April 16, 2019

The four most expensive words in the investment business are “this time it’s different”

— Investor lore

What a difference a quarter makes. By the end of the fourth quarter, it seemed as though U.S. policy makers were on the cusp of serious policy mistakes. As we look back on the first calendar quarter of the year, it does seem as though the risks have dissipated materially. However, as some risks have been reduced, there are other risks that demand our attention. Economies around the world have continued to slow, and there are some signals suggesting that a recession could occur within the next several quarters. Finding the proper balance between the risks and the potential reward will be the key to success for investors over the remaining quarters of this year.

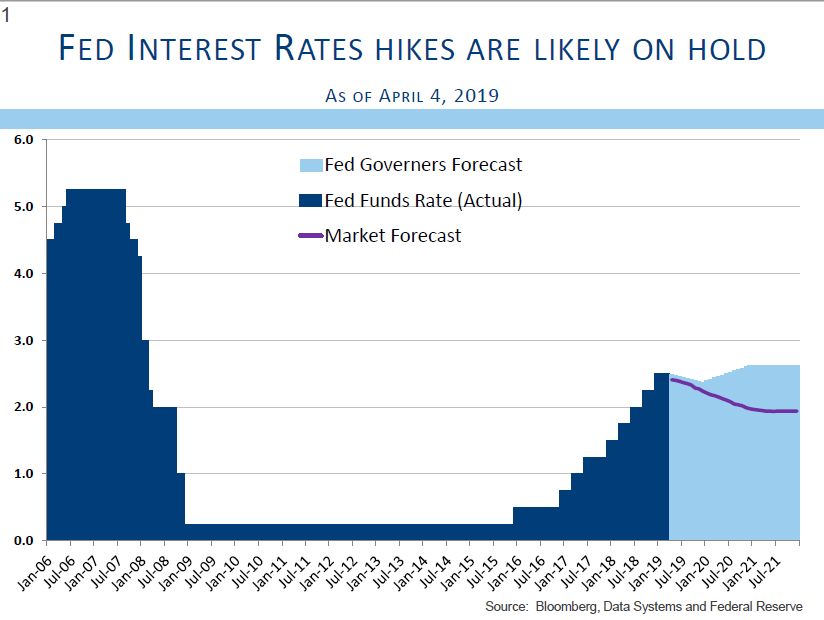

As this year started, financial markets were struggling with a Fed that was on “autopilot” with regard to raising interest rates, and also with planned reduction in the scale of assets they had accumulated following the Great Recession. This led to the perception that the Fed was oblivious to the slowing economic outlook, and would soon cause a policy mistake that could portend a recession.

To its credit, the Fed altered its policy stance and suggested that the need for further interest rate increases would be evaluated based on the economic data. That was taken by the market as a huge sign that the risks of a policy mistake had diminished. Further, the Fed also suggested that the size of its balance sheet would remain elevated in order to meet the need for liquidity in our financial system. There is an old adage in the investment business that one should never “fight the Fed,” and the Fed had just articulated a much easier policy stance than had been expected just a few weeks prior.

As the quarter progressed, other global central banks also recognized that growth had slowed, and have since altered their policy stance in favor of easier money. The adage of not to fight the Fed can easily be expanded to suggest that investors should not fight the European Central Bank, the Chinese Central Bank, the Bank of Japan, and others.

