July 10, 2019

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness…

— A Tale of Two Cities by Charles Dickens

By nearly any measure, the first half of the year has been a successful one for investors. Why then would we suggest it is both the best of times and also the worst of times? We find ourselves conflicted by the mixed messages we see as we look at both the stock market and the bond market.

Domestic large-cap stocks (the S&P 500) posted one of the best first halves in decades, while small and mid-sized stocks also posted very healthy returns. Foreign markets lagged domestic returns, but generally all stock market indices provided a solid years’ worth of returns in the first six months.

Bonds also provided investors with significant returns during the first half, with high quality and lower quality bonds generating generous performance.

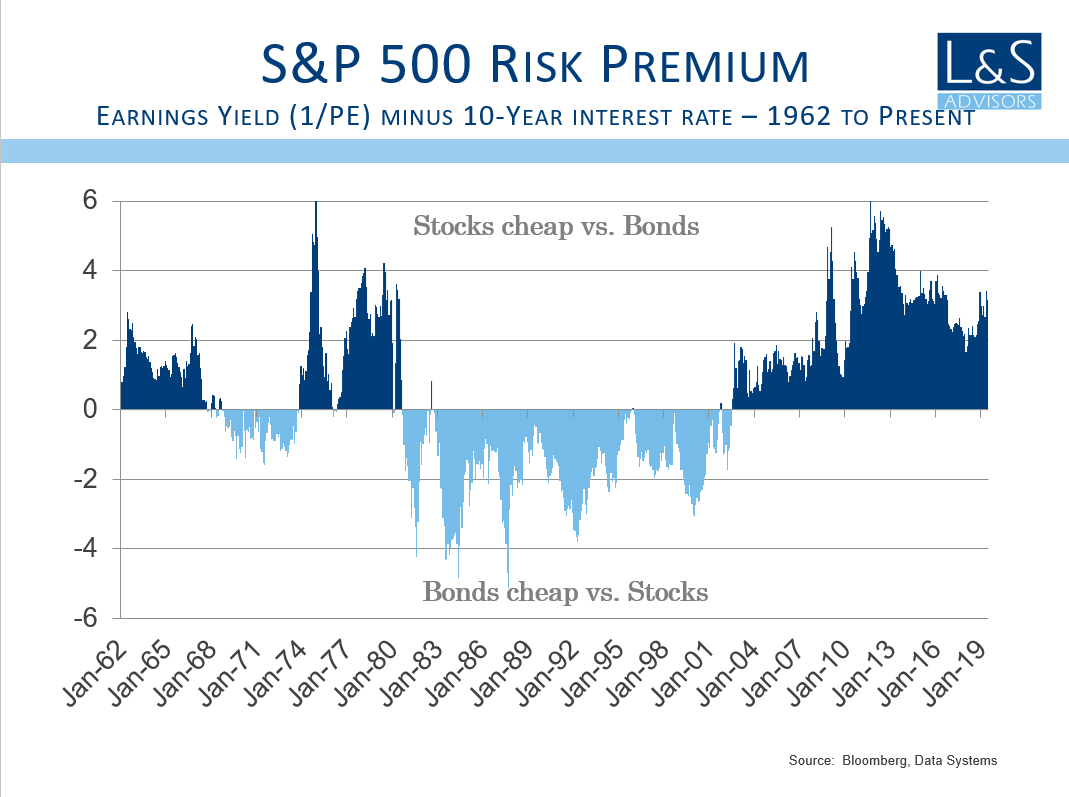

Therein lies the rub. It is a very unusual environment when both stocks and bonds do extraordinarily well. When stocks do well, it is generally because economic growth is solid. Strong growth pushes corporate earnings higher, and over the long-term, earnings drive stock prices higher. On the other hand, bonds tend to perform well when interest rates are declining, and lower rates generally suggest an economy that is languishing and a Fed that is cutting interest rates in the hopes of re-accelerating economic growth. Why then did we see good gains in both stocks and bonds?

