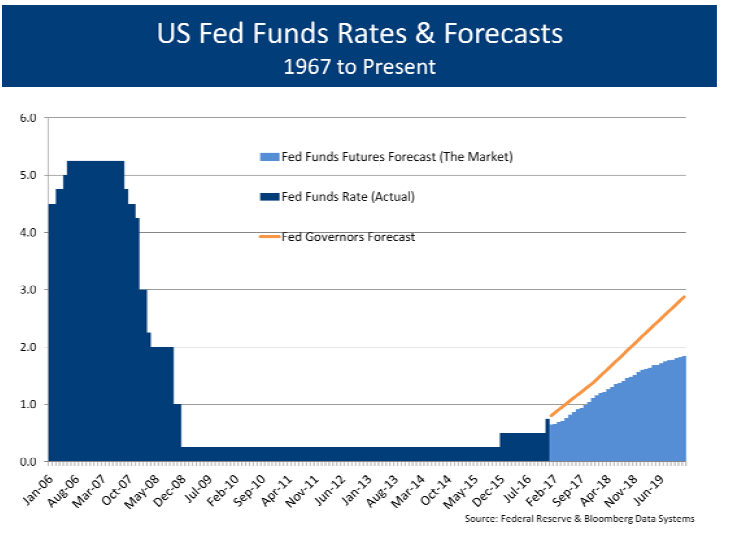

The prospects of higher growth suggest that the Fed is likely to increase interest rates more frequently in the coming months and quarters. After one increase in December of 2015 and another this past December, the Fed now expects to raise interest rates three more times in 2017. The Fed’s plans to raise interest rates have been foiled before, but with the market expecting higher growth rates, it seems more likely that we will see further interest rate increases as 2017 progresses. The Fed is still more aggressive than the market about how high interest rates are likely to go, but these estimates of future interest rate policy are coming together and do suggest the trend toward lower interest rates is likely to be over.

From 1945 through 1982, 10-year U.S. treasury interest rates rose. While there were times when interest rates seemed to reverse, the overall trend was toward higher rates. That trend reversed as Fed Chairman Paul Volker vowed to break the back of inflation. Volker raised interest rates dramatically and caused a severe recession. His plan worked, and inflation began a long decline. As inflation declined so did interest rates, and 10-year interest rates have been declining for the past 35 years. From a high of nearly 16% in 1981, 10-year rates hit an all-time low in the gloom that followed Britain’s decision to leave the European Union (EU), dubbed Brexit, and fell to less than 1.4%.

With the prospects for stronger growth comes the potential for higher inflation, and interest rates have risen accordingly. From the post-Brexit lows, 10-year U.S. interest rates rose to nearly 2.5%. While 2.5% is still quite low by historic standards, it represents a dramatic change from the levels just a few months prior. When interest rates move higher, bond prices adjust by moving lower, and the 10-year treasury suffered dramatic losses during this period. The price of the 10-year treasury declined by more than 9% from the post-Brexit highs through the end of the year. From election day, the price of the same 10-year treasury declined by more than 3.25%.

Bond prices have fallen and bond returns have been negative for the second half of the year. It hardly seems possible. Investment advisors and investors have seen 35 years of lower interest rates and higher bond prices, and suddenly the opposite has happened. No one is accustomed to a rising interest rate environment, and this has the potential to be a sea change that lasts for many years, perhaps even decades.

To be fair, as of this writing it is impossible to know with any certainty that the trend of interest rates and inflation has changed. We typically define a rising price trend as one that has higher highs and also higher lows. Similarly, we would define a declining price trend as one with lower highs and lower lows. While 10-year interest rates are already above the very recent highs, a more definitive change would be suggested if and when 10-year interest rates rise above 3%.

With growth accelerating and with the Fed raising interest rates more aggressively, the odds favor the end to the past 35-year trend of lower interest rates. This suggests that bond portfolios need to be restructured to reflect a more hostile interest rate environment.

The U.S. is not alone in seeing higher interest rates. While many global interest rates were negative in the middle of 2016, now there are very few negative interest rates. Interest rates have increased in virtually every country in the world, and only Switzerland still has a negative 10-year interest rate. This rise in interest rates has been confirmed by global markets. This is a change that is likely to have a profound impact on bond investors for many years to come.

Despite the near term optimism, we do recognize that there is plenty that can go wrong. We already mentioned our concern that some stocks seem to have already discounted growth that is not likely to occur for several quarters, or perhaps longer. We have also neglected to focus on the potential for a trade war, something that Mr. Trump seemed adamant to initiate in his many beratings of the Chinese during the election. A trade war would be a most unwelcome change and could easily cause the U.S. economy to stumble.

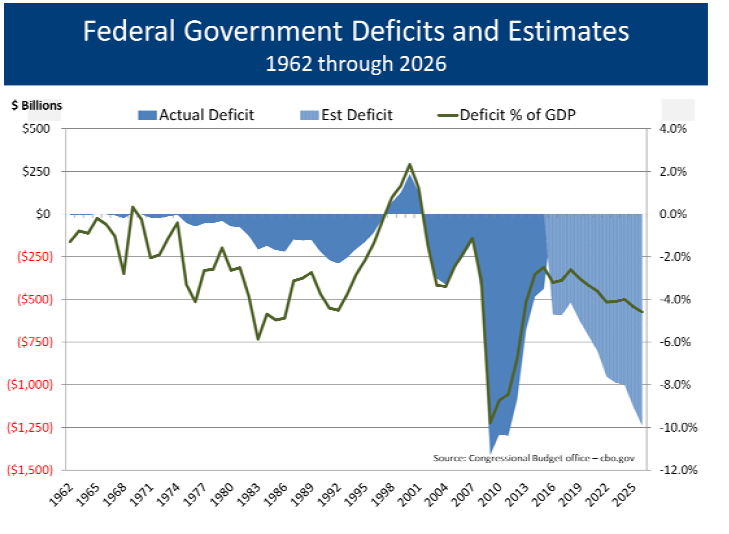

We have further neglected the fact that lower tax rates and higher spending on infrastructure and defense could explode our deficits. This has the potential to become a vicious circle. As deficits expand, investors will demand a higher interest rate to purchase our bonds. As interest rates go higher, the cost of servicing our debts will also rise, and this will further increase our deficits while also limiting the funds that can be used for more discretionary spending programs. At some point interest rates could become high enough to attract funds away from stocks which might cause stock market valuations to contract, just as they did in the late 1970s.

Despite the negatives, we believe the changes we are seeing are more likely to be a positive for economic growth over the next several quarters, and we are positioning clients’ portfolios accordingly.

From all of us at L&S Advisors, we send our most heartfelt wishes to you and your family for a New Year that brings good health, fine friends, much happiness, and abundant prosperity.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment advisor with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified for the periods October 31, 2005 through December 31, 2015. Upon a request, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.