October 13, 2021

Things may come to those who wait, but only the things left by those who hustle.

— Abraham Lincoln

Last quarter we remarked at how far the U.S. economy had come since the beginning of the year when the pandemic shutdown was wreaking havoc throughout the economy. As Yogi Berra famously said “its déjà vu all over again.” After declining for many months, the number of Covid cases began to rise as the Delta variant of the virus took hold. From lows of less than 12,000 new cases per day, the number of new cases continued to rise to more than 175,000 per day (seven day average) by mid-September. While the states that were hit the hardest were those with lower rates of vaccination, the economic impact did not stop at the border of those states. The good news (I guess) is that we are learning how to live with Covid. Stores and restaurants did not close the way they did more than a year ago, and a broad economic shut-down was not contemplated. This is progress. We all hope that Covid will soon vanquish itself from our consciousness, but learning to survive is equally important. (If you are pressed for time, please consider reading only the bold.)

One of the most surprising aspects of the country’s response to the delta variant is how strong the economy is, despite continuing supply chain issues. Imagine how strong the economy will be in a few months or quarters when the supply chain issues get much closer to being resolved.

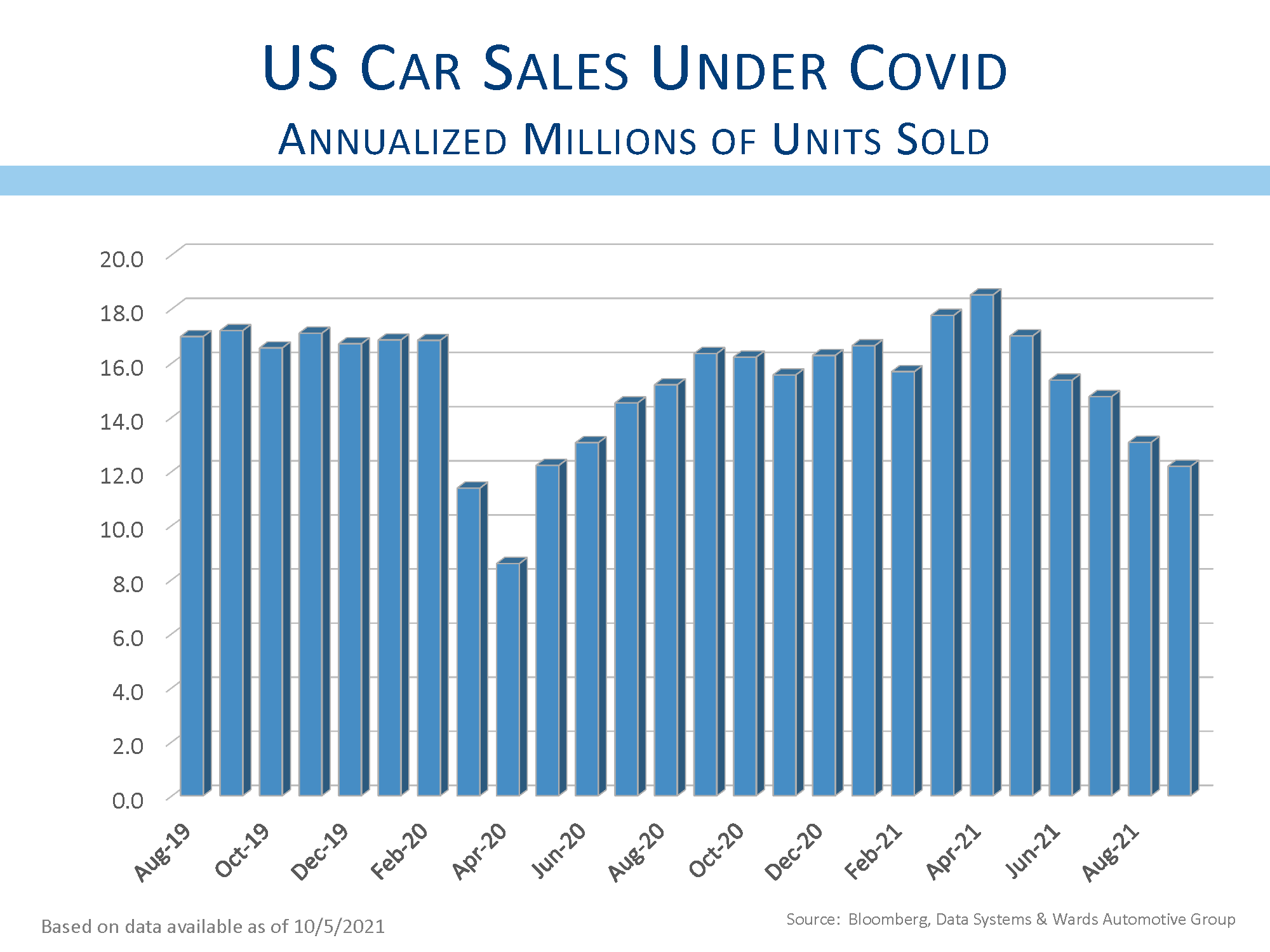

As the virus took hold of our country in the spring of 2020, companies slowed their orders of important components as they projected that sales could decline dramatically. The poster child for this circumstance can be seen in the auto industry. Car and light truck sales were averaging about 17 million units per year before Covid hit. In a severe recession, sales can easily drop by 40% or more, as they did in the Great Recession when sales dropped from over 16 million units to 9 million, a decline of nearly 45%. Fearful of a decline in sales, car companies took the proactive step to reduce their order of supplies including semiconductors. Remember that the cost of semiconductors is higher than the cost of steel for most cars.