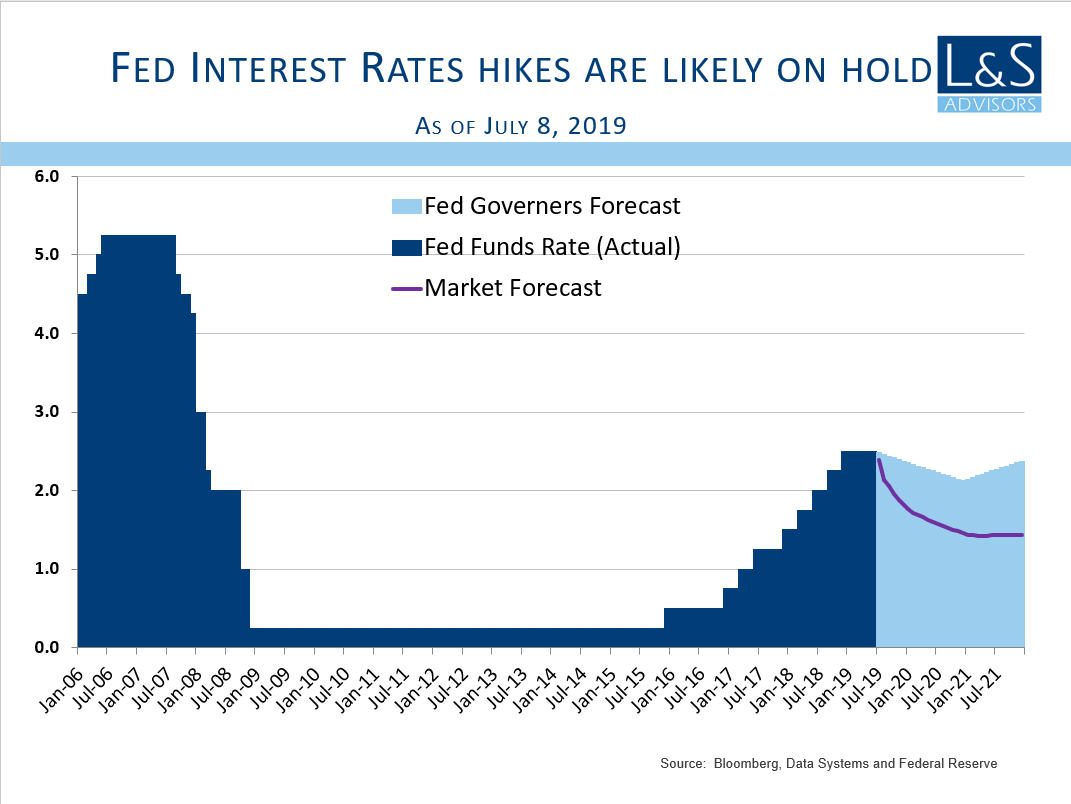

As we reported last quarter, the Fed changed its policy stance earlier this year. From an environment where interest rates were expected to steadily increase, the Fed announced its intention to pause rate hikes and make policy decisions based on the actual economic data that was being reported. The Fed reported that “uncertainties about the outlook have increased,” and the market assumed that an interest rate cut was forthcoming. Investors, seeing that the Fed was going to ease interest rates, pushed bond prices higher and interest rates lower in anticipation of the coming policy shift. So while the Fed had only signaled its intent to cut rates, the market has already pushed interest rates lower.