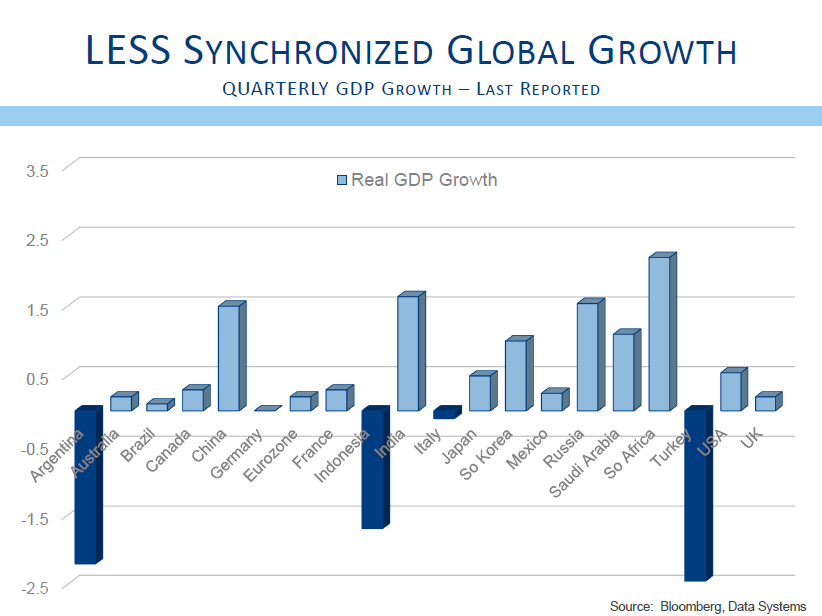

Of course, the real question is why have central bankers across the globe embarked on easier monetary policy? The answer is because growth has slowed. After growing at a very healthy clip during the third and fourth quarters of 2018, growth has slowed in the U.S., and expectations are that growth for the quarter that just ended will be lucky to hit 2%. In fact, the U.S. economy has actually held up much better than most. In Europe, growth has slowed across the continent, with Germany perfectly flat, France and the U.K. growing ever so slowly, and Italy’s economy actually shrinking. Across Asia growth is also slow. Some of this slowdown can be tracked to the disruptive trade policies of the Trump administration which damaged global trade and growth in the hopes of negotiating a better deal for American companies. But some of this slowdown has nothing to do with American policies. In the United Kingdom, the continued argument over how to divorce themselves from the European Union (Brexit) has led to significant uncertainty.

As an aside, the potential for a policy mistake with regard to trade seemed much greater at the end of last year. At that time, new tariffs were pending, and the tone of negotiations was not positive. It appears that both China and the U.S. want some kind of solution to the President’s trade war, and that has provided some optimism for the market. Investors seem to recognize that there are no winners from significantly higher trade tariffs. A more conciliatory tone from both sides is a welcome relief, and helps further reduce the risk of a policy mistake that could cause a recession.

