October 8, 2020

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to heaven, we were all going the other way…

— Charles Dickens “A Tale of Two Cities”

Perhaps I have overused this quote through decades of writing quarterly reviews for our clients, but nothing seems to sum up our current circumstance better than this. The economy is still reeling from a viral pandemic that does not want to quietly fade away. Yet some businesses are thriving. How, so many clients ask, could the stock market be doing so well when there is so much devastation? The quickest answer is Covid has created both winners and losers, and as investment advisors it is our job to find those sectors and industries that will benefit while reducing exposure to those whose struggle does not have a quick remedy. Perhaps even more interesting than the winners and losers is to focus on those changes that will long outlive the current virus. (If you are pressed for time, consider reading the bold only.)

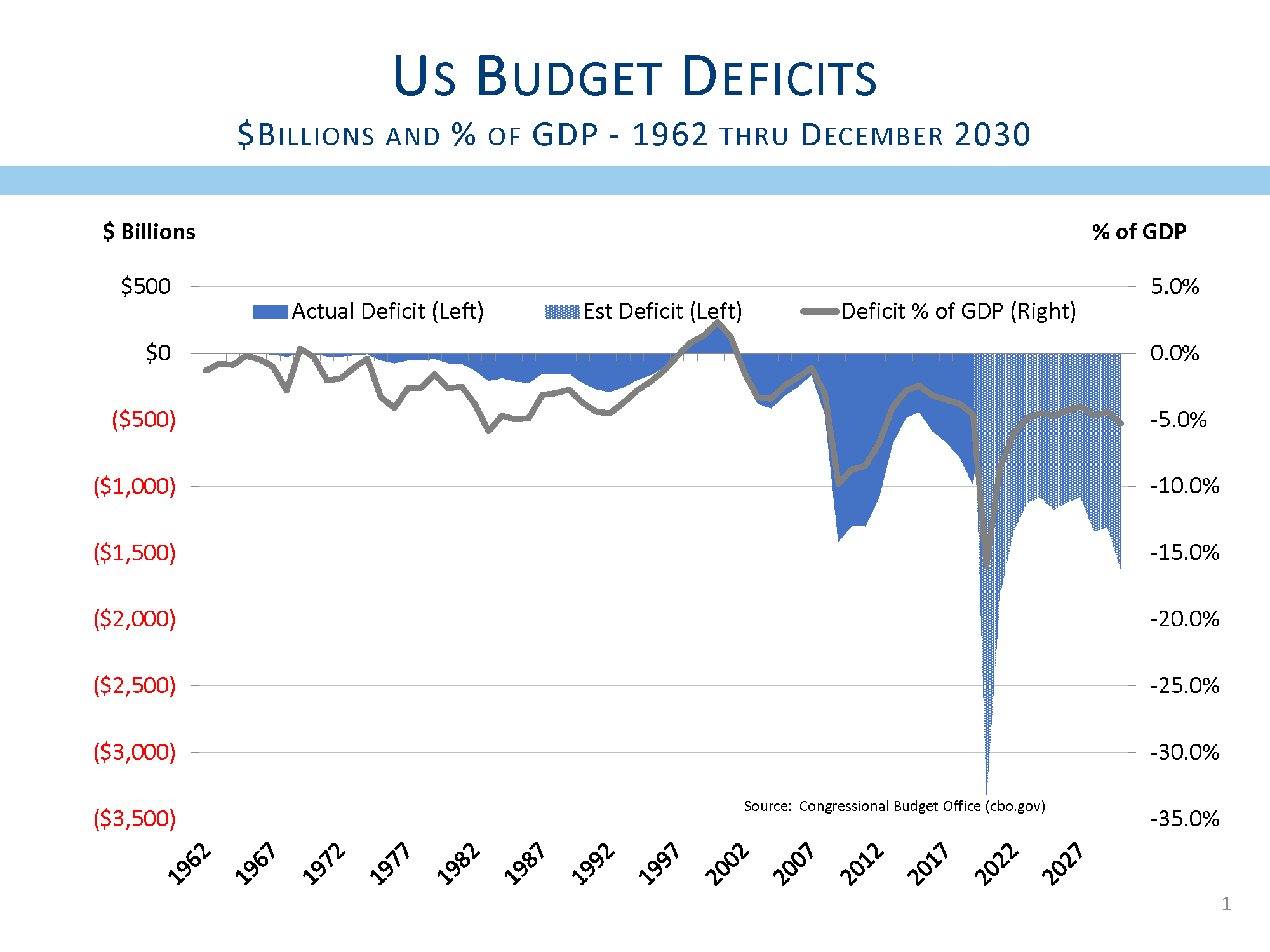

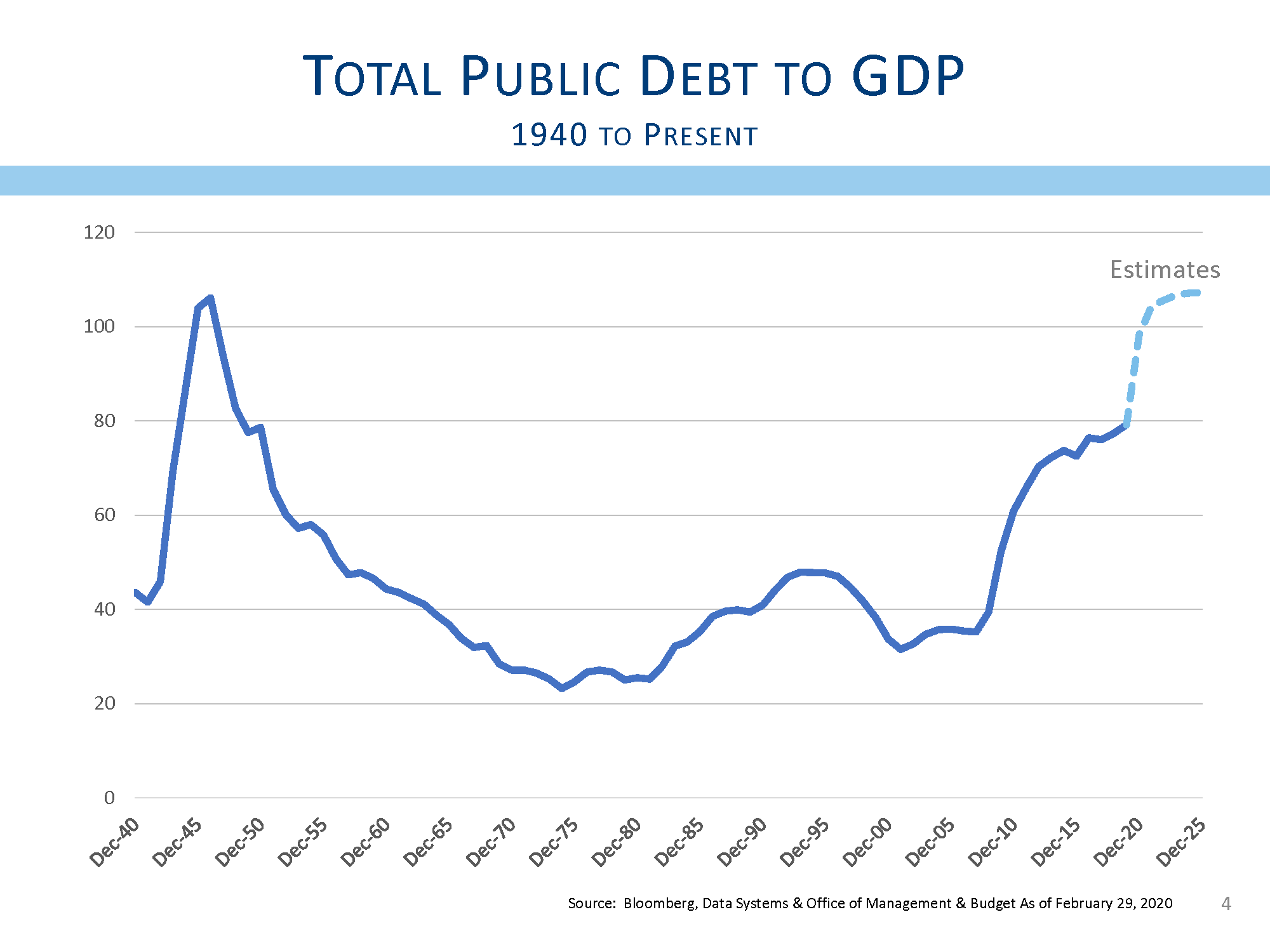

One of the biggest changes that will survive the pandemic is the added debt burden so many countries have taken on to help their citizens survive the current malaise. Economic growth is projected to drop by about 5% over 2020, much worse than the –2.5% in 2009, and it is the worst number on record since 1946 and 1932. In response to the dramatic drop in economic activity, the Federal government has passed several stimulus packages to help offset the economic impact. Additional stimulus is likely, although as of this writing our feckless politicians remain unable to agree on how to best help our citizens. According to the Congressional Budget Office (CBO.gov), the deficit will represent about 16% of the nation’s GDP (Gross Domestic Product, a measure of the broad output of the economy). As a percentage of the economy, this is the biggest deficit for the entire history of the data (1949). For perspective, the worst deficit during the Great Recession was –9.8% of GDP in 2009.

While the deficit spending seems necessary, the long-term impacts must be considered. Economic growth came to a screeching halt when the nation locked-down to quarantine against further spread of the virus.