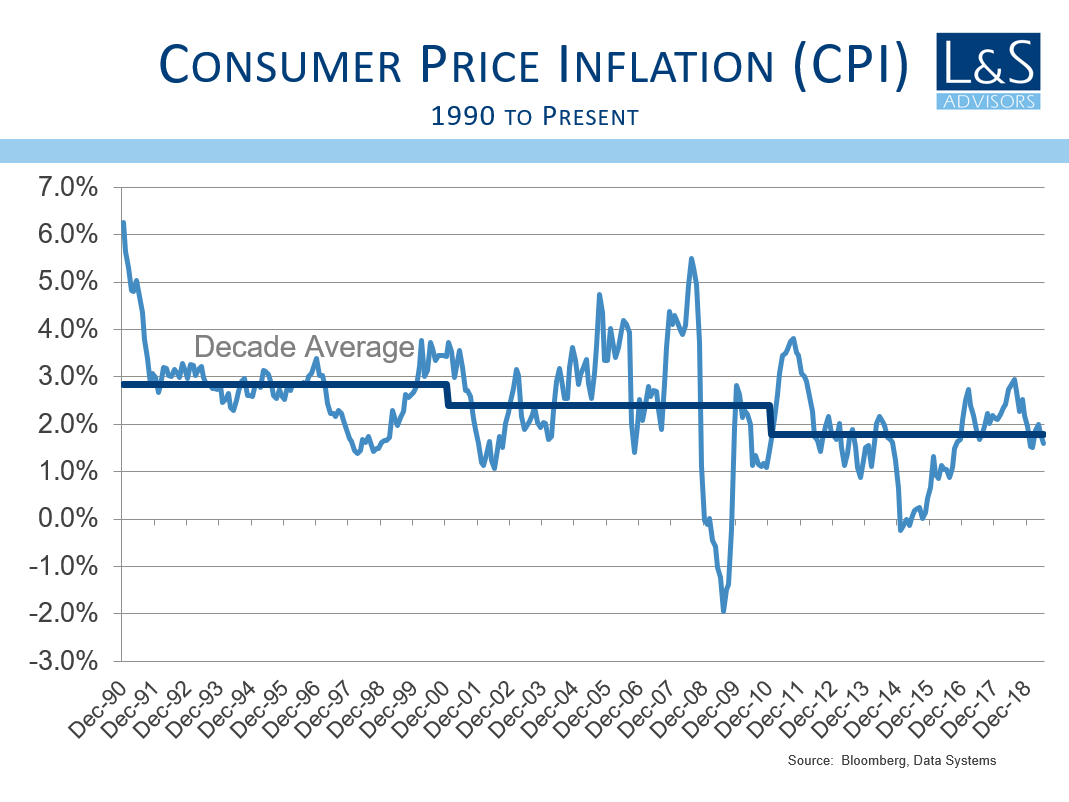

A key support for the bond market has been the very well-contained outlook on inflation. One of the classic causes of inflation has typically been wage inflation. As workers demand higher wages, companies are forced to accept lower profit margins or raise prices to offset higher labor costs. Wage inflation has been increasing for several years and is now running at about 3.4%, almost double the rate of inflation. Over the last 50 years, wage growth has averaged 4.1%. As we enter the longest expansion in history, and despite the push by many large corporations to raise minimum wages, we are seeing wage inflation that remains contained and well below the average over the last half-century.

Productivity is one of the components of wage inflation, and productivity growth has been anemic for quite some time, averaging just 1.6% over the past ten years. We acknowledge that productivity statistics were developed to try to calculate how many widgets were produced by how many workers, and may not have fully adjusted to 21st century manufacturing techniques. More recently, productivity numbers have been rising, and the recent report of 3.4% is the highest number since September of 2014. Increases in productivity help keep wage costs down, and the recent gains have contributed to maintaining the rate of inflation below the Fed’s long-term target of 2%.