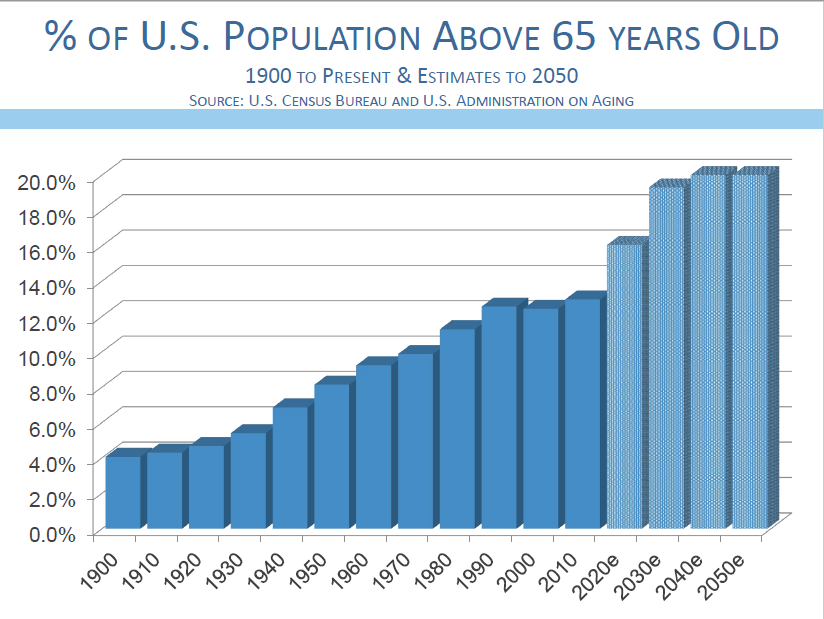

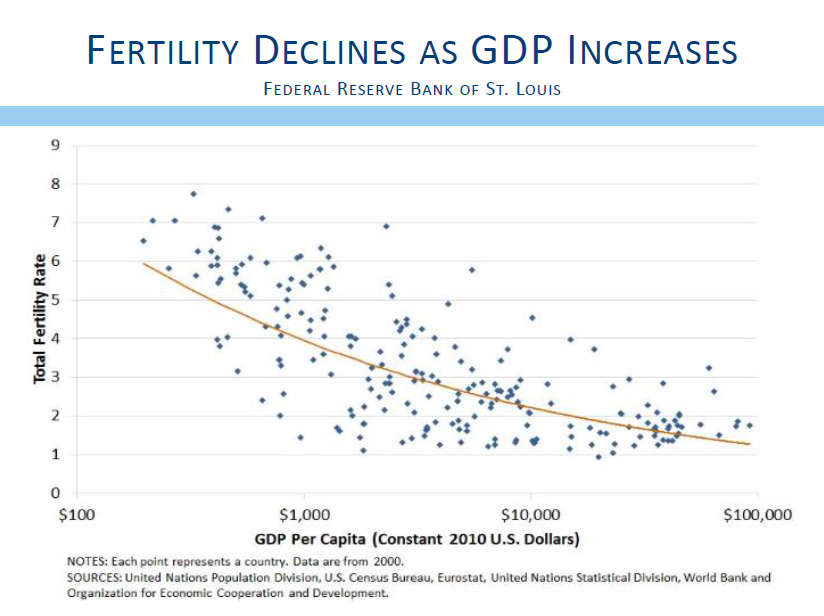

Some aspects of slower growth are due to demographics. As we age, we tend to consume differently. Older consumers spend more money on health care and less on clothes. We have enough cars and TVs, and we might want to downsize our homes rather than stretch to have an extra bedroom.

Baby Boomers are reaching the age of 65 at a pace of about 10,000 per day, and this trend is not going to slow for many years. The Japanese, having a very closed society that does not accept immigrants, has been aging for decades. Even in China, the effects of their one-child policy is causing their society to age faster than any other civilization in human history. The recent relaxation of this policy is a step in the right direction, but if every young family decides to have two children, it will still take a generation for there to be a meaningful demographic shift.

As societies gain wealth, birthrates have slowed. This has happened across the globe. More children survive, and middle-class parents tend to choose to give up fewer professional years for child-rearing. These trends have been fairly universal. The only way for developed economies to grow is through immigration, and the nationalist thoughts pervading across the globe have clearly slowed immigration. These demographic trends are unlikely to change any time soon, and are likely to continue to cause growth rates to remain slow for the foreseeable future.

