July 10, 2018

The whole problem with the world is that fools and fanatics are always so certain of themselves, but wiser people so full of doubts.

— Bertrand Russell (1872-1970)

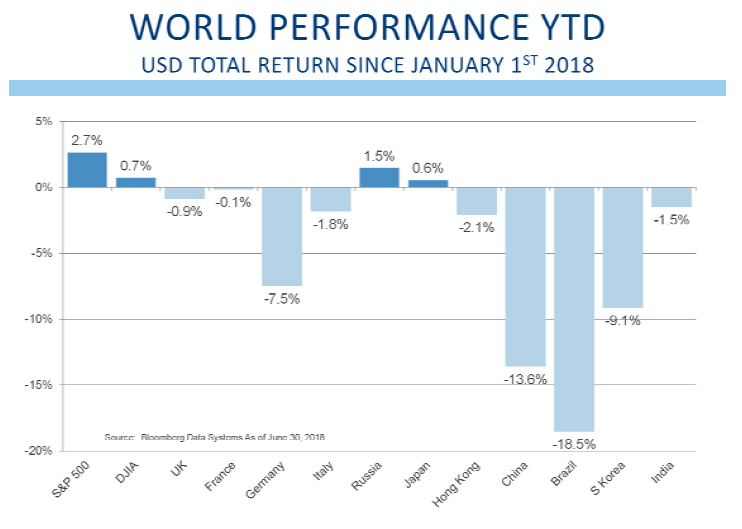

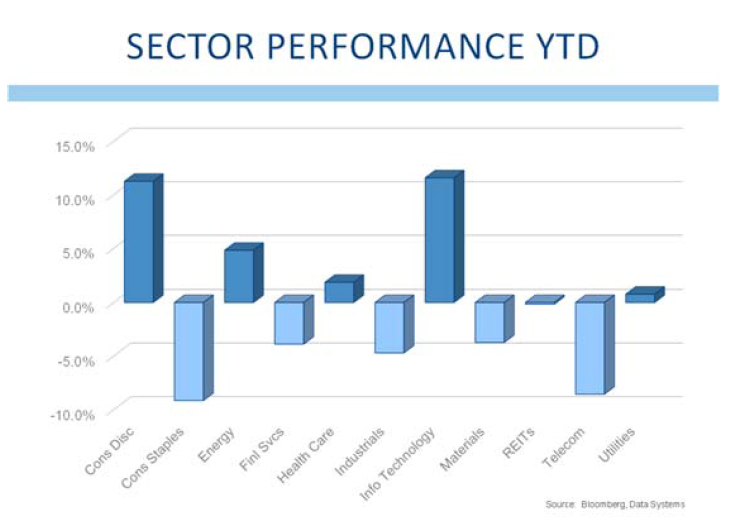

Following an enthusiastic rally in January, stock markets have had trouble making forward progress over the first half of this year. While markets did regain some ground in the second calendar quarter, returns for the first half have been somewhat disappointing, There are a myriad of crosscurrents that have been affecting markets, and it has been difficult to maintain conviction. Some data, including the strength of the economy, is excellent. Other data is less positive, and some indicators could be viewed as negative. With such conflicting signals, it is no wonder that markets have struggled to post any meaningful gains.

First, let’s take a look at those indicators that are unquestionably positive. The strength of the economy is undeniable. The Atlanta office of the Federal Reserve posts an indicator they call the “GDPNow GDP Forecast” and that number suggests second quarter GDP will be around 4%. Over the past several years, we have seen a pattern of weak growth in the first calendar quarter followed by a strong rebound in subsequent quarters. The first quarter number of 2% will be easily eclipsed by the coming second quarter report. That is not to suggest that large numbers are so unusual. We had 4% growth at the end of 2013, 4.6% in the second quarter of 2014, and 5.2% in the following quarter, but it is clear that currently the economy has good momentum.

We can see that momentum in the unemployment numbers where the unemployment rate is currently 4.0%, and as low as it has been since the end of 2000. Even the broader measure of unemployment, the U-6 that includes part-time workers who would like to have full-time work, is at a multi-decade low.

