April 8, 2021

Not everything that counts can be counted, and not everything that can be counted counts.

— Attributed to Albert Einstein

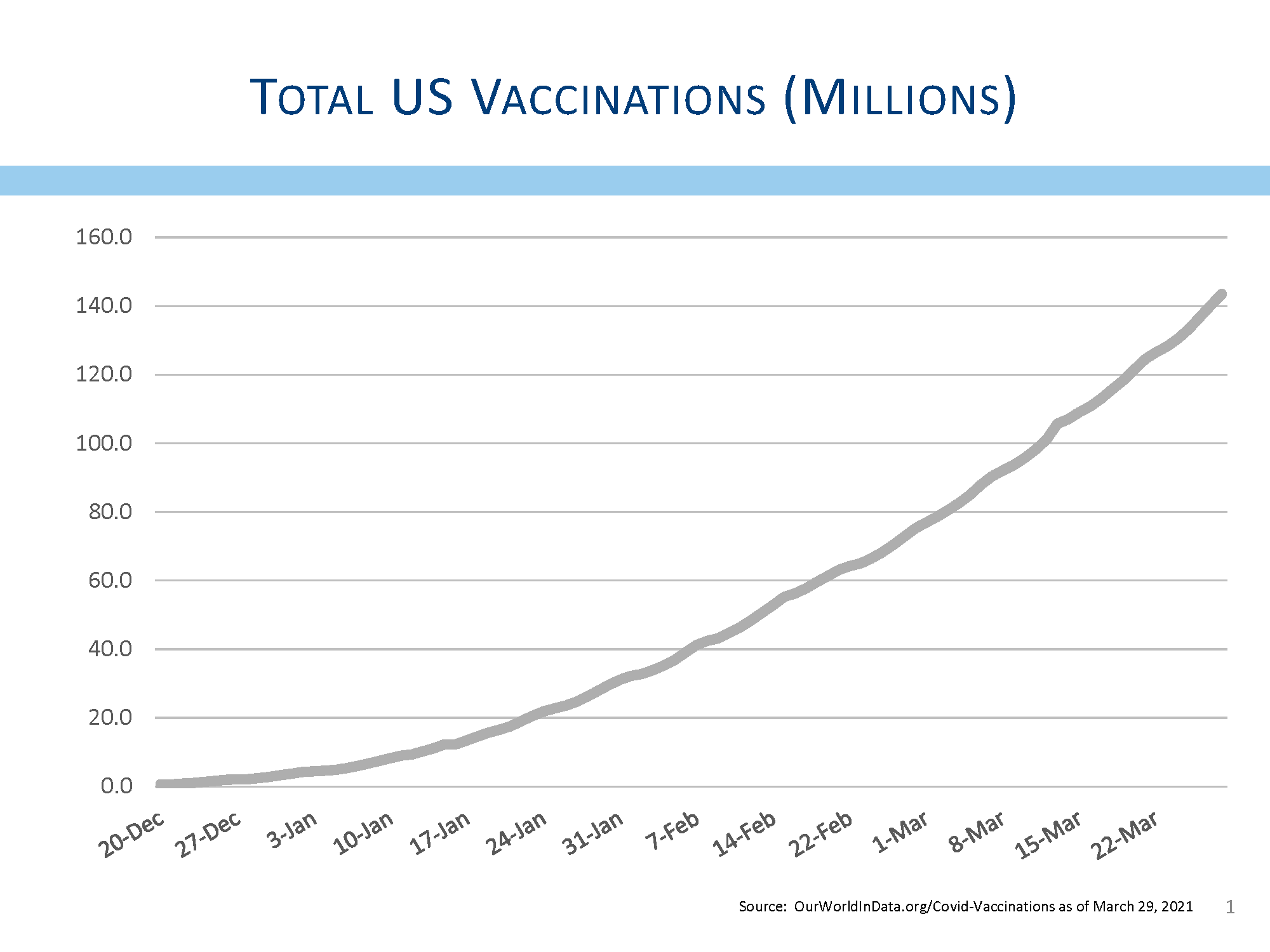

In the topsy turvy world that has been the stock market this first quarter of 2021, those industries and sectors that were the worst performers in 2020 have done the best so far this year. Leadership has been moving away from companies that showed so much promise early in the pandemic, and moving toward companies that will benefit from stronger economic growth. With 17% of the U.S. population fully vaccinated as of this writing, very few countries have done a better job at protecting its people. The high number of vaccinations is expected to lead to significant economic growth as people start traveling and dining out, and stronger economic growth is one of the most important themes for the stock market as we look ahead to the rest of this year. (If you are pressed for time, consider reading only the bold.)