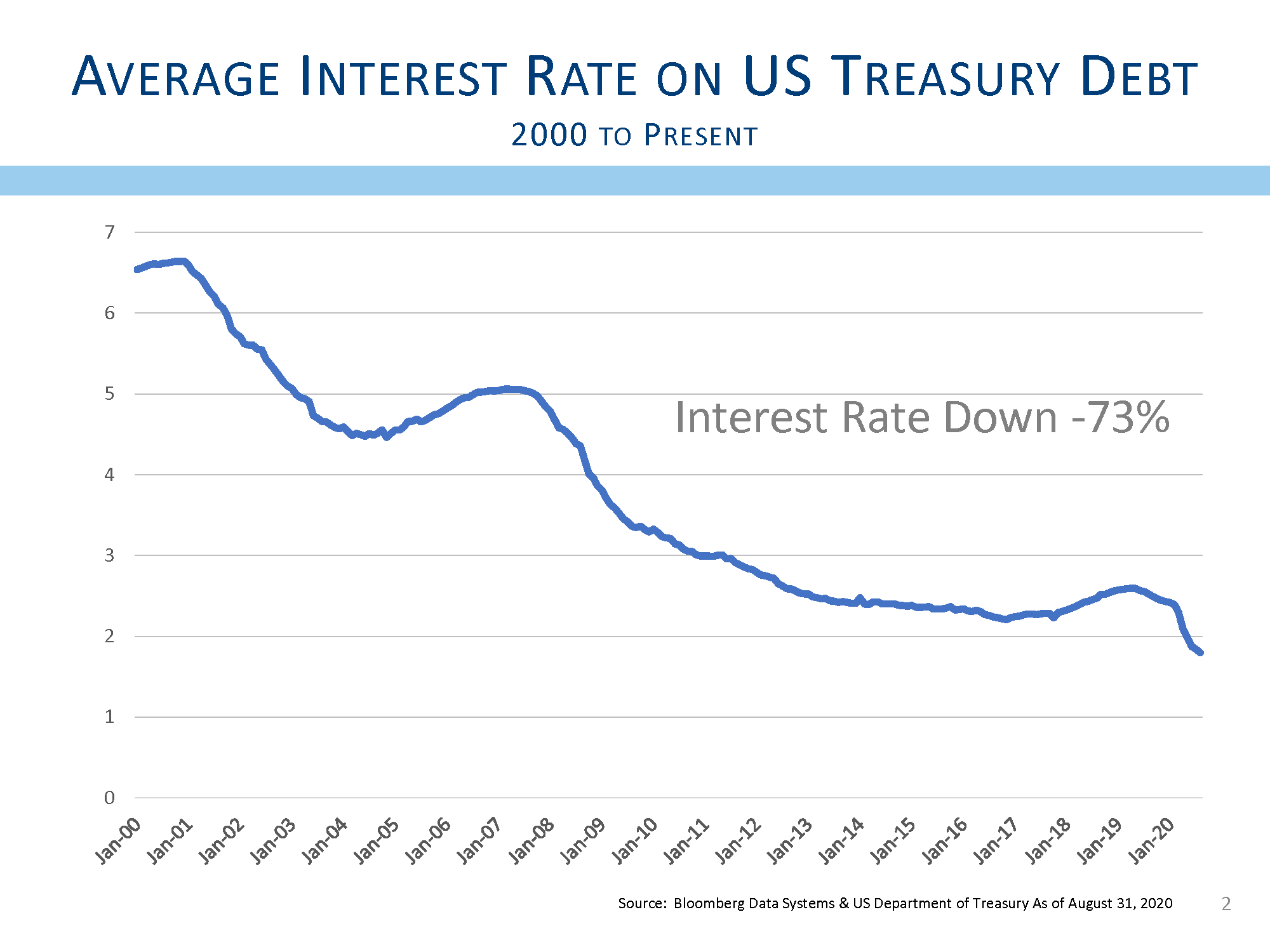

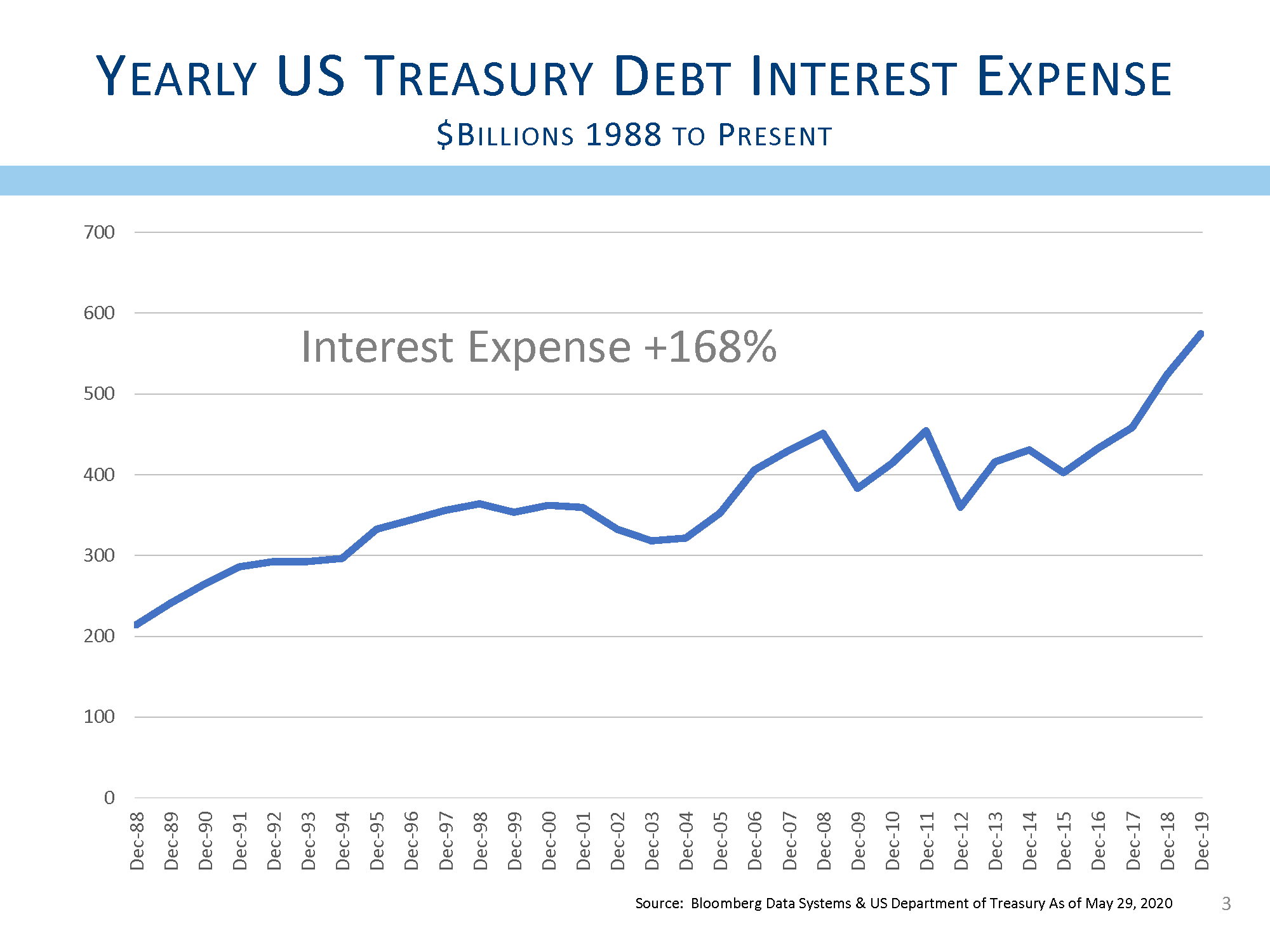

Slower growth led to a precipitous decline in interest rates, and 10-year interest rates dropped from 1.5% in February to 0.75% currently. So while debt has increased, the offset has been a decline in interest rates that has made paying for that debt much easier. Interest payments on the federal debt have made the huge increase in deficits fairly painless.

But what happens when interest rates start to rise? Interest payments on the existing debt could begin to take up a larger and larger percentage of federal spending. The nation’s ability to meet its obligations, especially as the number of retirees continues to grow reflecting the aging Baby Boomers, may begin to fall. Does that create a vicious cycle of higher deficits and higher interest payments?