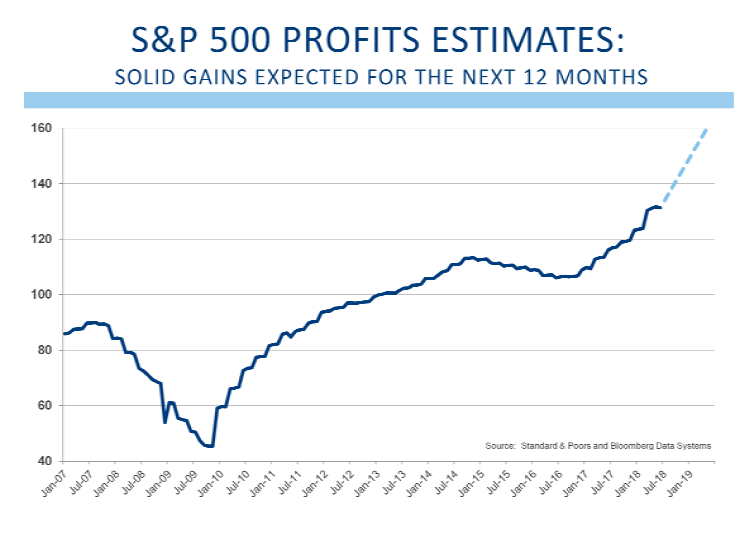

With strong economic growth and a solid employment picture, corporate earnings are growing at a healthy clip. Year-over-year earnings for the S&P 500 are up 13%, and are expected to continue to post double-digit gains for the next four quarters. While some of these gains are reflective of the corporate tax cuts enacted at the end of last year, a significant amount of corporate earnings growth is being driven by the solid economic expansion we are experiencing.

With solid growth, it is no surprise that confidence remains high. We look at four different confidence measures: two that measure consumer confidence, one that measures CEO confidence, and one that measures small business confidence. In all cases, these indicators are at or near highs, and are consistently well above the levels that prevailed before the start of the Great Recession.

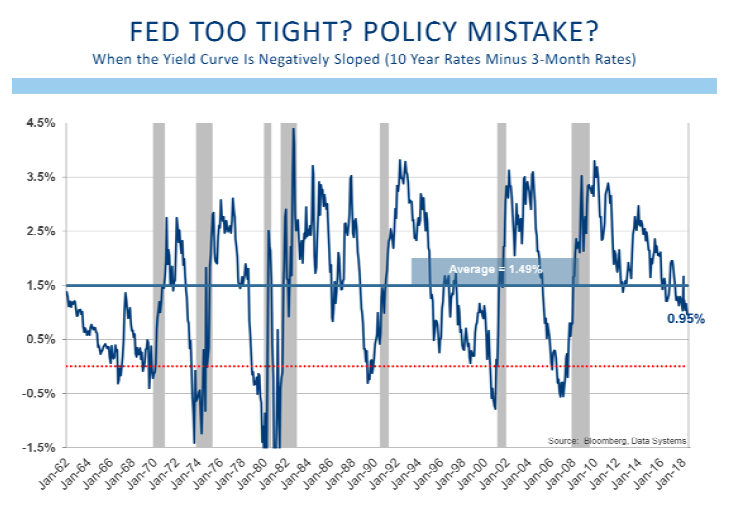

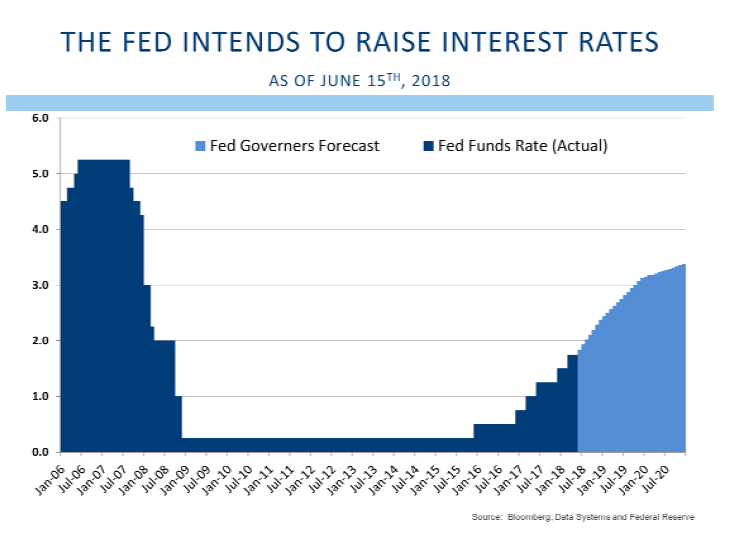

We have repeatedly remarked about our two favorite indicators that help determine when the start of next recession will occur. Our first is the curve of US government interest rates (called the yield curve). The Fed uses interest rates as a way to help regulate the economy. They lower rates when they are trying to make borrowing easier, which has the added result of increasing economic activity. In a similar vein, they raise interest rates when they believe growth rates are getting too hot and may cause inflationary pressures to build.