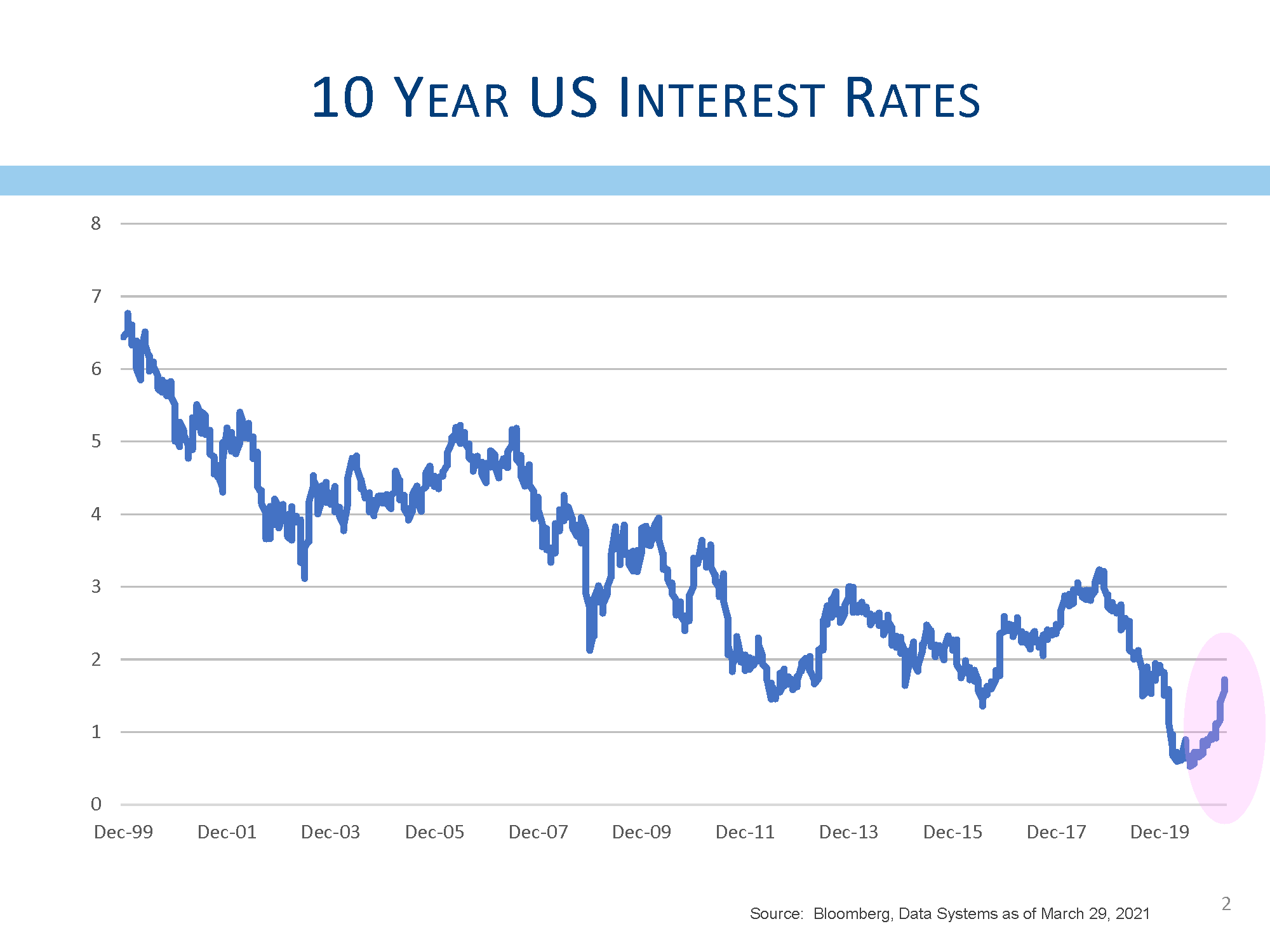

Of course, stock markets often find something to worry about, and this quarter seems no different. One of the biggest worries has been caused by a significant increase in interest rates. 10-Year interest rates have increased from a pandemic low of about 0.5% to more than triple that amount more recently. No one is suggesting that 10-year rates are high, at about 1.70%, only that they are materially higher than they were a few short months ago. Further, the pace of that increase has been quite swift and that too has some investors nervous. While we find the pace of interest rate increases to be a bit discouraging, as we mentioned above, there is nothing about the 1.7% yield on 10-year treasuries that is frightening.

Even more benign is that interest rates are approximately equal to the rate of inflation. So while investors earn an annual return on their treasury bonds, that rate is offset by inflation each year. Net after inflation, investors are not really earning much of a return at all. We call the interest rate adjusted for inflation to the be “real” interest rate, and investors should be concerned that interest rates are too high when those rates significantly exceed the rate of inflation (that is when real interest rates are high).

Interest rates are rising for most of the right reasons. At the pandemic lows, interest rates were reflecting a moribund economy. Forced closures had pushed economic growth nearly to a standstill, and one of the few places to hide at that time was in the government bond market. Now, however, we look ahead toward economic growth that is accelerating, and corporate earnings that are projected to increase by 30% over the next several quarters. Higher interest rates are reflecting the significantly improved economic outlook with the potential for a modest pick-up in inflation. In this scenario, interest rates should be higher.

It should also be noted that higher interest rates, particularly when rates are rising for the right reason, have not led to lower stock prices, but more often than not, higher interest rates have coincided with higher stock prices. At this point in the cycle, investors should not fear higher interest rates.

