July 15, 2020

We’re not even thinking about

thinking about raising interest rates.

— Federal Reserve Chairman Jerome Powell, June 11, 2020

As we start the preparation of our second quarterly newsletter written under quarantine, we once again hope that you are all safe and that your families are healthy. Like so many others, our firm had made plans to reopen our office after the Independence Day holiday, but the dramatic increases in Covid-19 illness has delayed those plans. When will Americans feel safe enough to consider returning more activities to the way they were prior to the Covid crisis? The cold hard fact is this will linger longer than many imagined, and the way to survive, perhaps even to thrive, is to adapt, adapt, adapt.

Last quarter, we wrote extensively about many of the societal changes that are likely to remain even after we have all been vaccinated against Covid-19. Many of these changes will have long-term investment implications that will need to be considered as portfolios are constructed going forward. (If you are pressed for time, consider reading the bold only.)

For example, it is likely that more people will work from home going forward. Some of our employees have expressed glee at avoiding commutes, which for some represent as much as two hours per day. While we all recognize the benefit of an impromptu conversation, of building a strong corporate culture, and of spending time working together, the fact remains that some people will never want to return to five days in the office. Perhaps only one or two days per week will suffice to encourage comraderie and shared corporate goals.

How does this impact the need for office space? At first thought, firms might need smaller spaces since not everyone will be in the office together. Until there is a vaccine, however, it is more difficult to share a desk. Further, bullpens and open-architecture desks need to be restructured to provide greater social distancing. Do firms need large conference rooms when we are not currently meeting many clients, and when it is not recommended that we all gather together in one large room? Space planners will need to rethink the office environment, and firms will adapt to life with Covid. A person who only comes into the office for one day a week may still need a desk. More separate offices suggest less communication and less impromptu cooperation, things that are sorely missed as we all work from home. It is unclear whether we need more office space or less, but the design and the layout of the office must adapt to new requirements and restrictions. Perhaps this confusion is why the Real Estate sector was one of nine economic sectors that generated negative performance for the first half of the year.

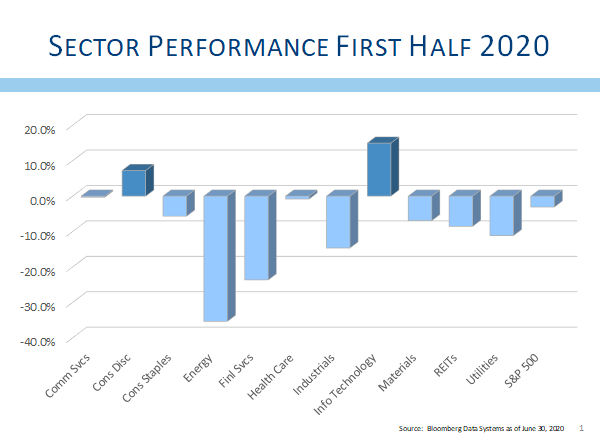

Of the eleven economic sectors of our economy, only two generated positive performance for the first half of the year. In fact, most broad market indices also posted negative returns for the first half. Despite big gains in the second quarter, remember that percentages are weird mathematical relationships. Consider giving yourself a 50% cut in pay. From your new level, give yourself a 50% increase in pay. You are still well-behind where you started. Yes, it is true that the second calendar quarter was one of the strongest in decades, just as it was true that the first calendar quarter was one of the worst performing quarters in decades. The math led to returns that were generally negative for the first half.

The best performing group, by far, was the information technology sector. These are the companies that provide the tools enabling employees to successfully work and connect from home. They also include companies that provide video teleconferencing and other tools that help overcome the painful solitude of quarantine. Not only are these companies able to grow earnings during the economic shut-down, they are also expected to continue to generate strong growth even as many parts of the economy try to return to pre-Covid activity levels. Driven by this group, growth stocks dramatically outperformed value stocks during the first half of the year.