When interest rates are increased too much, markets start to anticipate slower economic activity, and longer-term interest rates stop going up. If the Fed continues to raise interest rates in this environment, it is possible that short-term interest rates rise above long-term rates. We call this an inverted yield curve, and it is typically a sign of a policy mistake. Why, for example, would any bank make new loans when their costs are 6%, but they can only lend to willing borrowers at 5%? As bank lending dries up, the economy slows. This type of policy mistake has been an excellent indicator of coming recessions, and it has typically predicted the start of recessions by three to six quarters.

The yield curve has been flattening, and some market analysts suggest that we are getting perilously close to a policy mistake. We are much more sanguine about this indicator and do not see the Fed as having made a policy mistake, at least not yet. This indicator would suggest that a recession is unlikely to start before the end of 2019.

The second of our favorite recession indicators is similarly suggesting that the probability of a recession remains quite low. We look at the annual percentage change in the US Government’s Leading Economic Indicators (LEI). This index is comprised of ten separate components and is designed to predict the outlook for the US economy. The annual change in this indicator has also turned negative well before the start of the next recession. Similar to the potential of a Fed policy mistake, this indicator has also given investors three to six quarters of warning. Unlike the recent flattening of the shape of the yield curve, this indicator remains quite robust and has not as yet shown any signs of weakening. This adds to the tally of data points that are positive and are not as yet flashing warning signals.

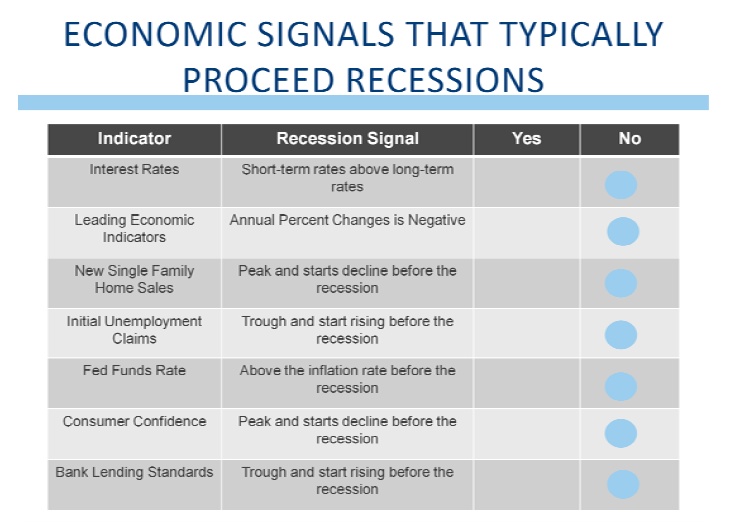

While the two indicators discussed above in depth are not flashing a caution warning, there are other economic signals that typically suggest the end of the economic cycle. Here too, the data is uniformly positive, and it is difficult to find indicators that suggest this near record-long expansion is winding down. New single family home sales have typically peaked and turned lower prior to the start of recessions. New single family home sales have not shown any recent signs of weakening. Initial unemployment claims typically trough and start to rise prior to the start of recessions. Not only has this indicator not turned, but it remains as low as it has been since the middle of 1971. With the Federal Reserve raising interest rates prior to recessions, it has been typical that the Fed Funds rate exceeds the rate of inflation prior to the start of recessions. While the Fed Funds rate has risen, it remains below the rate of inflation, and below the levels that have prevailed prior to the start of previous recessions. Consumer confidence has also peaked and started to decline prior to the start of recessions. So far we have not seen any indication that consumer confidence is starting to give us a reason for concern. Banks also start to tighten their lending standards when they start to see increased risks of a recession, but so far there have been no signs that banks are reluctant to make new loans.