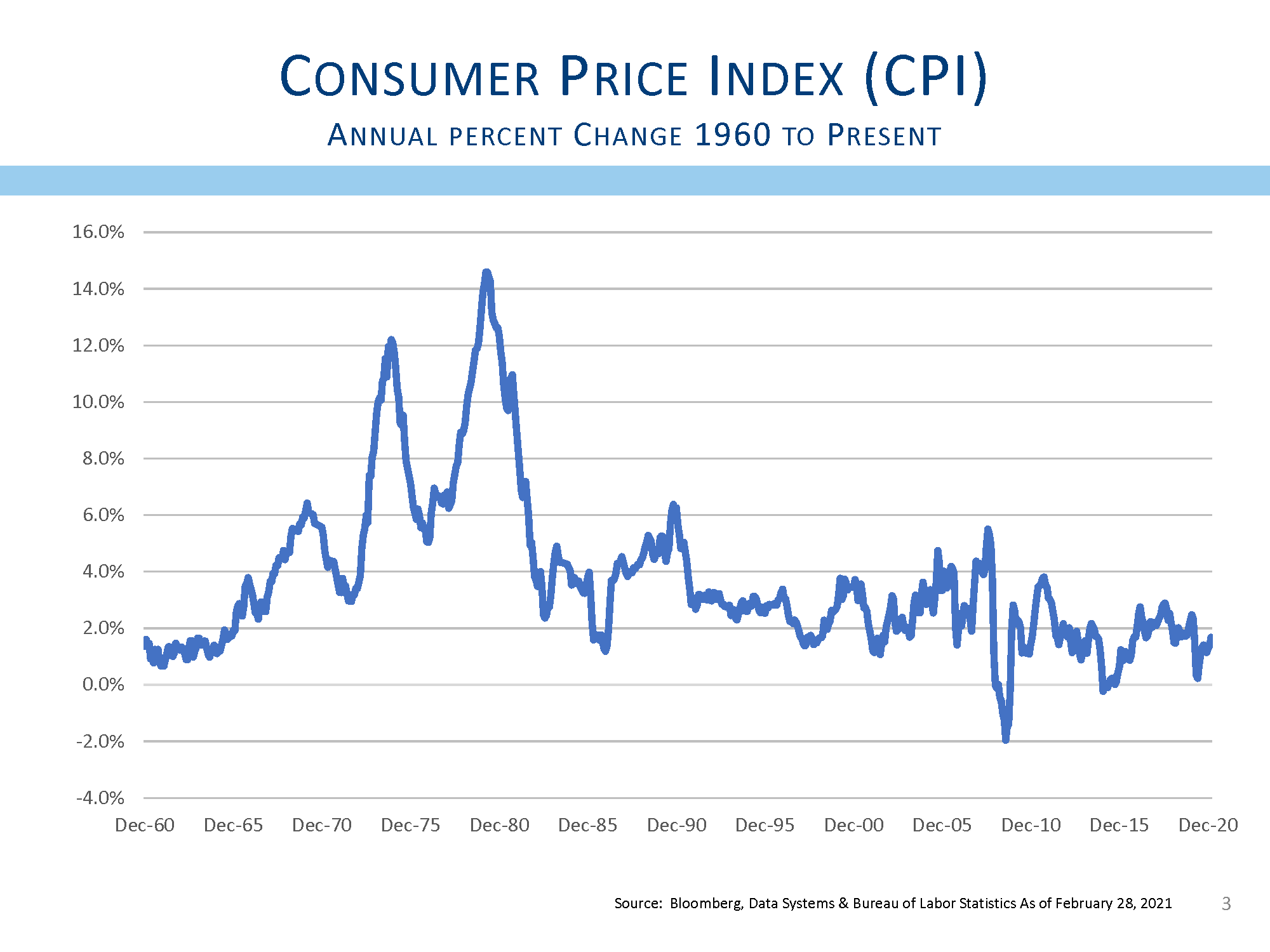

Some investors are concerned not just with interest rates, but with the idea that higher interest rates are being driven by higher inflation. We are seeing signs of inflation in commodity prices like copper and lumber, in gasoline prices, and in home prices. Inflation is likely to be higher through the rest of the year, but we do not think that inflation is going to run away as it did in the late 1970’s. It is often suggested that inflation is caused when too much money is chasing too few goods. With most Americans getting a recent stimulus check for $1,400, that is the fuel of too much money.

Inflation is barely at 2% and has rarely been above 4% over the past 30 years. The Fed has a long-term target of 2% inflation, and low inflation of around 2% is far less pernicious than deflation. When prices are falling, people’s attitudes change and they think, “why buy that good today when we could buy it cheaper tomorrow.” When tomorrow comes, the reality sets in that the price will be lower still in the near future. Deflation creates an environment that stifles consumption while we wait for ever-lower prices.

Wanting to avoid that destructive circular logic, the Fed has embraced a 2% inflation target. High enough to prevent deflation, but not so high as to meaningfully disrupt economic activity. The Fed has more recently suggested that since inflation has been running below the 2% target, they will permit inflation to rise above their target so that inflation averages 2% over the entire business cycle. This more lax definition of permissible inflation may be another reason why many investors fear an inflationary surge.

Years ago, when inflation was higher than the current 2%, the Treasury invented bonds that are designed to offset the potential ravages of inflation. These Treasury Inflation Protected Securities (TIPS) offer investors a yield that is regularly adjusted for inflation. By comparing TIPS to regular Treasury bonds, investors can determine what rate of inflation is built into these securities. The rate of inflation implied by the price of TIPS is currently just above 2%. If inflation was heading meaningfully higher, it is likely that TIPS would be one of the first places to reflect those fears, but so far that has not happened.

Certainly, as we mentioned, there are some prices that are going up. The price of oil has risen dramatically as the economy continues on the path to improvement. Oil prices are high compared to where they were during the early weeks of the pandemic, but they are not high by historic standards.

Oil prices are currently about $62 per barrel. From early 2011 through the summer of 2014, oil prices hovered around $100 per barrel. So while oil prices are double where they were last summer, they remain 35% below where they were a few years ago.

Higher oil prices will certainly show up in the inflation statistics, but do we really think oil prices will continue to rise? Like so many industries, oil prices have been dramatically impacted by technological improvements that allow us to mine oil from shale formations. Higher oil prices will encourage more fracking, and should supply increase above demand, the surplus will drive prices lower. We understand that oil prices are pushing inflation higher, but we are not confident that it will be sustainable over more than just a quarter or two.

What about wages? The Democrats tried to raise the minimum wage, but were unable to pass that legislation. That alone says plenty about the potential for wage inflation. One unintended consequence of higher unemployment benefits is that it will force companies to pay up for labor. Why go to work when you can earn $15 an hour to remain unemployed? Companies seeing their businesses grow will need to offer higher wages in order to attract workers. That will create wage inflation through the end of this year. But as next year comes around, those newly hired workers will already be earning a higher wage than their employers wanted to pay, and we suspect companies will only offer paltry increases next year. We do not see a cycle of wage inflation and think most of the impact will be short-lived. The Fed has said they expect inflationary pressures to be transitory, and we tend to agree.