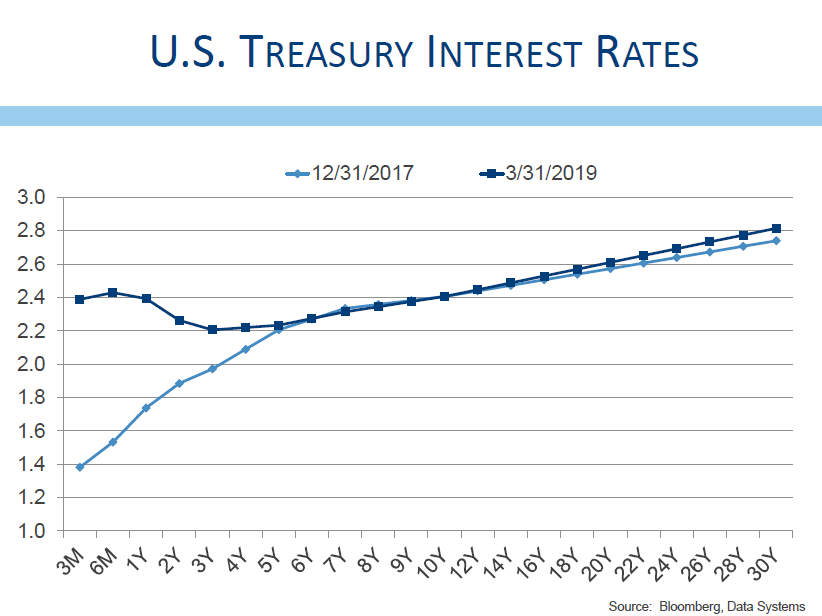

On the subject of slower growth, we must also be mindful of indicators that have accurately suggested when a recession might be on the horizon. One of the best signals has occurred when short-term interest rates rise above long-term rates. We call this an inverted yield curve, and it happens when the Fed is pushing interest rates higher, but investors do not believe further rate hikes are warranted. The yield curve actually inverted at the end of March, although it did not last more than a few days.

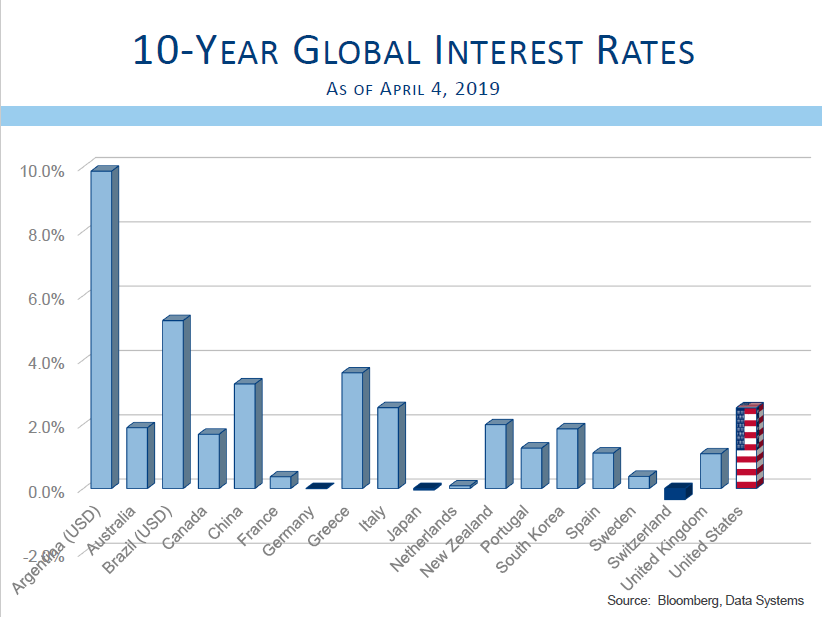

Some investors argue that the inverted yield curve does not really matter this time because interest rates are so low across the globe that investors seeking yield are finding value in U.S. 10-year bonds. That excess demand is pushing 10-year rates lower than the normal level, creating artificially low interest rates. I am reminded of words of wisdom we were taught when I started in this business. There was a saying that “the four most expensive words in the investment business are ‘this time it’s different.’”

During the Clinton administration, the government was running a surplus and was paying down debt. When the yield curve inverted in the summer of 2000, many prognosticators suggested the inverted yield curve did not matter because the government surpluses were pushing 10-year interest rates artificially low. Sure enough, there was a recession the following year, and ignoring well-regarded signals proved to be an expensive mistake. This is a mistake we are trying not to replicate.