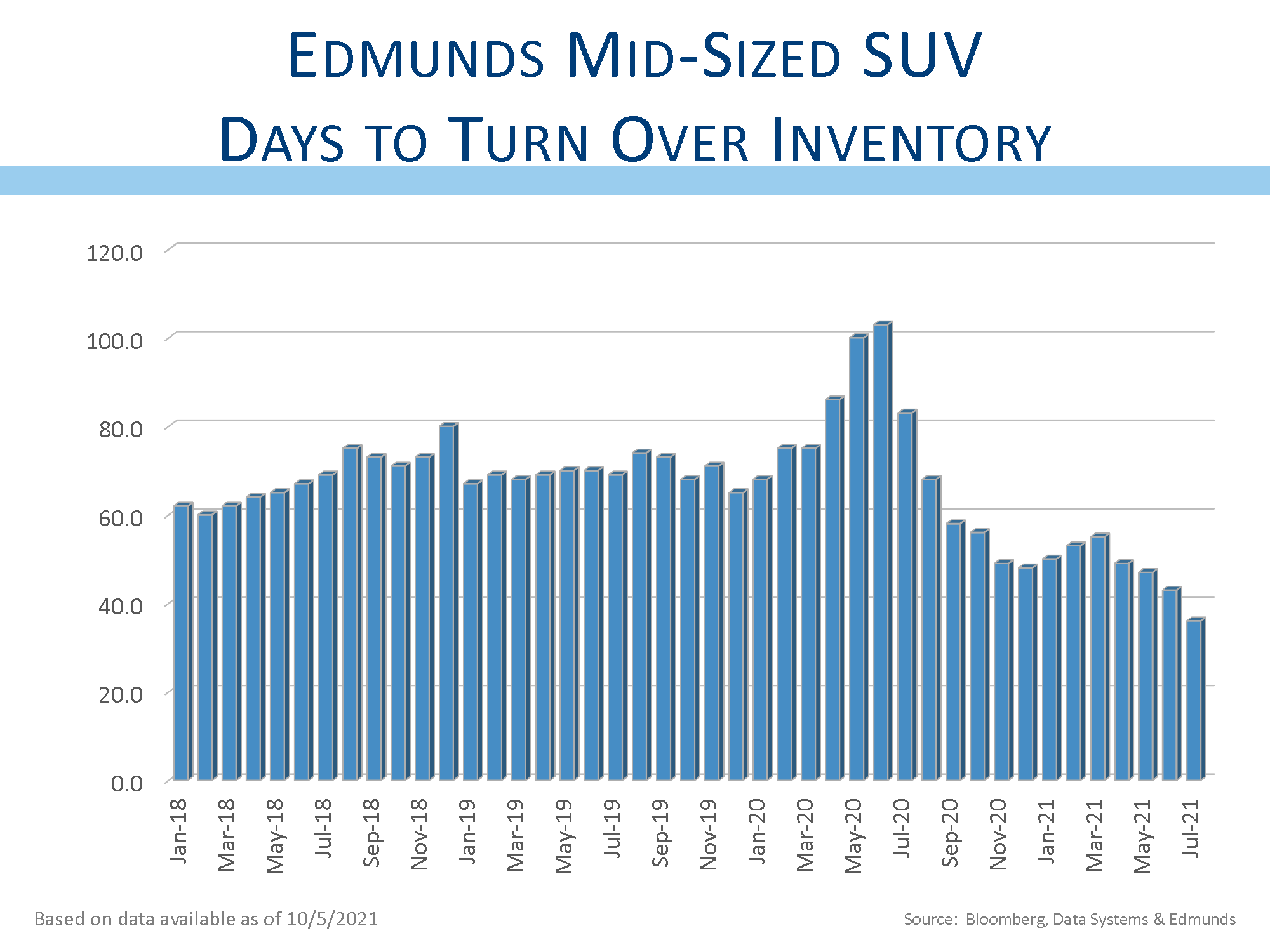

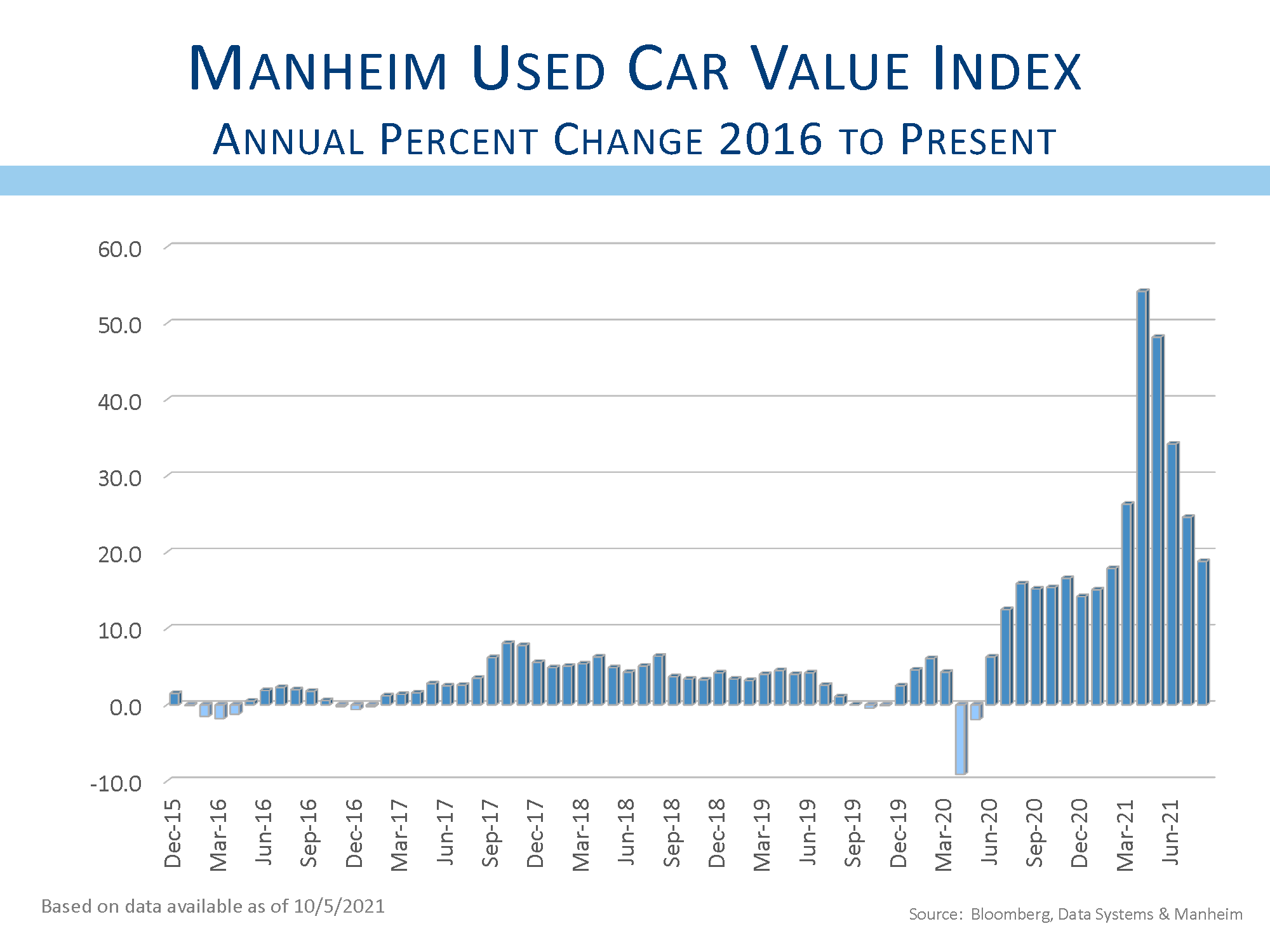

As people were forced to work from home the demand for laptop computers skyrocketed. Semiconductor companies were making too many chips for cars and too few chips for laptops. As production shifted to where the demand was strongest, another change took place. Workers moved out of big cities into more rural areas. Working from home for many has meant working from locations far away from public transportation, and people needed cars to support their new lifestyles. Car companies had cancelled their orders for supplies and have been unable to increase their production. Inventories of new cars on sales lots have dropped to record lows. U.S. car sales remain nearly 30% below the levels of two years ago before the pandemic. The demand for transportation spilled over into the used car market, driving the cost of used cars materially higher. Higher used car prices have contributed to the higher inflation reported over the past several months.