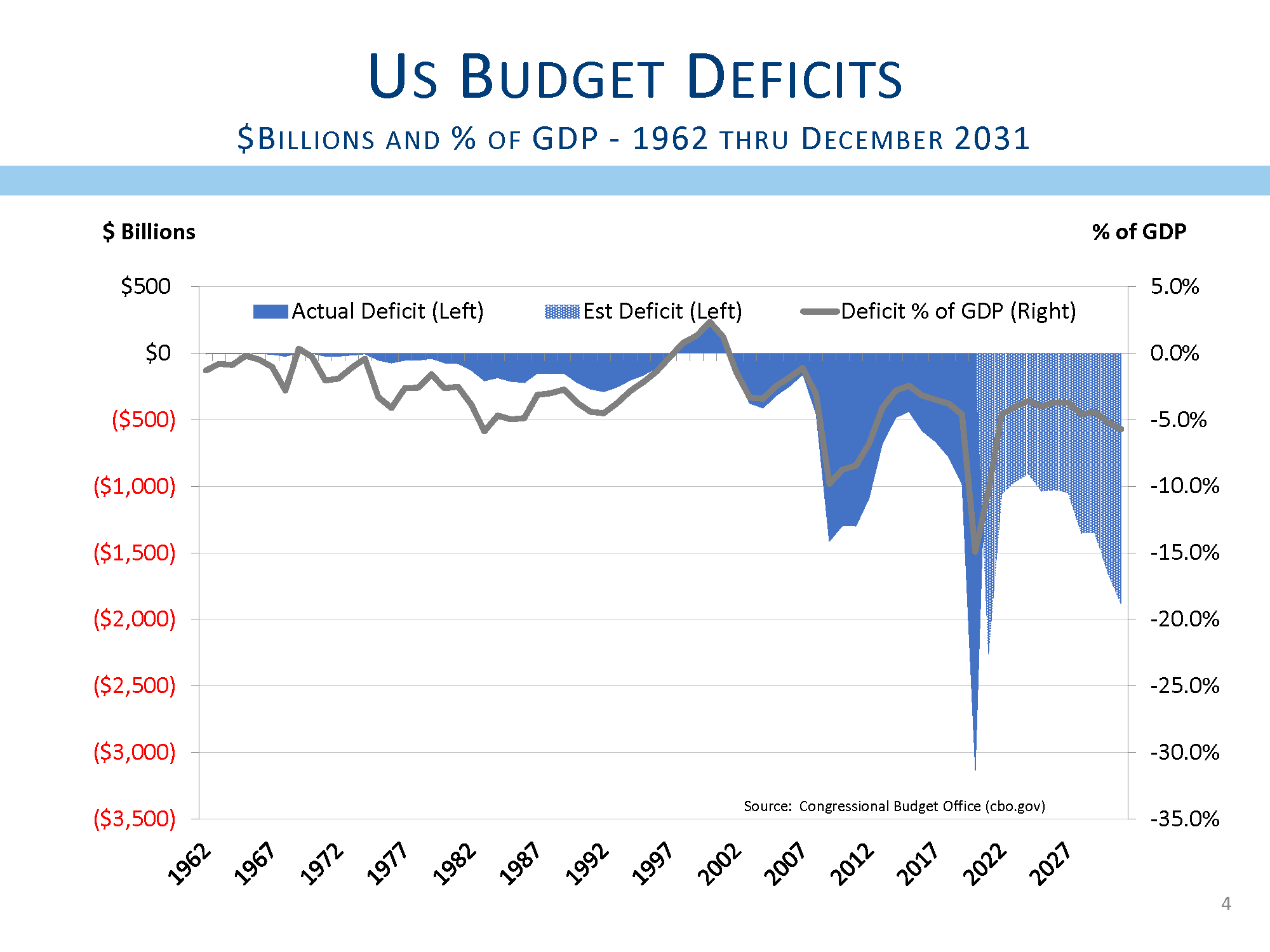

Another concern that we hear from strategists and investors alike centers around the enormous budget deficits that seem almost normal. President Obama ran trillion dollar deficits as he worked to prevent the Great Recession from becoming another Great Depression. President Trump ran trillion dollar deficits as he lowered tax rates on corporations and high earning taxpayers, and also as his administration provided aid to the country suffering from the Covid-19 pandemic. President Biden too will be running trillion dollar deficits as he has provided additional stimulus to offset the pandemic. The Congressional Budget Office projects near trillion dollar and higher budget deficits for their 10 year forward-looking forecast.

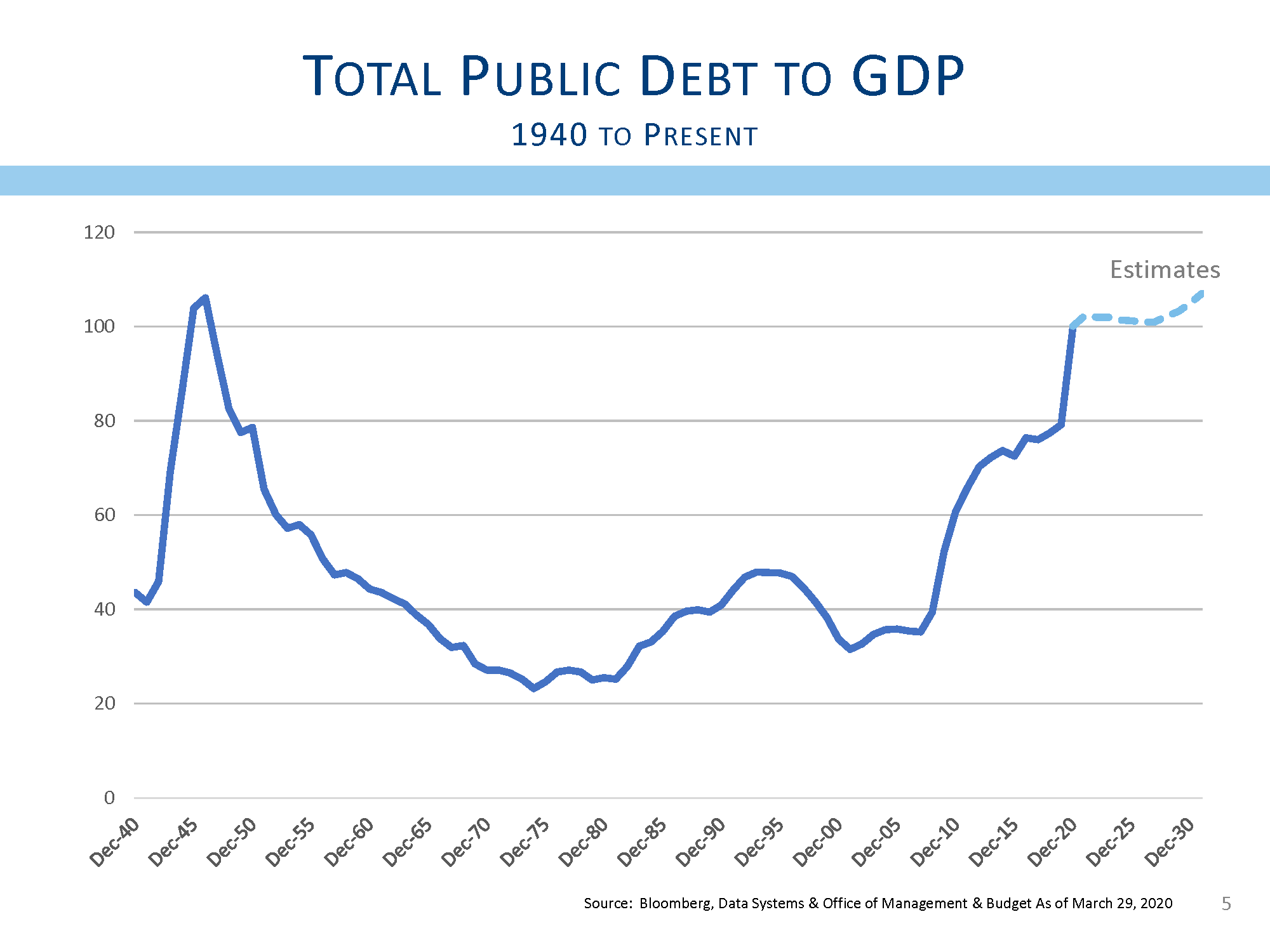

Government debt as compared with the size of the economy is bigger than it was at the end of World War II. That level of debt proved to be temporary as the economy grew over the next several decades. It is hard to fathom the U.S. economy growing as rapidly as it did during the baby boom years, and that suggests our economy will not be as able to grow our way out of debt.