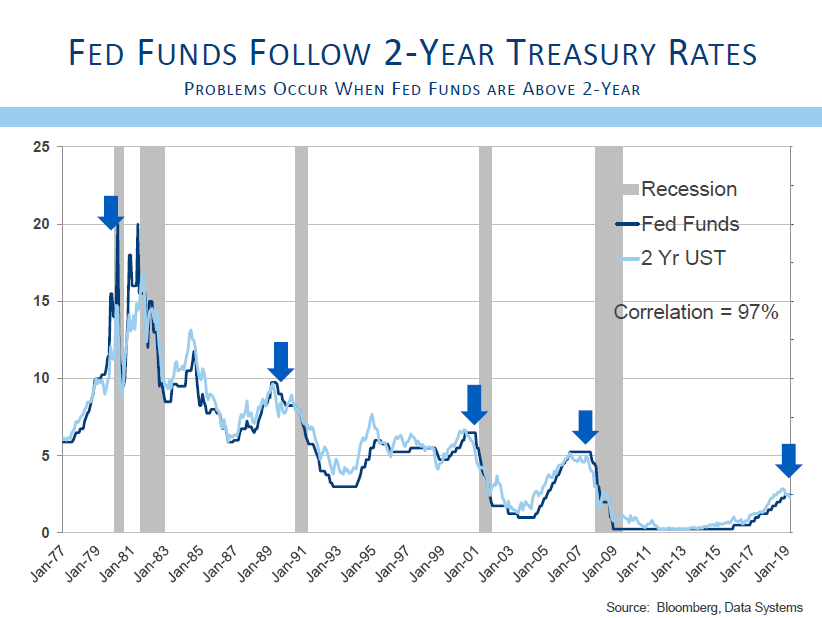

For this reason, we spend a huge amount of time and effort reviewing many data points. Several indicators have a good record of predicting a recession. Earlier we mentioned interest rates as one of the best tools we have for predicting the likelihood of a recession. Other interest rate indicators also exist, and, here too, the message is that the probability of a recession has increased. When the Fed Funds rate exceeds the interest rate on 2-year treasury bonds, that has typically happened occurred prior a recession. Here too, the indicator has recently flashed a recession warning.

Some recession indicators are decidedly mixed. We would expect to see a fairly large decline in the number of new home sales prior to the start of a recession. New home sales peaked late in 2017, and had declined about 18% by the end of 2018. That series, however, has recently rebounded, and is now only about 6% below the recent highs. The weakness in 2018 is an indicator that supports the concern for a recession, but the recent strength may help to negate that signal.

Consumer confidence also tends to peak shortly before a recession. Confidence peaked in the fall of last year, and has continued to post weaker numbers over the past several months. While the recent weakness is disconcerting, it is important to remember that the current level of confidence is well above the peaks that were prevalent prior to the last recession. Still, we find that the directional movement in these indicators tends to be important, and the recent weakness suggests some caution is warranted.

Another sign that is giving mixed signals is the percentage of banks reporting tighter lending standards. This number did pick up in the last report, but it remains below recent highs, and well below the levels that have been prevalent prior to the last three recessions (This data series only goes back to 1990).

To be fair, there are also indicators that have not flashed a caution warning. Unemployment tends to begin to rise prior to the recession, and here the news remains quite good. The latest unemployment report showed a 3.8% unemployment rate. This number is near a 20-year low, and remains quite low by historic standards.

Initial unemployment insurance claims have also troughed prior to the recession, and like the unemployment report, this number remains quite strong. The latest number is the lowest since late 1969, nearly 50 years ago.

Finally, we rely heavily on the government’s Leading Economic Indicators (LEI). This series goes back to 1960 and signals a higher potential for a recession when the current number is below the reading one year prior. The year-over-year reading is just above +3%, about average for this series. While this data point has weakened over the past six months, the absolute level still suggest economic growth is likely to continue.

When we take all of the data together, our conclusion does suggest a higher probability of a recession. The data, however, is mixed enough to lend some credence to the idea that the economy may just plod on at a slow rate, without dipping into recession, for many more years.

One important consideration when evaluating these data points is that they tend to be predictive with a fairly long lead time. Some indicators lead by several months while others lead by a few quarters. This suggests that if we are to have a recession, it is unlikely to happen before 2020.