No matter what indicators we look at, we can find no indicator that suggests a recession is around the corner. That does not preclude a policy mistake, and it does not suggest that some external shock can quickly change the outlook. It does add to the positive data that reinforces the idea that this economic expansion still has some legs.

While the number of positive indicators is substantial, we would be remiss if we did not discuss those indicators that tend to make us somewhat more apprehensive. Let’s start with the tone of the market overall. After solid gains in January, the market stumbled, and has been unable to make new highs. If the economic news is so good, we can’t help but ponder why the market is struggling?

Why too are bank stocks unable to lead the market? A strong economy with rising interest rates should be a good environment for banks and other financial intermediaries, yet the financials have been one of the poorer performers so far this year.

Is the market trying to tell us that we are missing an important ingredient in our analysis? Are the banks sending the same message?

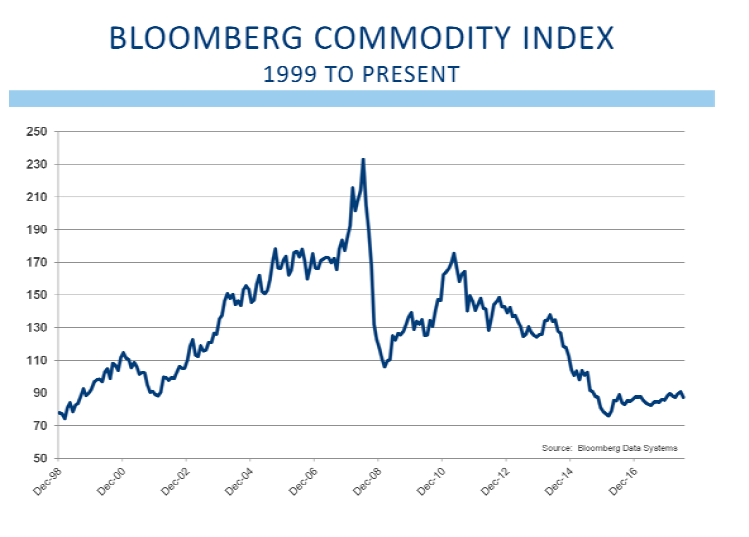

Commodity prices have recently been selling off, and that increases our concern. If the economy is so strong, why are copper prices at 52-week lows? Copper prices are often cited as a good economic indicator because copper is required to manufacture any electrical system. Its ability to predict the economy has earned copper the moniker “Dr. Copper.” With copper and other commodity prices selling off, the message would normally be that the economy is slowing. Yet our other economic indicators suggest the economy is quite robust. Why is there such a discrepancy between indicators that would normally be aligned? This causes us some consternation.

We know that the Fed is raising interest rates, and that typically happens towards the end of an economic cycle. To be fair, the Fed probably should have started raising interest rates several years ago, and many Fed watchers agree that the Fed remained too easy for too long. Some of the interest rate hikes should be seen as a means for the Fed to “normalize” interest rates to where they should be, rather than as a means for slowing an overheating economy. But the economy is close to overheating, and the Fed shows no signs of relenting on its stated goal of raising rates. The market suggests an 82% probability of another rate hike when the Fed meets at the end of September. Would the Fed keep raising interest rates if the outcome would be to invert the yield curve, something that is widely seen as a policy mistake?