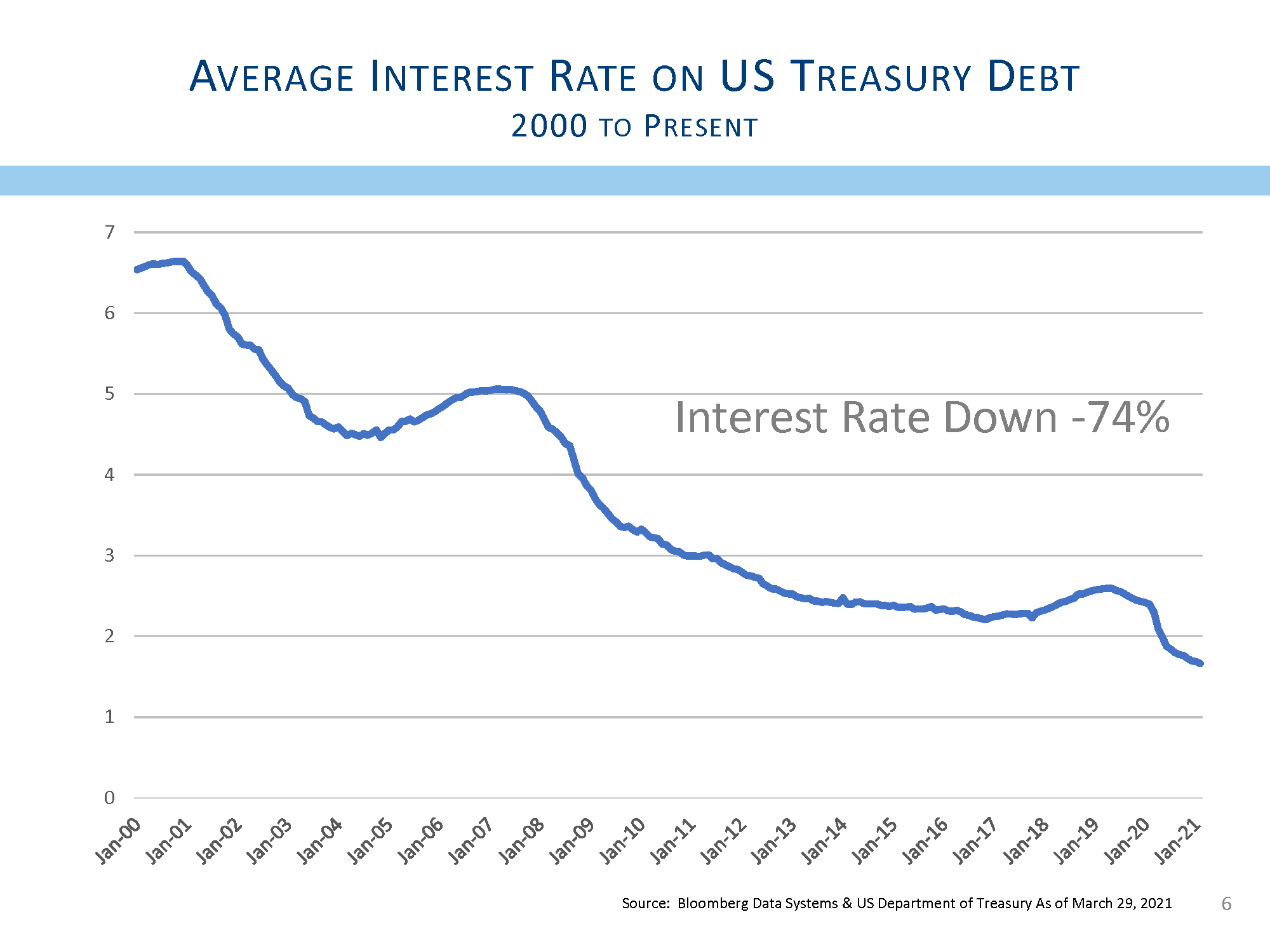

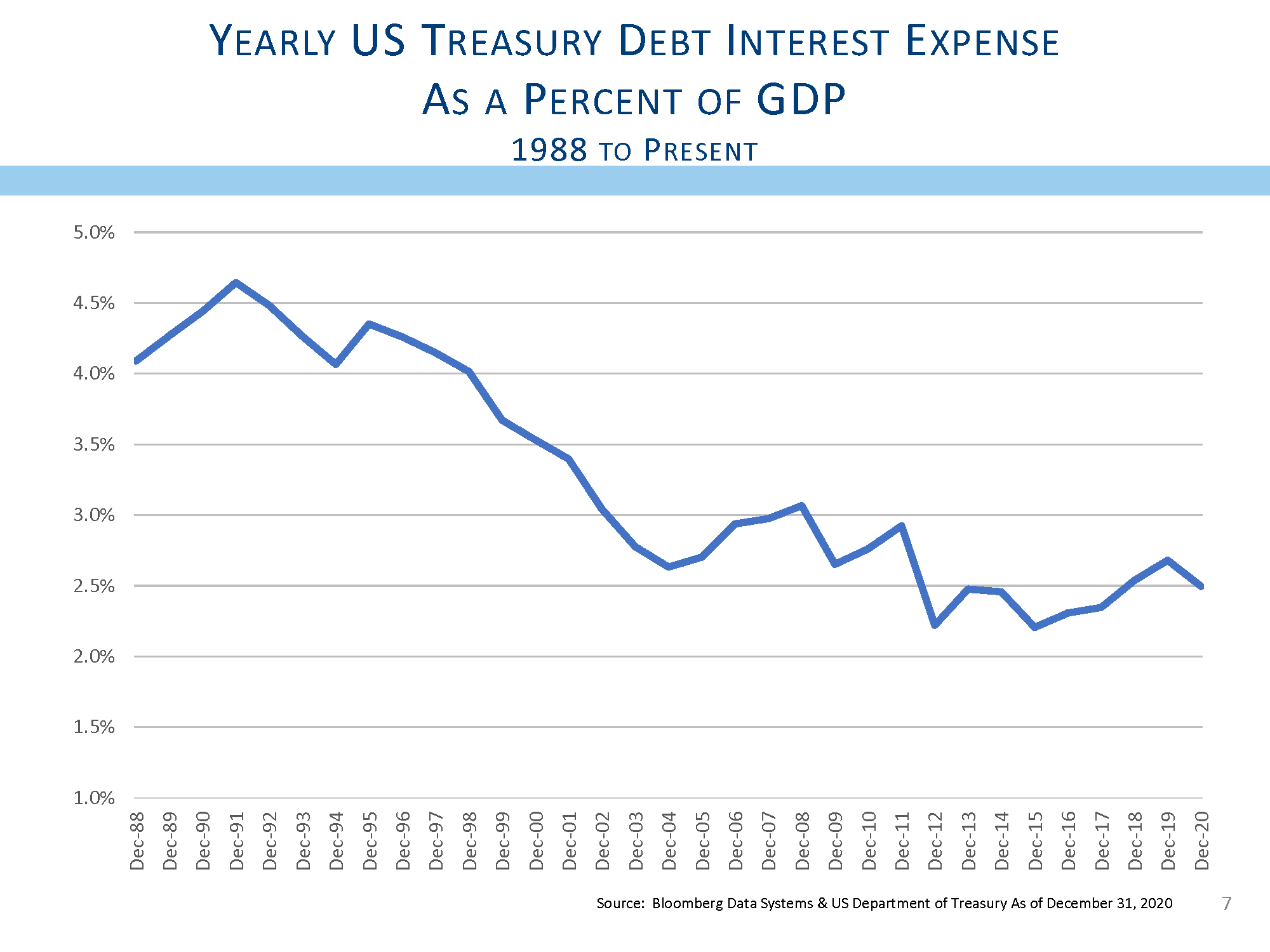

There are some other factors that help ameliorate the impact of higher levels of debt. First and foremost is the lower rate of interest. At the start of the twentieth century, the average interest rate paid on U.S. Treasury debt was about 6.5%. Now the average interest rate is down to about 1.7%, a reduction of nearly 74%. Even though debt is up, the cost of that debt is down substantially. As compared with the size of the economy, the amount the government spends on Interest expense is actually down over the past thirty years. In 1991, interest payments represented about 4.6% of the economy (measured by Gross Domestic Product or GDP), while in 2020 that number had declined to only 2.5% of GDP. So while the amount the government owes has gone up, our ability to service that debt has actually improved. At current interest rates, we can easily afford the debt we have.

Of course, debt does need to be paid back and high levels of debt are an obligation that our children and grandchildren will have to face. Should interest rates rise, our ability to service our debt will get more difficult. Our deficits are driven by two factors: revenue collections are well below average and expenditures are well