The only other sector that posted positive returns for the first half was the consumer discretionary sector. This group includes on-line retailers and delivery services that helped many people supply themselves with groceries and other goods without having to venture into stores. Like the technology stocks that have done well, these companies will see dramatic earnings growth during the pandemic, and are also likely to continue to grow once we can put Covid behind us. After all, once consumers get used to having products delivered, they may continue to use delivery services even after stay-at-home orders have been lifted.

Of the remaining sectors that generated negative performance during the first half of the year, the two that suffered the greatest declines were energy and financial services. Energy suffered staggering losses during the first six months as too much supply accumulated as Saudis and Russians were unwilling to cut production. Excess supply was also met with a dramatic decline in demand as consumers were not driving or flying, and factories were not operating. Energy stocks are the victim of their own success, in that higher production from successful fracking has driven prices lower. Lower prices made some wells unprofitable, and concerns over the survivability of these companies made it very difficult for energy companies to access credit markets and fund their liquidity needs. This has led to several high profile bankruptcies during this past quarter, making investors increasingly nervous about the entire sector. While oil prices have rebounded smartly from the late-April lows, commodity prices remain down about one-third from the levels existing prior to the Covid crisis.

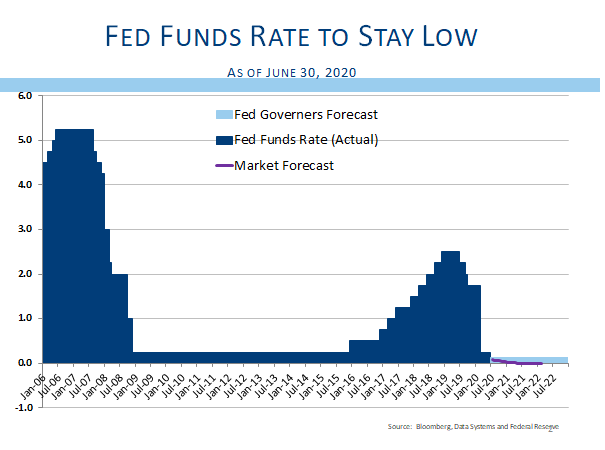

As energy companies and other firms started having difficulty raising money, and as liquidity dried up in credit markets, risking the concern that the health-care crisis would become financial crisis, the Fed acted aggressively and lowered interest rates. The Fed cut interest rates to just above zero, the same level that was in place following the Great Recession. The Fed also acted aggressively by dusting off liquidity programs and quickly putting them into place to ensure sufficient liquidity in the financial system. The Fed’s swift action provided confidence to investors and helped the market find a bottom in late March, and then stage a substantial bounce-back.

In testimony before Congress, Fed Chairman Powell acknowledged that interest rates would stay low through the end of 2022. The Fed clearly does not want investors worried that the Fed’s assistance will be short-lived. In fact, when asked about when interest rates would rise, Chairman Powell said “we’re not even thinking about thinking about raising rates.”

While this sounds like good news, there are always unintended consequences of policy decisions. Keeping interest rates near zero will reduce banks’ ability to earn interest rates spreads on loans they make. This will limit banks earning power. Further, with unemployment skyrocketing, banks are no longer sure which borrowers are still credit-worthy. The longer the quarantine, the more loans are likely to be at risk, and it is simply impossible to determine how many loan defaults will happen and which banks will struggle. With such a high level of uncertainty, it is no wonder that financial stocks were the second worst performing group in the first half of the year. The good news is that nearly all banks passed the latest stress tests, so the sector remains in much better shape than in 2008-09.

During normal recessions and market sell-offs, it is often the case that consumer staples, utilities, and healthcare stocks are the best performing. Even when unemployed, people still buy food and toothpaste, they still go to the doctor, and they still keep the lights on. This recession and market decline have been different in many ways, including the fact that these “defensive” sectors were not the best performing areas. While health care stocks were barely down during the first half, consumers did forego receiving treatments and seeing doctors to prevent being exposed to the corona virus. Patients even cancelled their cancer treatments rather than spend the morning at an infusion center receiving medication. At some point we do expect people to return to doctors for regular treatments, but expect more of those appointments to be over the phone or via video conference to reduce the potential infection of both the care-giver and the patient.