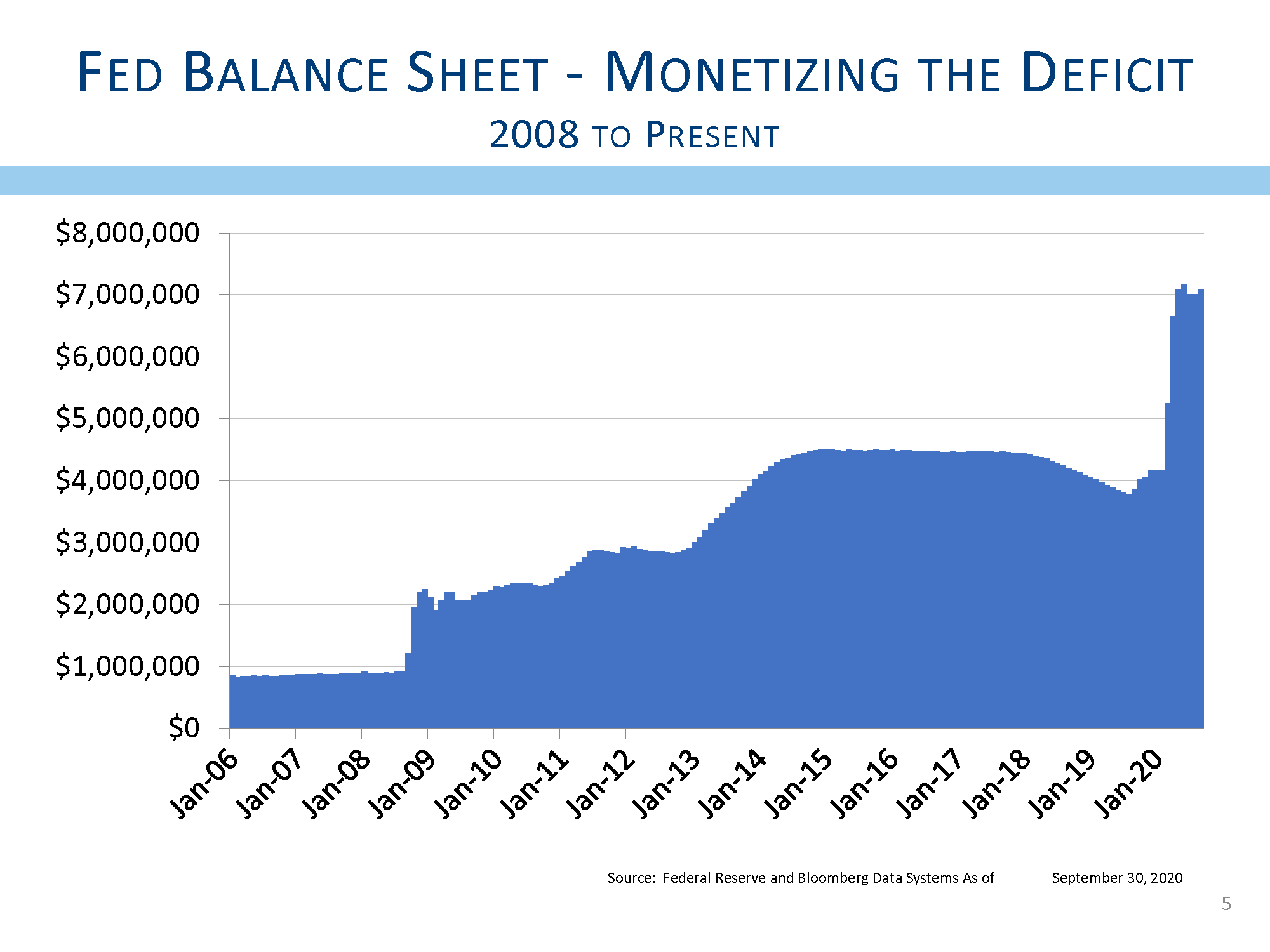

In order to ameliorate the potential long-term impact of higher deficits, the Fed has been buying up a huge percentage of the new debt being issued. For economists, when the central bank buys its own country’s debt obligations, we call that “monetizing the debt.” The Nobel prize-winning economist, Milton Friedman, suggested that monetizing the debt was a sure way to create inflation, and many market strategists fear the seeds of higher inflation are being sewn into our recovery. Some suggest that the increase in the price of gold is indicative of the potential for higher inflation as we look ahead.