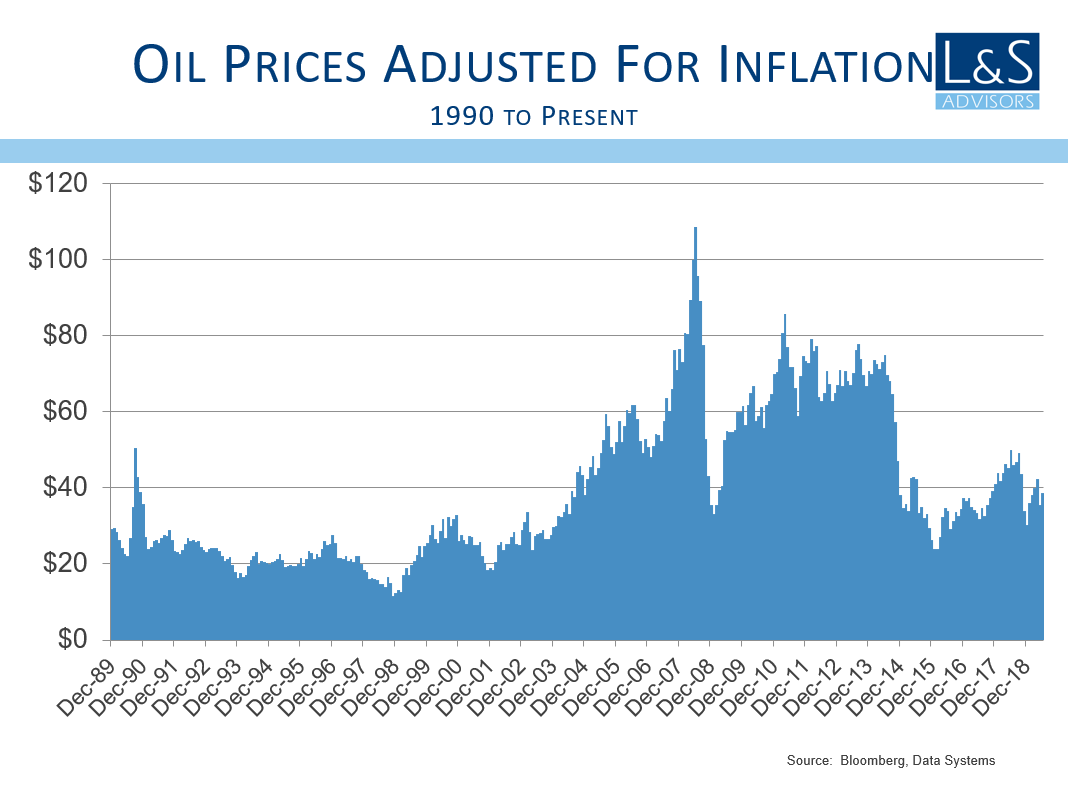

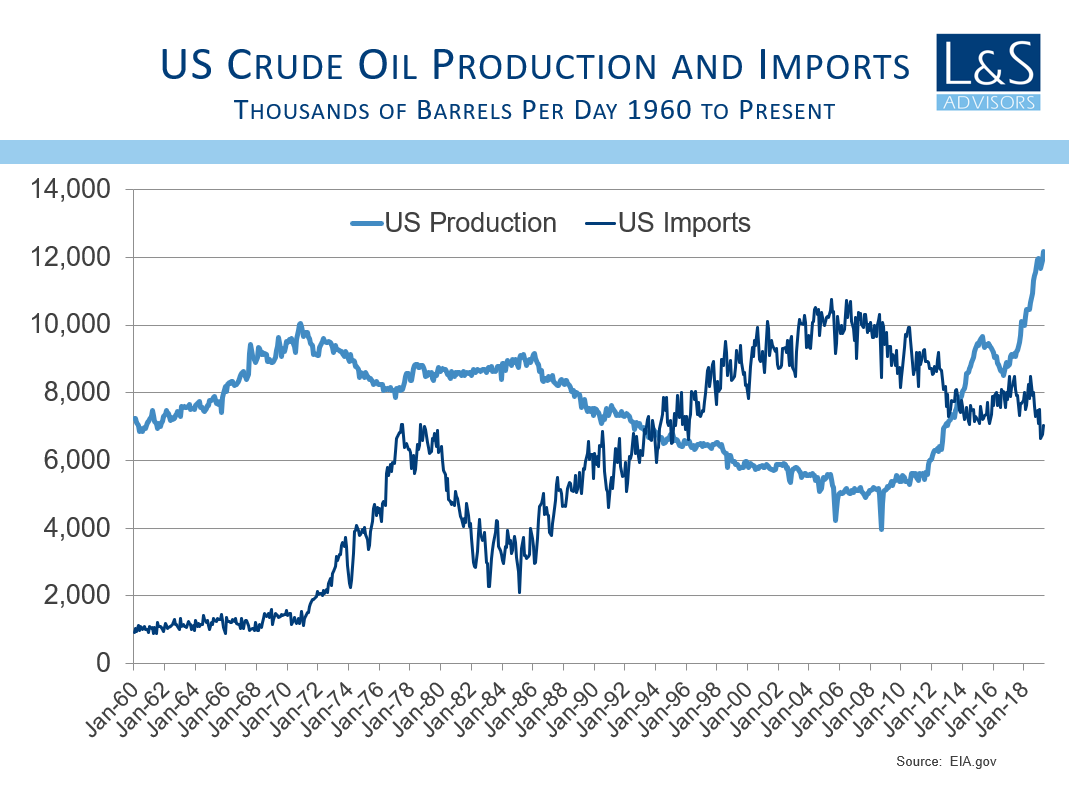

Another contributor holding inflation in check has been the price of oil. Lower oil prices are a result of a dramatic increase in production in the United States. This has been driven by the technological innovation of fracturing shale formations, commonly called “fracking” (our favorite f-word). U.S. production has increased by 34% since 2016. This represents an increase of just over 5 million barrels per day, and it is expected that U.S. production will increase by another 1.5 million barrels per day in 2020, another 7% increase. Compare that with the global increase in demand of 4.2 million barrels per day since 2016. Put another way, the U.S. has increased production by 120% of the growth in demand, and U.S. production is to increase faster than global demand again in 2020. It is no wonder that OPECers are scrambling to trim production in order to try to keep oil prices stable. Lower oil prices have also contributed to the low inflation environment and that gives the Fed more flexibility in setting its policy decisions.