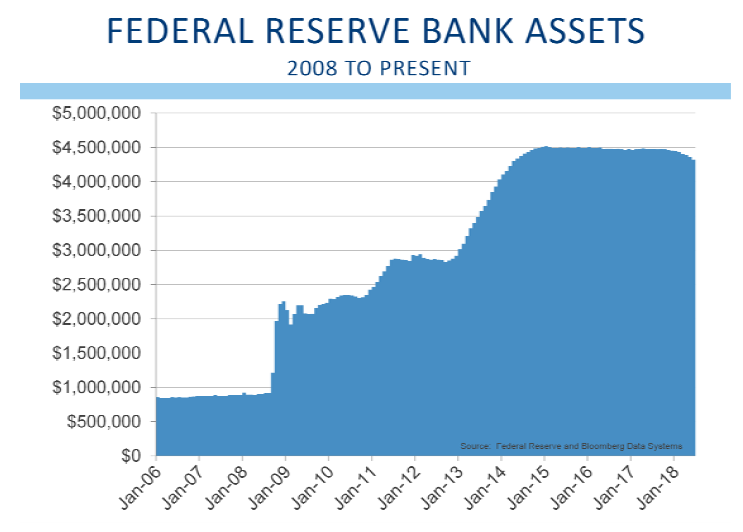

In addition to interest rate concerns, the Fed has embarked on a decision to reduce the size of its balance sheet. As you may recall, shortly after the Great Recession, the Fed embarked on a policy called Quantitative Easing or QE. Under QE, the Fed purchased bonds in the open market to keep interest rates artificially low, thereby helping to sustain economic momentum. From $900 billion in 2016, the Fed’s balance sheet increased nearly five-fold to a peak of $4.5 trillion. Now the Fed wants to reduce the size of its bond holdings to once again “normalize” their policy and reverse the extreme measures they took to prevent the Great Recession from getting even worse. The Fed has reduced the size of its holdings by nearly 5%, and it is expected they will continue to reduce their holdings for many years to come. So the Fed is using two tools at once to cautiously slow the economy, and we do worry that the risks of a policy mistake are elevated.

Speaking about policy mistakes, we are concerned that the potential for a trade war is just the kind of policy mistake that could end our expansion. Whether it is a trade war, a negotiation, a battle or a skirmish, we continue to believe that there are no winners in a trade war. Sure the economic effect has been calculated to have a modest impact on economic growth, but we are now seeing secondary effects, and the law of unintended consequences is likely to assure that there are no winners. As the cost of stainless steel goes up, so too will the price of kitchen appliances. Is that good for the manufacturers that make these goods? Further, we are seeing companies being forced to consider moving production overseas in order to avoid the impact of retaliatory tariffs from other countries. This is not just motorcycle manufacturers like Harley Davidson and Polaris Industries, but American-as-apple-pie General Motors has also indicated it might need to move production overseas to avoid retaliatory tariffs. Jobs moving overseas is not what we think the President was anticipating when he made the decision to utilize tariffs to reduce the trade deficit. While the actual damage done by our tariffs and others retaliatory tariffs may remain fairly modest, the repercussions for American business, including the added uncertainty, should not be underestimated.

Speaking about uncertainties, the mid-term elections are less than four months away. Historically the party in power has lost seats, with average losses of 30 House seats and 4 Senate seats. Were the average losses to occur, Democrats would regain control of both houses of Congress. With a strong economy and solid employment, it seems likely that Republican losses will be less than average. On the other hand, the primary loss by a 10-term incumbent in New York suggests that political uncertainty remains quite high. Markets hate uncertainty, and the upcoming mid-term election may also provide enough uncertainty for the market to remain range-bound for quite some time.

It is important to reinforce the idea that the largest market declines come when the economy is in a recession, but that markets may struggle even when the economy is doing well. Just as there are indicators we use to help us determine when we might face a recession, there are also indicators that can help determine when stock prices might top.

Some of the signs of a market top include heavy speculation and high levels of retail participation in the stock market. When your Uber driver gives you stock tips, or when cocktail party chatter suggests that making money in the stock market is easy, those are signs that the market may be near a top. We would also expect to see weakening earnings revisions and a shift toward more defensive leadership. So far, none of these indicators is flashing.

There are, however, some signals that warrant watching. A high level of merger and acquisition activity and a high level of initial public offerings (IPOs) are often signs of a top. Rising real interest rates can be a sign of a top. Tightening credit spreads, peaking corporate profit margins, and an erosion in the number of companies participating in the markets gains and making new highs are all signs that the market may be reaching a pinnacle. All of these indicators are prevalent. That does not suggest that a market top is imminent, but it does suggest that risks have increased and we must remain vigilant. After all, “chance favors the prepared mind.”