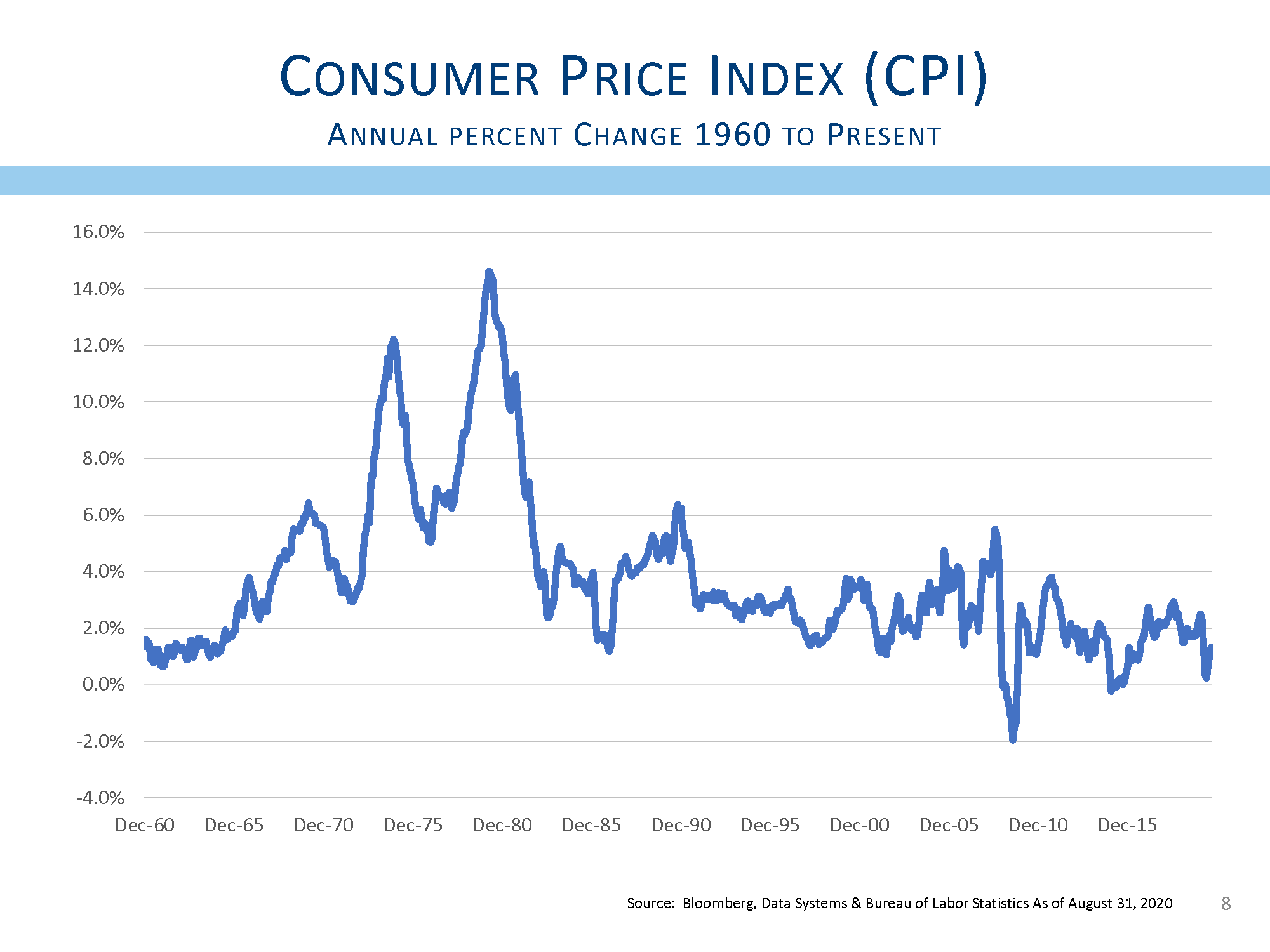

Are we destined to see a steady pick-up in inflation as we saw from the late 1960’s through the 1970’s, or is there some other likely outcome? From a demographic perspective, the current period is very different from that previous period more than forty years ago. While spending to fund the Vietnam War is generally viewed as one of the culprits causing inflation back then, our society is in a very different position. In the 1970’s, the baby boomer children were coming of age, and families were rapidly increasing their consumption. Homes with additional space in suburban areas were in high demand, and second cars and second televisions were the rewards and costs of suburban living. Now, the baby boomers are coming up on retirement age, and they are consuming less. Many families find the nest empty, and the need for downsized homes with fewer stairs much more appealing. The demographics alone may help reduce the threat of inflation.

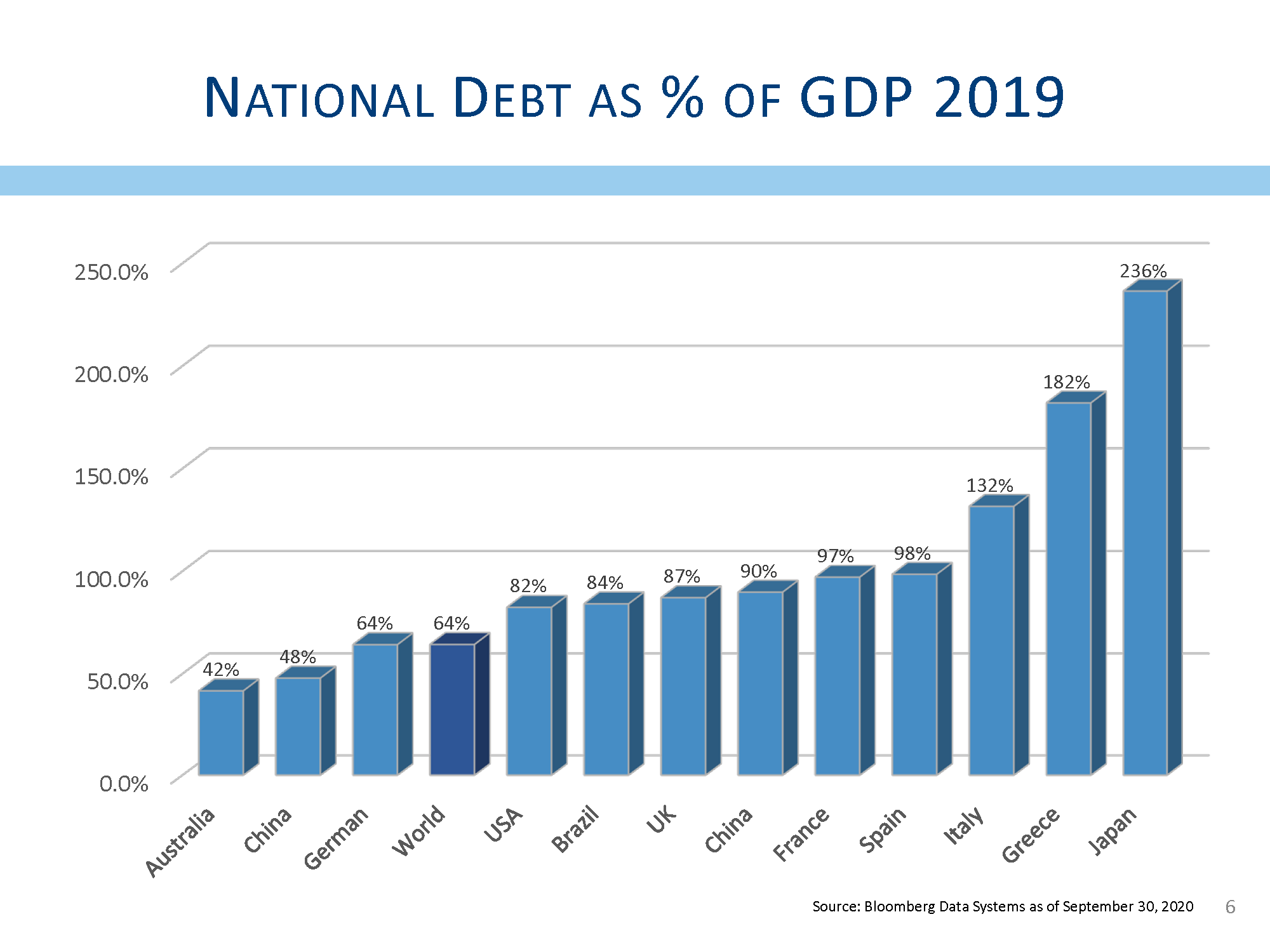

If we look around for other examples of countries whose debt levels have increased dramatically and now exceed the size of their economies, we need look no further than Japan. Japan’s debt is more than twice the size of their economy. Like other developed countries, Japan’s birthrate has dropped and without any immigration their economic growth has slowed to a trickle. High debt levels and monetization of the debt did not cause inflation but instead caused deflation. The rate of inflation has actually been negative for 11 years of the past 20. Deflation actually has a more sinister impact on consumer behavior than inflation. With inflation, the price of a good keeps going up. Why not buy that good today because the price will only be higher in the future. In contrast, when prices are falling, why buy something today when it will only be cheaper tomorrow. But when tomorrow comes, why not wait because the prices will only be still-cheaper in the future. Deflation can actually slow economic activity.