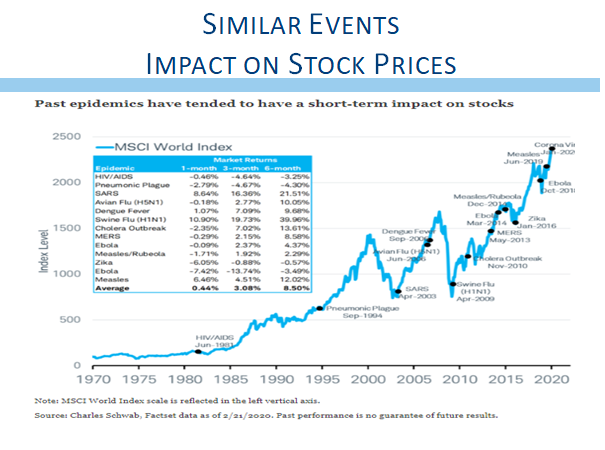

At the beginning of this crisis, we looked at historic data of similar events that had the potential to be significant healthcare issues. Those include AIDS, SARS, MERS, Ebola, and others. The historic data suggested a fairly modest market impact, with a very minor long-term impact. In fact, as the data shows, the market was usually up six months after the beginning of the threat.

In many ways, the Covid crisis is very similar to a natural disaster. The impact is huge, particularly for those directly impacted, but the long-term repercussions can be fairly modest. The recent behavior of the market seems to be quite similar. The market sell-off in February and March was enormous. Markets have been able to look past an 11% unemployment rate, an estimated 15% decline in corporate earnings, a 15% decline in retail sales, 20 million more people collecting unemployment benefits, and an economy contracting at a 5% rate. The market rebound has since regained a substantial amount of the downside. Economic data is returning to more normal levels much faster than many expected. The reason investors are not as concerned with the current economic reports is that most of those indicators are now improving, and the long-term impact of this crisis is assumed to be fairly contained.

While we are exceedingly encouraged by the dramatic action by the Fed to limit risks and by the Federal Government to provide needed aid to businesses and consumers, we do worry that the market may be ignoring some fairly obvious risks.

First, and perhaps most obvious is that the virus did not go away despite a near complete shut-down of our economy. Some states are seeing their first real spike in infections while others are seeing a second wave. Virus cases are now expanding faster than they were in February and March. Masks, recommended by most, are seen by some as an infringement on personal rights, and that has prevented the U.S. from reducing viral infections in the same way as other countries have done. Warmer summer weather does not appear to be the panacea that was hoped for. The good news is that mortality rates are declining, and doctors are finding improved treatment options, and anti-viral medications are helping save lives.

Still, one can’t help wondering if we are winning some strategic battles against the virus, but are still far from winning the war. Without a broadly-available vaccine, it seems that the Covid crisis will be with us much longer than we thought, and hot spots will emerge and discourage investors along the way. While we do not expect another national or even state-wide shut-down because the economic costs are simply too high, we believe the market is expecting virus-related news to continue to improve dramatically. If that improvement is delayed, the market may find itself well ahead of the economic realities.

Another risk that may not fully discounted into the market are the long-term changes to supply chains that need to be established. We learned the hard way that Covid test kits were unavailable because of a shortage of three cent swabs used to sample potentially infected people. That swab often came from China, and China was selected to supply that part of the kit because they were the low-cost provider. Should we rely on parts from China for strategically important products including test kits? For many companies, the answer is “no.” New supply sources will be sought, and many parts and products will soon come from new suppliers. Some of that manufacturing will return to the United States helping create jobs at home. However, it seems likely that the cost of those goods will go up. If the low-cost producer is no longer an acceptable political choice, what happens when other suppliers charge higher prices?