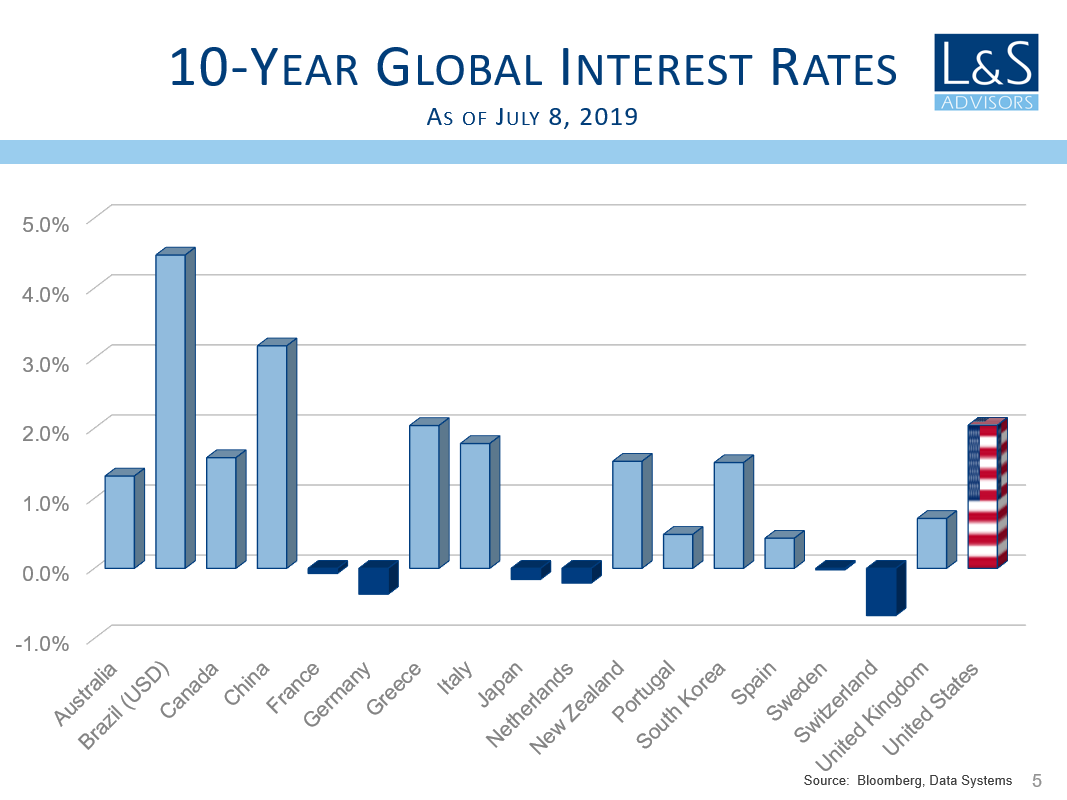

Another issue that drove interest rates lower is the fact that U.S. interest rates are some of the highest in the developed world. Only Brazil, Mexico, Greece, and China offer 10-year government bond interest rates that are higher than those of U.S. 10-year bonds. In fact, as of this writing, German 10-year interest rates are a negative 0.37%. Yes you read that correctly — interest rates in Germany are negative. That means you buy a bond for $100.37 and expect to get $100.00 back at expiration. An investor is guaranteed a loss. This policy guarantees the return of your money but no return on your money.

Remember that Europe was dragged into the chasm of the Great Recession along with every other nation. As the U.S. recovery started to accelerate, the Europeans fell into their sovereign debt crisis where investors worried that the PIGS of Europe (Portugal, Italy, Greece, and Spain) would be forced to exit the European Union. Just as U.S. interest rates were kept artificially low to encourage investment, the European Central Bankers kept pushing rates lower and lower until they were actually negative. Their goal was to encourage investment, and the thought was if investors could not earn any return by purchasing government bonds, they would invest their funds elsewhere to earn a better return. Sadly, that policy has not worked as expected, and interest rates remain negative in France, Germany, the Netherlands, Switzerland and Japan.

For an investor, the 2% offered on U.S. 10-year treasury bonds seems like a gift compared with the negative rates available in other major European bond markets. Would you buy a 10-year bond issued by the U.S. which provides a yield of 2%, or would you prefer a Greek 10-year bond yielding 2.14%? The choice seems clear, and international funds have flocked to the U.S. where a positive return is offered and where the credit quality is one of the best in the world.

It is entirely possible that a substantial amount of the appreciation in bond prices was a result of global capital flows finding the U.S. bond market one of the most attractive opportunities in the world.

As we review the environment for both stocks and bonds, it is important to remember that the Fed said economic uncertainties had increased. This does not sound like the most encouraging environment for stocks.