Consider two recent college graduates, one with a substantial amount of student loans and one without. Assume they have the same incomes and prospects. After a few years, both have seen their income rise, and both are in need of a new car. The one without the student loans easily qualifies for a car loan and finds herself with shiny new wheels. The one with the student loans is still making loan payments and cannot qualify for a new car loan. She finds herself keeping her old car alive longer than might be desired. High debt levels actually slowed economic activity.

It remains unclear whether our current policies will create inflation as occurred in the 1970’s or whether it will create deflation as seen in Japan. What is clear is the unintended consequences of the increased debt levels caused by the response to the pandemic will be with us for many years into the future.

At the start of this document, we mentioned there were Covid winners and losers. Airline passengers are still down nearly 70% from pre-Covid levels. Dinner reservations made through Open Table are down more than 40%. Outlet mall visitors are down roughly 30%. The ten largest cities have office occupancies of only 25%. Regal just announced the closing of their movie theaters. Disney recently announced they are laying off 28,000 people reflecting the difficulty they are having reopening their amusement parks. These are just some of the businesses that are struggling in the face of the relentless virus.

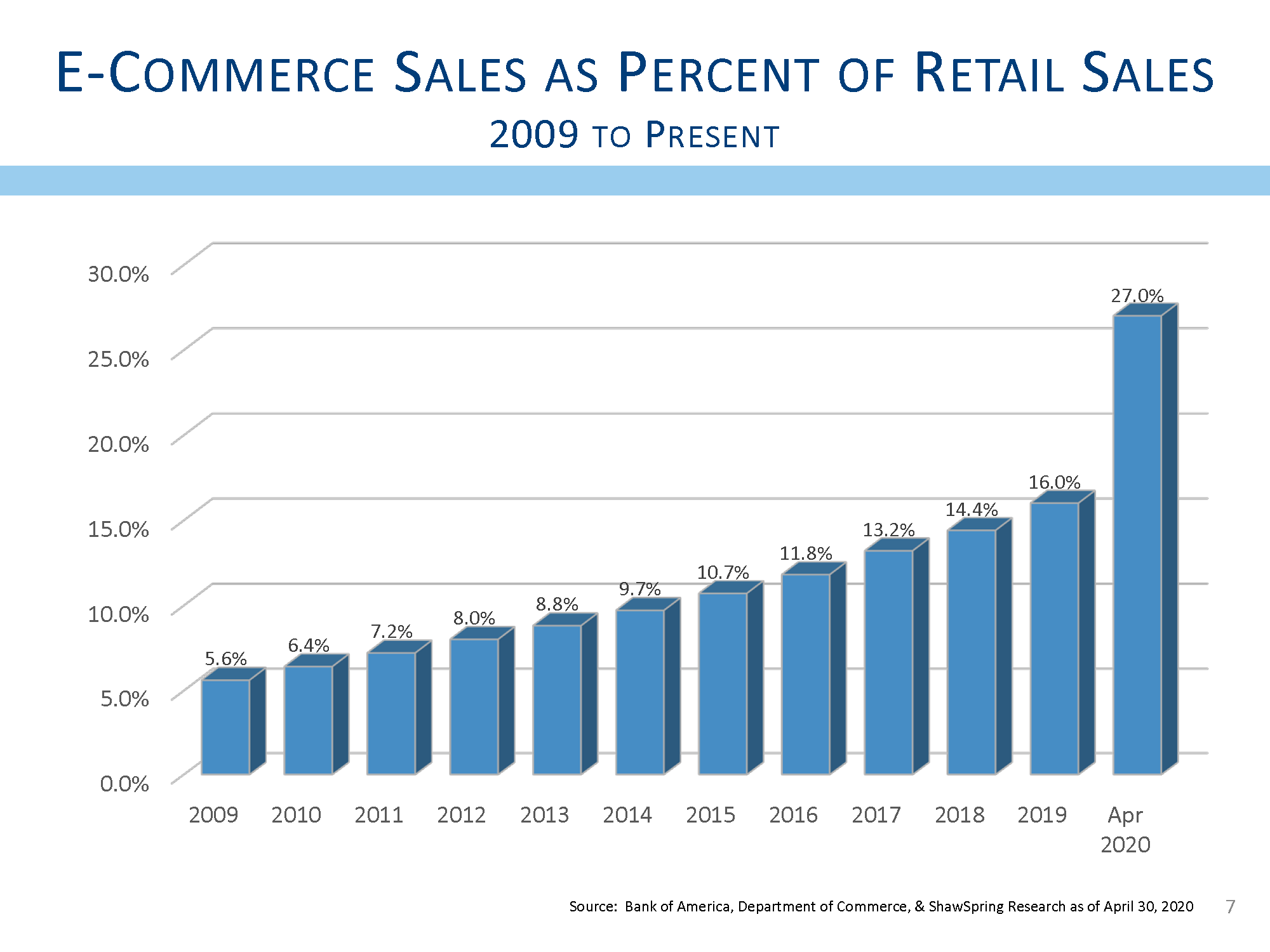

On the other hand, video conferencing apps have seen downloads up more than 300%. Online payment apps are up more than 30%, and streaming apps are up about 15%. Amazon said they were looking for 100,000 new employees in the United States and Canada. These jobs are to support their business which has seen exceptional growth. Over the ten years from 2009 through 2019, e-commerce sales increased from less than 6% of retail sales to 16% of sales. Over the first ten weeks of quarantine, e-commerce sales increased to 27% of sales. The same gain in e-commerce penetration that previously took 10 years has recently occurred in ten weeks. Talk about winners.

Some of the changes that are occurring represent changes that were already taking place and have been accelerated by Covid. For example, we cited the increase in cashless transactions. The trend toward a cashless society has been in place for quite some time, but with Covid, consumers do not want to hand cash to clerks and receive change. That is too much touching in a pandemic world. Visa and Mastercard are reporting an increase in credit card transactions, as are other cashless transaction services, and this is one of the changes that is likely to remain long after we have this virus under control.

Another change that was already taking place is a change in how people are purchasing and consuming their television media. The trend away from cable and satellite services, commonly called “unplugging” has been underway for years. Cable operators have lost hundreds of thousands of subscribers, while existing and new streaming services have picked up millions of new customers.

As people are home more and are unable to go to the movies or to a show or concert, people are watching more television. Unfortunately for the big networks, they have been unable to produce any new content, and that has exacerbated the trend towards streaming. It would not surprise us if much of the lost clientele never returns to their expensive monthly service subscriptions.

One of the trends that seems in its infancy but where we expect changes to be long-lasting is how buildings are ventilated. High-rise buildings tend to try to maintain the air in the building since fresh air needs to be heated or cooled while the existing air has already been temperature treated.