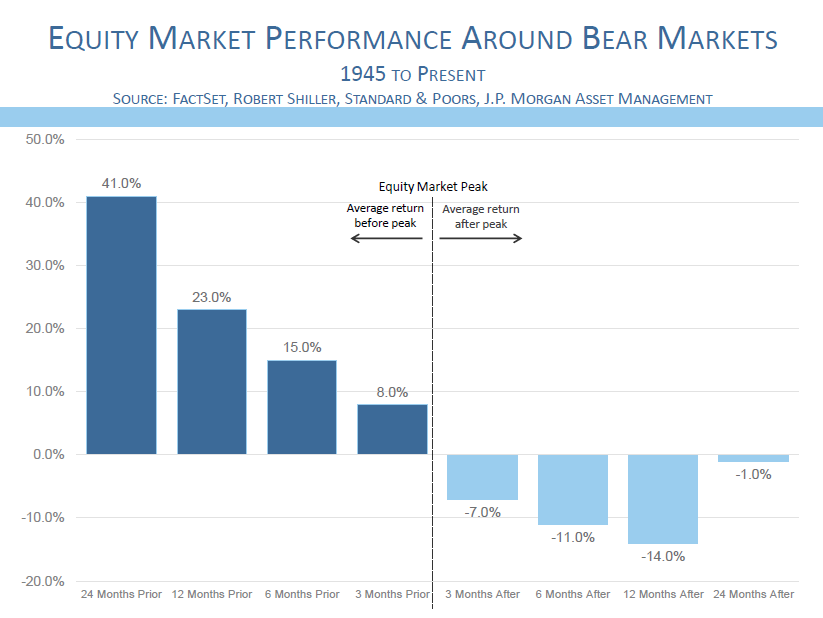

Still another consideration is the fact that stock markets tend to post reasonably strong gains prior to a peak. Since 1945, on average, the stock market has increased 15% in the six months leading up to a peak. This suggests that one mistake investors can make is by being out of the market too soon. Admittedly, this is a difficult tightrope to walk. Ignore the signals and wait too long, and the market tends to fall. Act too early and investors tend to miss large moves. We focus on the data points so that we are aware of the risks, but we recognize there simply are no perfect signals.

In addition to the risks of recession and policy mistakes, another concern that troubled the market late last year was the prospect for zero or even negative growth in corporate earnings in the early part of this year. Last year, lower corporate tax rates drove strong gains in reported earnings. Now, however, earnings have stagnated, and have shown no growth since September of last year. While the outlook over the next several quarters calls for growth of about 13%, it is typical for markets to struggle when corporate earnings are stagnating.

Not only have profits languished, but S&P 500 operating profit margins have also struggled to post any improvement. Operating margins have been relatively flat since the summer of 2017, and have declined somewhat since the recent peak in November of last year. Profit margins seem to be reflecting some higher wage costs, but are also indicative of the slow growth in productivity we have seen over the past few years.

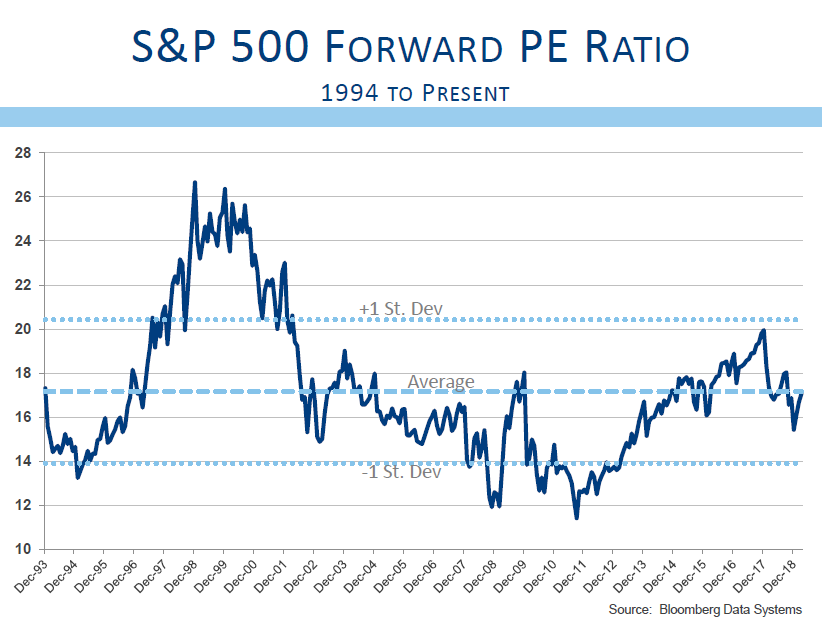

With flat earnings, the rebound in the market from the Christmas Eve lows has been driven entirely by higher valuations. While this is reflective of greater confidence and lower risks, it also suggests the market can again be vulnerable to concerns over trade, interest rates, and other potential worries and policy risks.