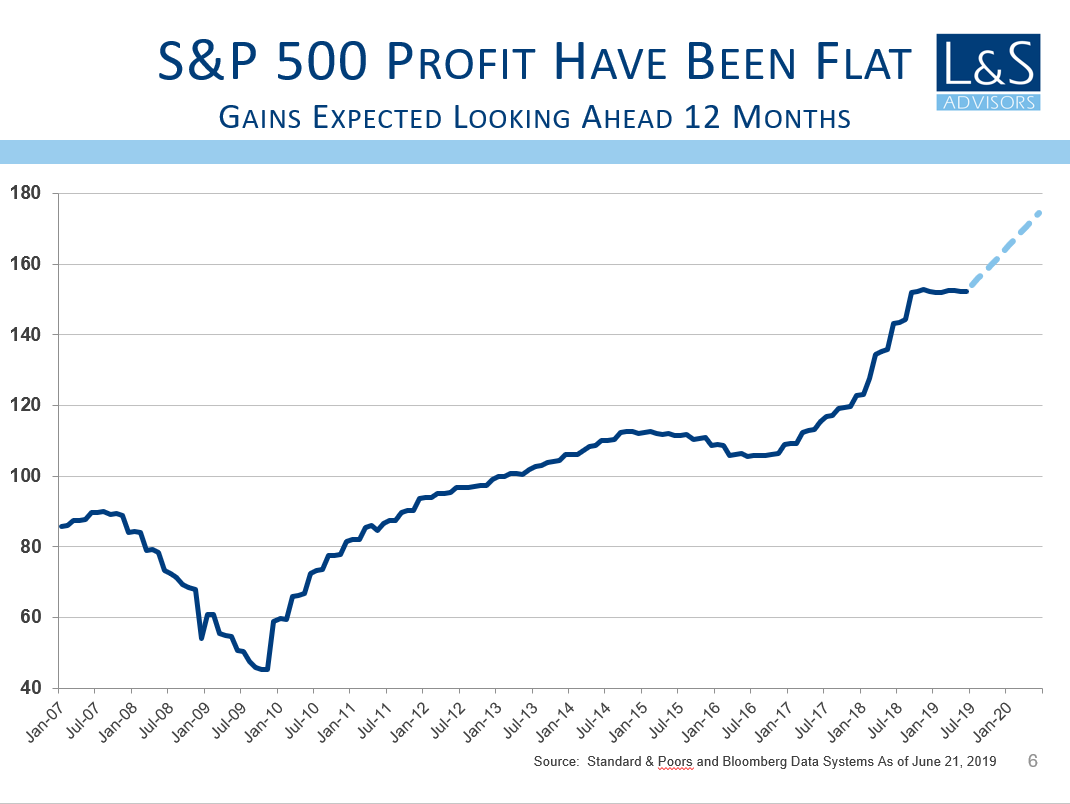

Regarding some of the factors that may have contributed to the very strong stock market performance over the past six month, it is interesting to note that corporate earnings have actually been flat for the past nine months. While revenues grew in the first quarter, profit margins have actually declined. Over the past 18 years, profit margins have been expanding by more than 4% per year, but during the first part of 2019, margins fell. It is difficult to fully determine why profit margins have started to decline. Wage pressures are a common cause of profit margin declines, but as we discussed, wage pressures have not been excessive, although they may be responsible for some of the margin decline. We mentioned that oil prices have declined, and many commodity prices have also been somewhat weak especially over the past few months. Lower commodity prices should also help improve profit margins. Certainly the regulatory burden has been reduced under the Trump administration and that should have helped increase profit margins.

One potential cause of profit margin declines is intense competition. Very few companies appear to have any pricing power (good for the inflation outlook), and if competition is causing prices to decline, that would certainly have an impact on profit margins. Additionally, if consumers were trading down to lower margin products, that too could have a negative impact on profit margins.

With declining profit margins and flat corporate earnings, the valuation of the stock market has become somewhat stretched as prices rose during the first half. Low interest rates help to make the competition for investor funds from bonds less attractive, negating some of the increases in valuation metrics. With valuations approaching recent highs, we would not be surprised to see the market pause somewhat, particularly after the strong run of the first half. We do acknowledge that valuation is a terrible metric to gage short-term expected returns from stocks, but higher valuation provides one more reason to be a bit cautious as the second half unfolds.

One of the concerns that has been raised is the very high level of inventory accumulation that has been powering economic growth. Over the last two quarters, private inventories have grown by $236 billion. Contrast that with $119 billion of inventory accumulation over the previous three quarters.

Inventory accumulation tends to occur for two reasons. First, companies may try to increase production in anticipation of a change in the environment. The threat of additional tariffs may cause companies to rush to order supplies before prices rise. Additionally, inventories tend to accumulate when demand slows and companies have not fully adjusted their production schedules.

In either case, once accumulated, those excess inventories must be worked off before additional orders are placed. This suggests that growth immediately following a period of large inventory accumulation is likely to be slower.