above average. One problem on the expense side is that as our society ages and more baby boomers retire, the Medicare and social security expenses are going to increase over the next couple of decades. It seems that neither Republicans nor Democrats are embracing fiscal responsibility, so it is likely that budget deficits will continue to mount. Still, as we mentioned above, our ability to pay our debts remains quite good. Budget deficits will need to be addressed, but there is certainly no pending disaster even as deficits will be near a trillion dollars for many years to come.

The last worry to address is that of valuation. By many measures, the stock market is expensive. But simply because the market is expensive does not necessarily mean that it is poised for a fall. It was British economist, John Maynard Keynes, who said “the markets can remain irrational longer than you can remain solvent.”

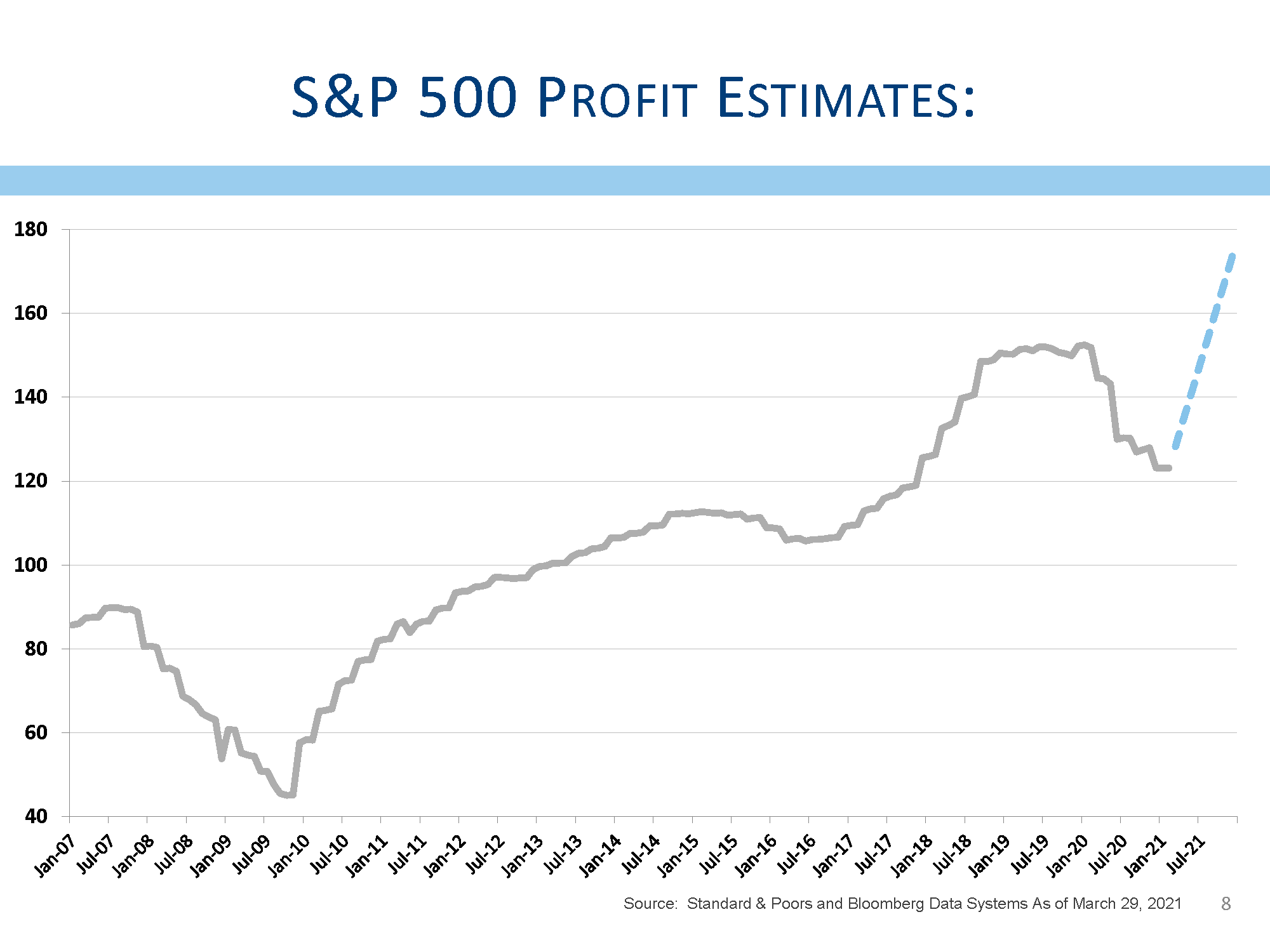

Markets are expensive, in part because earnings are so depressed as we start to emerge from the pandemic lockdowns. Corporate earnings fell by nearly 20% in 2020, and most estimates call for a significant rebound in 2021. We would not be surprised if earnings grew by 30% in 2021 bringing earnings to a new record before the year is out.