Higher parts and goods prices will have two effects. If companies absorb those costs and do not raise prices, their profit margins will decline. Lower margins imply lower corporate earnings, and that could have a negative impact on share prices. Alternatively, if companies are able to raise prices, that will create inflation. Companies in competitive industries may have difficulty raising prices, but neither lower margins nor higher inflation are very good for stock prices.

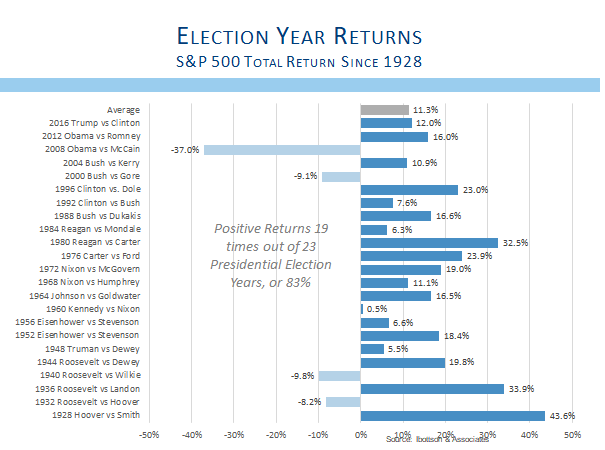

One of the most overlooked risks for the stock market is the upcoming presidential election. Presidential election years tend to be positive for stock markets with about 83% yielding positive returns for investors. Markets tend to be very good predictors of election outcomes, and when markets are up over the last 90 days prior to the election, that has generally suggested the party in power will stay in power. In contrast, markets tend to be down during those last 90 days when the party in power is about to lose power. Since 1972, this indicator has been wrong only when Reagan defeated Carter in 1980. In 2016, the market was down during the last 90 days leading up to the presidential election suggesting the party in power was going to lose. That is exactly what happened when Donald Trump defeated Hillary Clinton. Watch the performance of the stock market from August 3rd through November 3rd of this year. The stock market could once again be better than any poll at helping determine who might be our next president.

Former Vice President Joe Biden has suggested that some of the Trump tax cuts would be reversed under his administration. While that might be an important step in reducing deficits, the immediate impact will be to lower corporate earnings. Some investors are concerned that the policies of a Democratic administration would be bad for stock prices, but the data does not support that conclusion. Stocks have actually provided higher returns when Democrats occupy the White House. No matter who is president, the best returns occur when there is a split government and one party does not control both houses of congress and the presidency.

Stock markets correct, but long-term returns far exceed those available from bonds. While historic returns are no guarantee of future results, we do believe that stocks are likely to outperform bonds over the next several years.

Still, it is important to consider that stocks face some risks, especially as potential Covid infections continue to expand, and as we get closer to the presidential election. While near-term corrections are unsettling, we continue to stay focused on investors’ need for long-term returns. When you are out sailing and getting seasick from rough seas, the best advise is to focus out on the horizon. The same is true for your portfolio. Stay focused on the long-term horizon. Stocks represent the growth of successful companies, and without stocks your long-term returns are likely to be much more modest. Try hard to prevent emotion from getting the best of you. Some portfolio adjustments are appropriate, but getting out of the market when things seem unsettled may be a very costly decision. Warren Buffet recommends that we “be greedy when others are fearful, and be fearful when others are greedy.” As portfolio managers, we continue to adapt to the changing environment to make the best investment decisions possible.

Everyone at L&S is working tirelessly to make sure that we continue to meet your needs. Please do not hesitate to contact us with your questions and concerns. This has been a very difficult time, something that none of us could have foreseen a few short months ago. We remain confident that American ingenuity will beat this unfortunate illness. Stay well, stay safe, and stay sane.

Bennett Gross CFA, CAIA

President

Disclosure

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2019. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.