We expect new regulations will require that air be changed much more frequently, and the air itself will likely need to be filtered and treated to reduce the spread of viral particles. Further, apartments buildings that typically rely on large systems to heat and cool many different living spaces will likely be replaced with more individual systems that do not share air across many different apartments and families. We expect the companies that produce HVAC (heating, ventilation and air conditioning) equipment will be the beneficiaries of regulatory changes that create more stringent rules. These companies, we believe, should be considered as one way to participate in the changing needs for improved ventilation.

Speaking about apartments, one of our realtor clients expressed extreme difficulty in closing sales in units within the high-rise buildings on the Wilshire corridor. Houses are selling fast, while condominium units that require an elevator ride to reach are no longer coveted.

As more people are working from home, the need to live in a small downtown space that was close to the office is no longer a priority. Housing sales, particularly those sales outside of the downtown areas, are very strong. Additionally, with people spending more time at home, home improvement stores and vendors are doing quite well. People can no longer go on vacations that offer wonderful experiences. Instead, people are investing in new homes and in improvements to the homes they have. While this trend may not remain quite as strong once a vaccine is widely utilized, people who are working from home and have moved out of downtown will still live there, and the demand for small loft spaces may suffer along with the office spaces those residences previously supported.

One trend that seems to be gaining momentum, but is not growing out of Covid-driven needs is that of renewable energy. According to a Pew research poll, 67% of adults say the government is not doing enough to reduce the effects of climate change. That includes 90% of Democrats, and 65% of moderate Republicans. But perhaps even more important than sentiment is cost. The cost to generate electricity from solar is now as low as the lowest costs to produce electricity from fossil fuels. On-shore wind also produces electricity that rivals the lowest-cost fossil fuel plants. In a few more years, off-shore wind will also be able to generate electricity costs that rival the most efficient plants. Investments in these technologies will continue because of the high returns available. One of our analysts noticed that the solar energy companies have been trading up as the polls show former Vice President Biden with an increasing lead over the President. While the Biden administration is likely to create policies that are more supportive of expanding renewal energy sources, these trends are occurring without any current political support. They are occurring because it makes economic sense to do so!

As much as we try to avoid politics, we would be remiss in not mentioning the upcoming presidential election less than four weeks away. We would expect a higher level of volatility until the election results are known, but it is unclear what direction the market might take. While Biden has suggested he would consider reversing some of Trump’s reductions in corporate tax rates, these plans are unlikely to be enacted prior to a full recovery from the deleterious effects of Covid. In fact, the Biden administration may be more willing to increase fiscal spending to help heal the ailing economy.

While the polls are suggesting Biden has an advantage, it is important to realize that markets have not been selling off into this news. Markets hate uncertainty, but as that uncertainty diminishes, the market will focus on the Covid winners, and the fact that any vaccine will help the economy more quickly return to the level of activity that was prevalent before the outbreak.

Everyone at L&S continues to work tirelessly to make sure that we meet or exceed your needs. Please do not hesitate to contact us with your questions and concerns. This has been a very difficult time, something that none of us could have foreseen a few short months ago. We remain confident that American ingenuity will beat this unfortunate illness. Stay well, stay safe, and stay sane.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2019. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.