When we identify risks that deserve attention, it is important to recognize that we do not suggest in any way that we are on the cusp of another 2008-09 style Great Recession. When we speak of the potential for a recession, we could expect a very normal cyclical slowdown, but there is nothing to suggest the systemic risks that we struggled through a decade ago.

There were a number of factors that exacerbated the risks as we look back on the Great Recession. To begin, banks were willing to lend to anyone, and no effort was made to verify that applicants were not committing bank fraud. Got a pulse—get a loan was the modus operandi of most mortgage lenders. Today the criteria for loan approval is much tighter, and that is a good thing for our system, even as some very credit-worthy people will have trouble borrowing.

After those loans were made, they were packaged into mortgage-backed bonds, and the rating agencies were quick to give virtually every one of those bonds a “AAA” rating. By packaging and selling those loans, banks were able to make suspect loans without taking the risk that some people would be unable to meet their obligations. Those risks would be borne by the investors who purchased those bonds.

Why worry about “AAA” rated bonds? These highly rated bonds were sold everywhere — to pensions, corporations, sovereign funds, retail investors, and mutual funds. Since the rating agencies gave them the highest ratings, virtually every investor was able to purchase them, and these suspect bonds found their way into every portfolio. When the bonds started to show problems, they were so widely held that every portfolio and investor was caught with too many bonds that were purchased as high quality instruments, but were, in fact, very sketchy.

Today it is much harder for banks to sell bonds from their holdings, and it is much harder for bonds to qualify for “AAA” ratings.

Finally, increased regulatory requirements have required banks to hold materially more reserves in order to prevent problem loans from putting bonks and our banking system in jeopardy. By every measure, it is very unlikely that the mistakes of 2008-09 are being repeated in our economy today. While we may be making some new errors, particularly with regard to trade and tariffs, it is simply not the case that we are on the verge of having another 2008-09 type recession. That just does not seem likely at this time.

When we try to determine the level of risk, we look at many factors. We consider the current stance of the Fed’s policy as well as the direction of that policy. While the Fed has not started lowering interest rates, their policy initiatives suggest a more investor-friendly stance, and as we suggested earlier, it is not prudent to “fight the Fed.”

We also consider global central bank policies, and here too the most recent moves have been to a more accommodative stance. Our corollary to “don’t fight the Fed” is to not fight the global central banks either.

Credit markets remain in good shape, and there are no signs of credit stresses or systemic risks. Some investors worry about the high levels of corporate debt, but companies are able to make their debt-service payments, and there are no indications that companies are locked out of credit markets. Our outlook on credit markets remains fairly positive.

Economic growth is another of our considerations, and U.S. economic growth remains quite reasonable. Growth overseas is slow, but the data is starting to suggest that growth may be troughing. Friendly central banks help us suggest the current economic weakness may not get any worse.

We also consider the tone of the market, and here too the news is fairly positive. At the end of last year, good news was seen as bad and bad news was seen as bad. Today the stock market seems able to ignore some bad news and reward those companies that are able to grow revenue and earnings at a faster pace. While we worry about excessive optimism and stretched valuations, the tone of the market remains a positive.

There are always risks of policy mistakes and external shocks. The risk of an interest rate policy mistake seems to have diminished, as have the risks of an all-out trade war. While there is always a risk of an external or unforeseen shock, we do not see these risks as significantly above average.

With modest risks, and with no recession in site for the rest of this year, we continue to suggest this is a reasonably positive environment for investors.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

Disclosure

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2018. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.