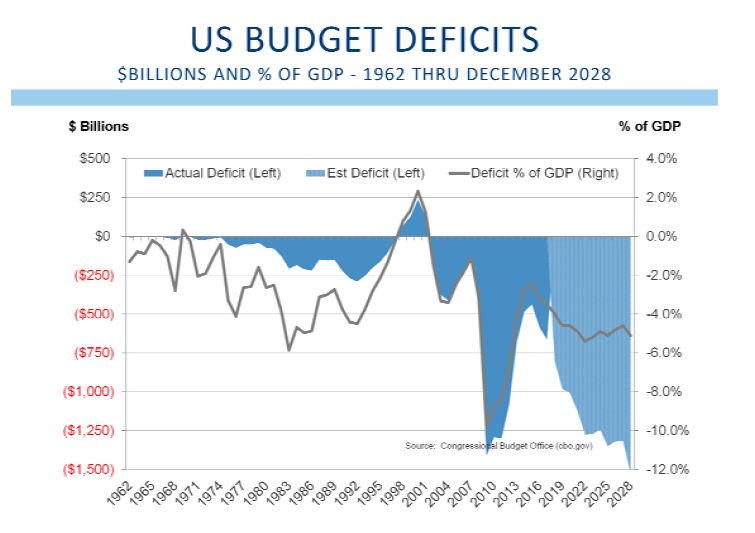

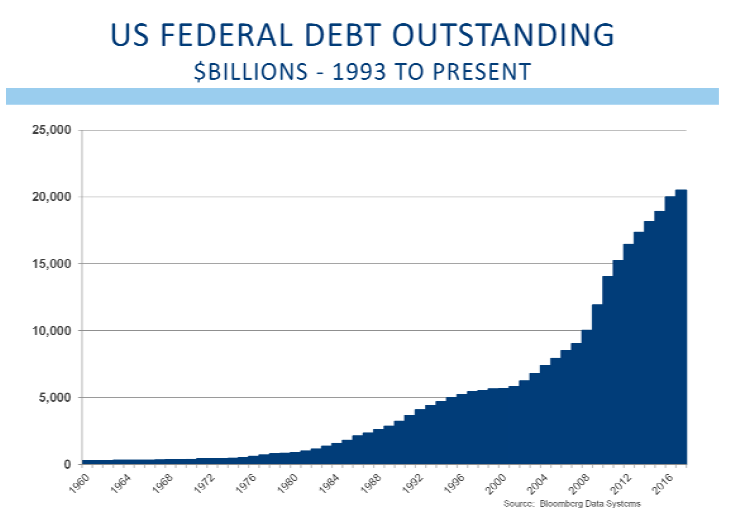

On the very long-term front, we are troubled by the very high levels of federal debt. The recent tax cuts and dramatic expansion of the deficit came at a time when the economy was humming along at a solid pace.

In a pure Keynesian world, (Keynes was an early 20th Century English economist) deficits should be used to help reduce the impact of the economic cycle on a country’s citizens. Once the economy regained its strength, deficits were to be pared back, and surpluses would be expected when growth was excellent. Those surpluses could be saved to provide funds for the deficits that would be necessary during the next economic downturn.

Prior to the current administration, the common perception was the Republicans were the deficit hawks while the Democrats were the spendthrifts. Now it seems that both parties have become profligate, and concerns over deficits seem non-existent.

The US Federal deficit exceeds $20 trillion, and deficits approaching $1 trillion per year are expected as far as the forecasters can project. Interest expenses currently run just over $450 billion per year, while the average interest rate on federal debts has declined from more than 6% in 2000 to about 2.4% today. Should interest rates rise by 1%, the interest expense of the federal debt will increase by more than $200 billion. That $200 billion represents more than 50% of the governments grants to states for the Medicaid program. So as interest rates rise, as the Fed suggests they should, interest expense will also rise, and the US government must decide whether to run even bigger deficits, or cut programs that help millions of people. The consequences of higher interest rates pose a serious problem for our government and our ability to provide important services to our citizens. Further, the lack of a constituency that believes debt levels need to be controlled suggests long-term difficulties for our country. Certainly the deficit is not an issue that will become problematic anytime soon, but like the baby boomer that has saved nothing for retirement, the consistent and expanding deficit spending poses a significant risk for our country. We will be able to kick the can down the road for many years, but at some point borrowing from our future will limit our ability to grow and provide for our citizens.

We do not mean to end on a negative note. That is not our intention. We see many indicators that are exceedingly positive; some that are troublesome; and a small number that are downright worrisome. These crosscurrents have led to a market that is struggling to find some direction.

Markets will need to dissect the impact of the Administration’s trade policy, and will need to get more comfortable with the outcome of the mid-term election. Once some of the uncertainties are diminished or eliminated, we would expect that the solid economic fundamentals will again rule the day. We continue to expect that stocks will outperform bonds this year, and that stock prices are likely to end the year higher than they are now.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

Disclosure

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2017. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.