We generally believe that stock prices follow earnings, but that does not necessarily mean that both stocks prices and earnings go up simultaneously. It is certainly possible that the strong gains in stock prices last year were anticipating the growth in earnings we expect this year.

Warren Buffet has often compared the price of stocks to the size of the economy, and here too the market looks expensive. While we challenge Mr. Buffet at our own peril, companies today are far more international than they were a decade or two ago. Today, international sales represent nearly 30% of revenues of S&P 500 companies. Buffet’s comparison of U.S. stock prices with the size of the U.S. economy may be ignoring the prospect of significant overseas revenues and profits. Perhaps the market is not as expensive as the Buffet indicator suggests.

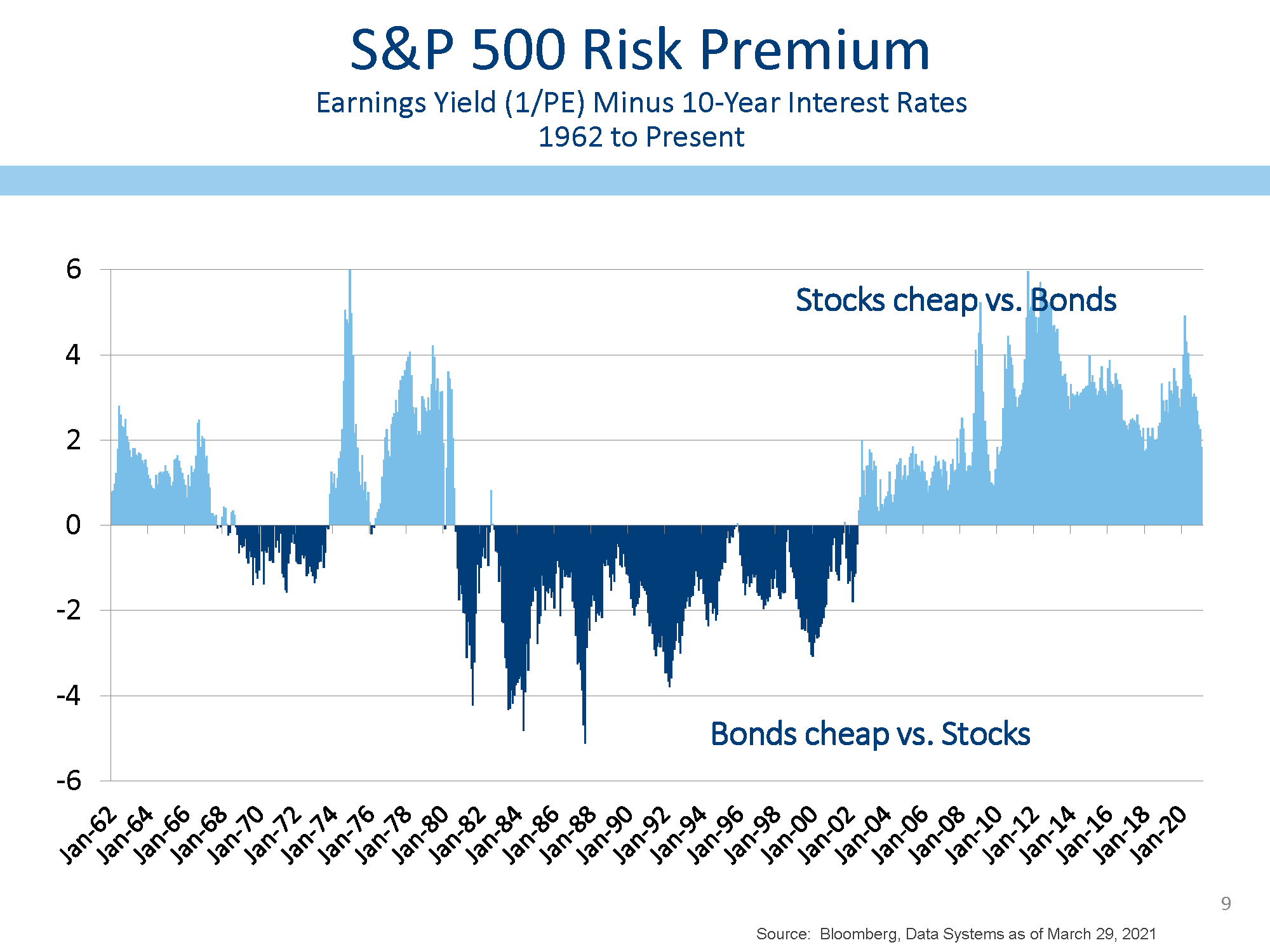

We have frequently compared the price of stocks with the interest rates and here the news is quite good. When compared with the current 1.7% yield on 10-year U.S. Treasury obligations, stock prices are not expensive.

Market valuations are stretched by many measures, but with corporate earnings poised to grow, the market does not seem as vulnerable as some valuation measures suggest.