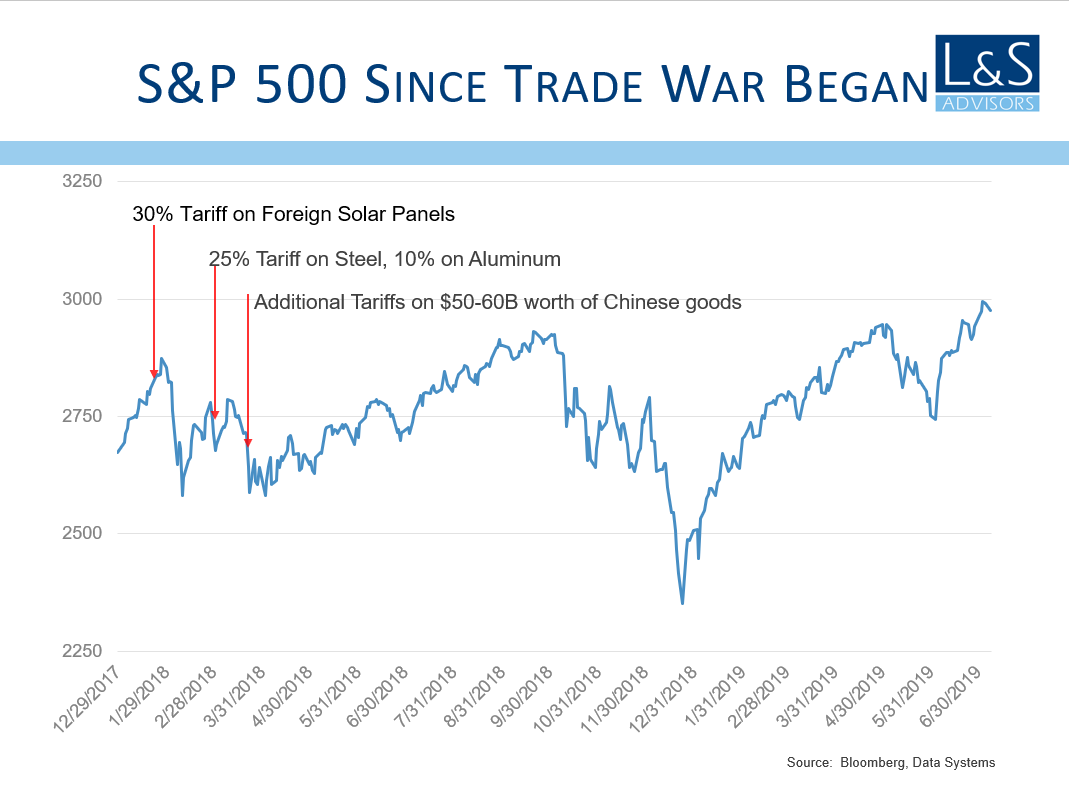

President Trump started his trade war in January of 2018 with tariffs on foreign-made solar panels. Tariffs on steel and aluminum followed, as did more broad-based tariffs on other Chinese goods. From that date, the price of the S&P 500 is up 3.8%. Add another 3% in dividends, and the total return of the stock market has been 6.9% over the past 18 months, less than 5% per year annualized. We have seen significant volatility as the President has added threats of more tariffs, and we have seen relief rallies as the president has backed away from those threats. Since the trade war began, the price of the S&P 500 is up less than 4%.

It seems apparent that the market has voted on how successful it sees this policy or “tactic.” Worries about making mistakes similar to those that exacerbated the Great Depression in the 1930’s may not be over-exaggeration. Lately, the President has threatened tariffs on Mexico to encourage it to reduce the number of refugees seeking asylum from hostile lands south of Mexico that had, only a few short years ago, been safe places to live.

Even more discouraging is the recent discussion of expanding tariffs to the EU to penalize Europe for the subsidies provided to Airbus to enable them to better compete with Boeing. Let’s be clear that these subsidies are violations of trade rules that have been agreed to, yet they persist.

Further, let us also agree that China has taken advantage of its position as a member of the WTO (World Trade Organization). Their theft of intellectual property has, at times, been egregious.

These are complex problems requiring complex solutions that are exceedingly difficult to resolve. Still, when your only tool is a hammer, all problems tend to look like nails. The market has stumbled in the face of tariffs, and if trade wars were so “easy to win,” we would not be waiting for the next positive tweet on trade negotiation progress while the stock market languished.

The good news for the U.S. is that our economy is not very dependent on trade and exports for our GDP growth. Only about 8% of our economy is dependent on exports. The news for nations that depend more on exports to support their economies is not nearly as sanguine. The export-led countries of Germany, Korea, Taiwan, Canada, the UK, Japan, and Russia are already seeing their manufacturing sectors contract. Other export-led economies such as China, Brazil, and Mexico are on the cusp of contraction in their manufacturing sectors. Many economies have strong service sectors and are able to withstand a contraction in manufacturing without falling into recession. The number of manufacturing sectors that are contracting at the same time seems more than coincidental.

For those that see our commentary as being too politically motivated, understand that we are reporting on the data not on the political consequences that might transpire. The data suggests that the uncertainty surrounding trade is having a deleterious impact on global growth.

As we evaluate risks to the economy and to the market, there are several criteria we look to. As we mentioned earlier, the Fed changed its policy outlook earlier this year, and policy interest rates have remained constant for the first half of the year. More recently the Fed’s commentary suggested a more conciliatory approach, and the market expects policy rates to be decreased later this month. There is an old adage that investors should never fight the Fed. The fact that the Fed is perceived as moving to a more accommodative stance suggests the risk of a policy mistake have diminished. While market expectations can often differ from actual Fed policy decisions, a more investor-friendly Fed helps reduce risks for investors.

Like the Fed, foreign central bankers have maintained accommodative policies across the globe. Recently, Australia lowered their policy rates to the lowest in history. Christine Legarde, currently the head of the International Monetary Fund, was recently nominated to head the European Central Bank (ECB). It is widely believed she will closely follow the policies of her predecessor Mario Draghi, who famously said the ECB would do “whatever is necessary” to preserve the European Union. Investor-friendly policies from other central bankers across the globe suggest that the risks of a policy mistake remain well-contained.