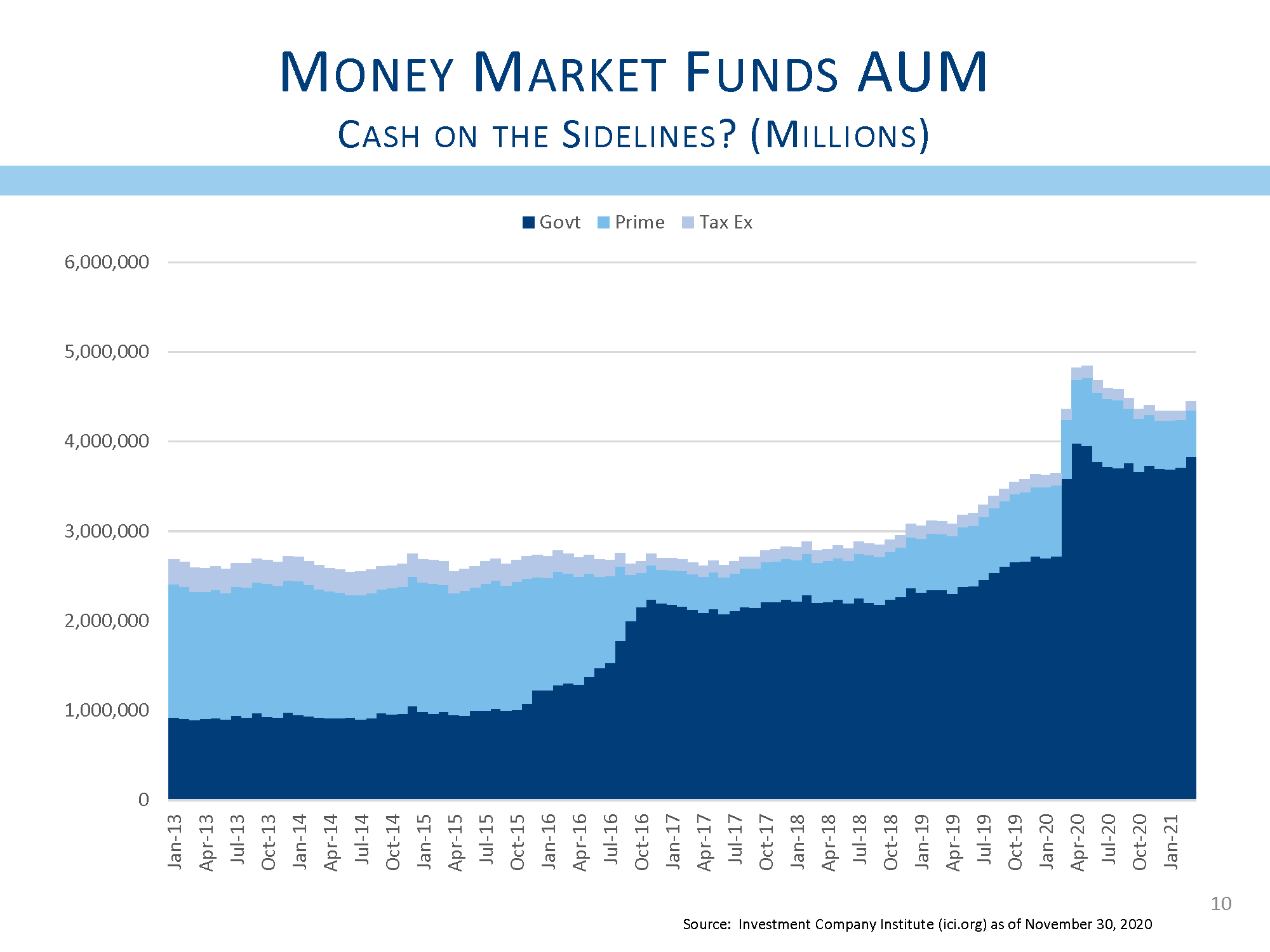

Another saving grace for stocks is the tremendous amount of cash on the sidelines. The amount of cash held in money markets has gone up by about a trillion dollars since the pandemic began. This is cash held by both individuals and by corporations. With virtually no yield earned on money markets, it is likely that a significant amount of that cash will find its way into investments in stocks, home improvements and capital equipment. All are likely to lead to stronger growth and potentially stronger stock prices.

With a Fed that has expressed a willingness to keep interest rates low for the foreseeable future, and with corporate earnings poised to expand as more people are vaccinated and are able to return to more normal activities, we do not see an environment that would be poor for stocks. Yes, markets might have already priced in significant improvements, but the risks of recession or of the Fed tightening interest rates too much seems quite remote, and that should help stocks provide better returns than many alternatives.

Crypto-nite—Recently we have received more questions about bitcoin and other crypto-currencies. The attraction to bitcoin is that it is a means of transactional value that is not tied to any government. Governments have sometimes resorted to foolish policies that have resulted in very high inflation followed by severe declines in the value of their currency. The most notable occurrences were in Weimar Germany and more recently in Zimbabwe. In both cases, paper currency was literally not worth the paper it was printed on. When governments run huge deficits, the thinking goes, some measure of value that is not susceptible to the inflationary policies of any particular government would be attractive. That is the thought behind gold, and now bitcoin. This is not a totally foolish thought process.

Before we go on, one obvious fact is that the technology behind bitcoin is revolutionary. Imagine creating a general ledger for your company that is not susceptible to fraud or malfeasance. Transactions are entered by many players and only when those transactions match is the latest transaction added to the chain of past transactions (hence the name blockchain).

There are a few big problems with bitcoin. First, it is hard to suggest bitcoin is a store of value when the value has gone up from $4,000 to $60,000 over the past 12 months. That is great if you own bitcoin, but what goes up can also go down, and bitcoin fell 83.9% in 2018 (from $19,500 to $3,150). This makes us worry that people owning bitcoin as a hedge against inflation could find the value of their holdings significantly reduced simply by market moves. Also consider that when you use some of your bitcoin to make a purchase, you are actually creating a capital transaction that must be reported on your taxes. Perhaps the rules will change, but if you purchased bitcoin at $40,000 and sold some at $50,000 to buy groceries, you would also need to report the capital gain on your taxes. This makes bitcoin difficult to use in everyday transactions (until the tax laws change).

The second disadvantage with bitcoin is that it is hugely energy inefficient. By some estimates, it takes as much electricity to complete one bitcoin transaction as it does to create several hundred thousand transactions on Visa. The reason for this is the blockchain methodology. Since all bitcoin transaction reporters (called miners) must produce the documentation for each transaction before a random selection process picks one transaction to be included, the amount of energy required is enormous. It is estimated that bitcoin uses almost as much electricity as the Netherlands. Since electricity costs are important, this drives bitcoin miners to do their work where electricity costs are low, often where coal is the source of that electricity. Imagine that the number of bitcoin transactions goes up by 10X. That would suggest bitcoin could demand more electricity than most countries.

We do understand the attractiveness, but for now we see bitcoin as more of a speculation than as an investment or as a store of value. Perhaps we will miss the next big thing, but we think the disadvantages would become ever more troublesome as more and more people think they can use bitcoin for everyday transactions.

Everyone at L&S continues to work tirelessly to make sure that we meet or exceed your needs. If you have any questions or concerns, or if your investment objectives have changed in any way, please contact us. Stay well, stay safe, and stay sane.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015, and ACA Performance Services for the periods from January 1, 2016 to December 31, 2019. Upon request to Sy Lippman at slippman@lsadvisors.com. L&S can provide the L&S Advisors GIPS Report which provides a GIPS compliant presentation as well as a list of all composite descriptions. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.