Despite easy monetary policies, economic growth remains quite slow. Following a solid beginning to the year, it is widely expected that economic growth has slowed as the second quarter progressed. The Atlanta Fed now projects economic growth will be only about 1.3% in the second quarter, less than half the rate of the first quarter. While we expect the U.S. economy to avoid a recession for the remainder of this year, and into 2020, the very slow growth we are experiencing does suggest an economy that could be more susceptible to an external shock, should one occur.

Global growth also remains somewhat disappointing. While there are small green shoots that give us hope the worst is behind us, the contracting manufacturing sector in so many countries suggests that any recovery might be limited. Still, the risk that things get materially worse seems quite modest.

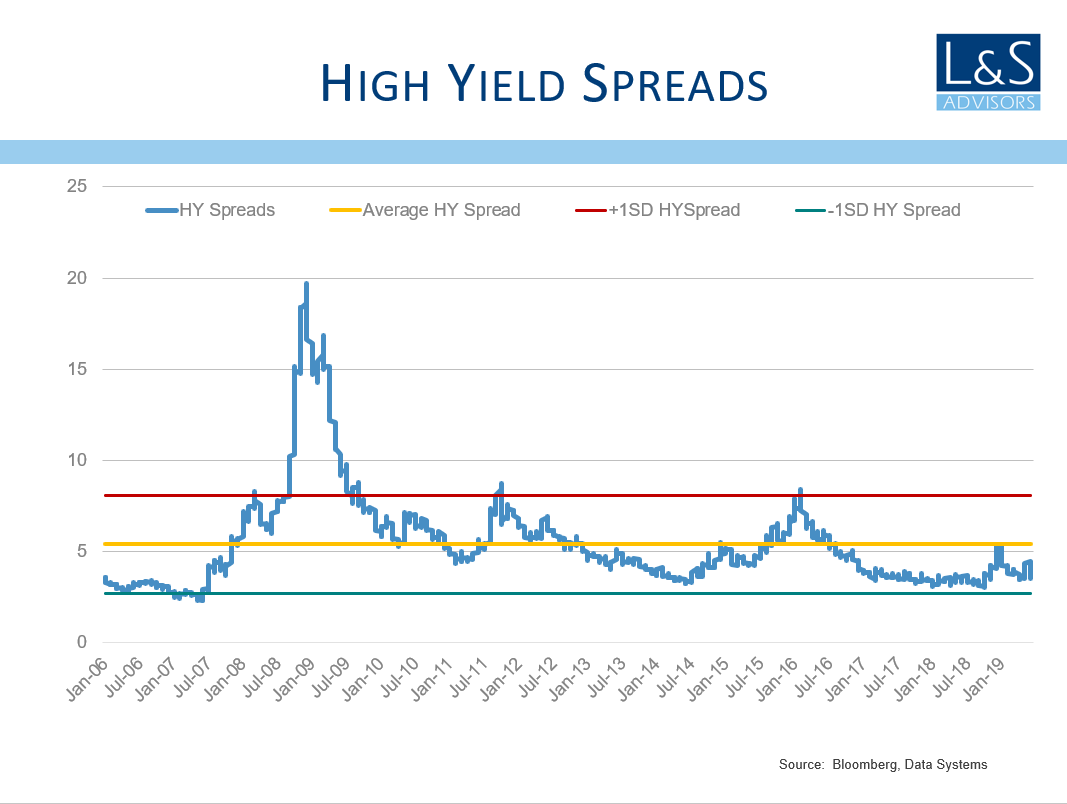

We also look to credit markets to help us evaluate when risks might be building, and here the news is quite good. There are no signs of credit problems, as both lower quality and high quality companies are having no difficulty raising money. Credit costs remain quite low and signs of systemic problems are not apparent. This supports our belief that the risks of a recession starting anytime soon are quite low.

The tone of the market has been pretty good, with the S&P 500 making new highs as the first half of the year ended. We would prefer to see more broad-based participation that included small-caps, mid-caps, and other asset classes also making new highs, but overall the tone of the market has been constructive. We remain a bit cautious that second quarter earnings reports could be a little disappointing and that might set the tone for the market to give back some of the large gains posted during the first half. We also worry that while the potential for a policy mistake by the Fed has diminished, the potential for a policy mistake regarding trade remains elevated.

The market has posted solid returns during the first half and some caution might be prudent as earnings growth might slow along with the economy. Still, signs of a recession are missing and credit market problems that caused so much pain in 2007-09 seem absent. Following a more cautious stance for the third quarter, we suspect the fourth quarter could again be good for investors.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

Disclosure

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2018. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.