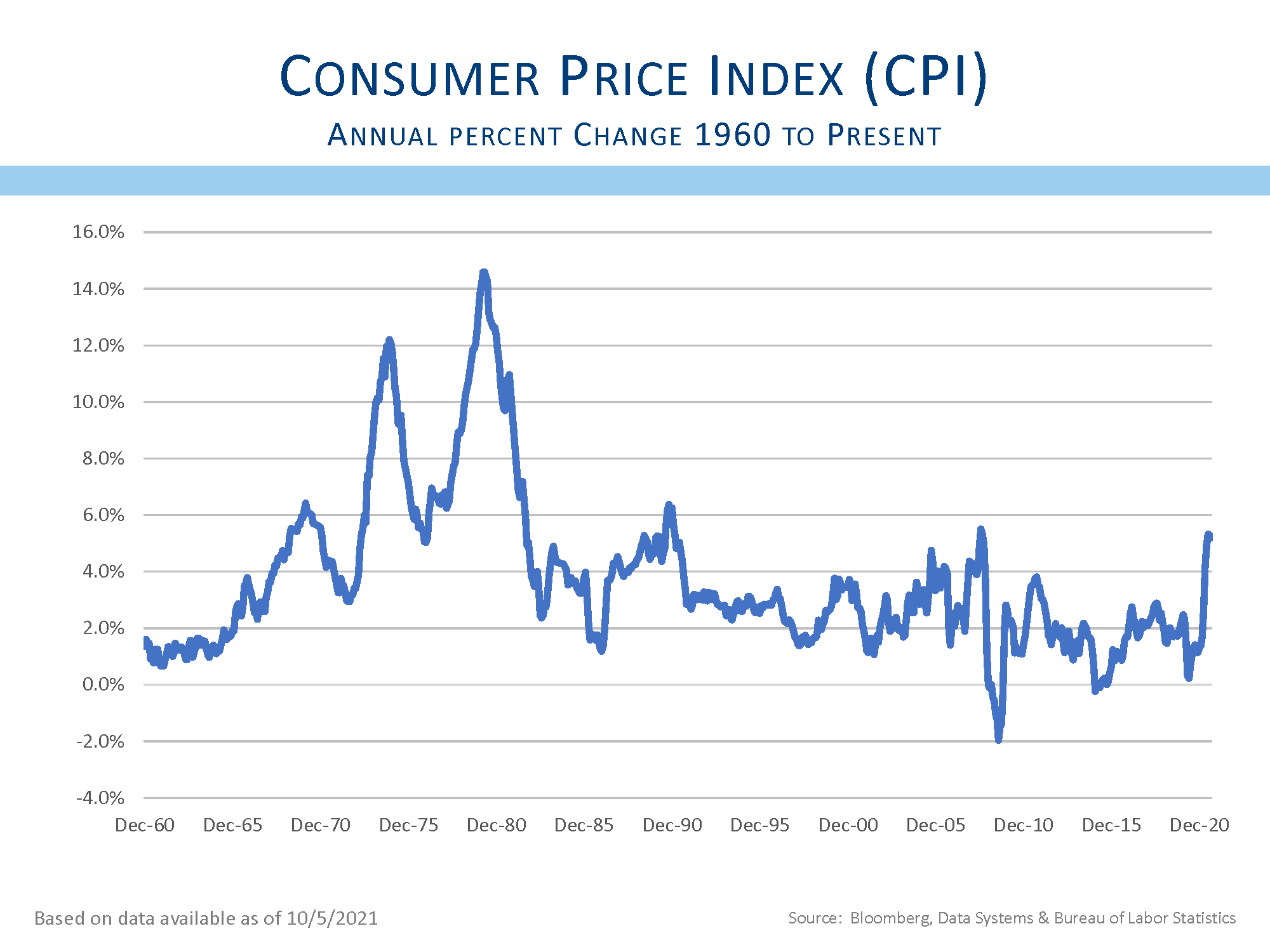

It takes many quarters and many billions of dollars to build a new semiconductor fabrication plant, and higher demand is encouraging an increase in production, although this will not happen overnight. When car production returns to higher levels to meet demand, we will see an increase in employment and economic output from car companies. Further, as inventories of new cars rebuild, the price of used cars is likely to ease, reducing some of the inflationary pressures. This is one of the reasons why the Fed continues to suggest that many inflationary pressures are “transitory.”

As you can imagine, with strong demand, semiconductor companies have shown solid earnings growth. Companies that make equipment to build new fabrication plants see good prospects for earnings growth for many quarters in the future. This is an example of how a thematic investment approach can identify industries that are likely to see strong growth for the next several quarters, perhaps for the next several years.

Our discussion of the shortage of semiconductors highlights another potential investment theme—the need to recreate and update supply chains. Many companies increased efficiency by ordering supplies to show up exactly at the time needed for manufacturing processes. This “just-in-time” inventory system meant that companies did not need space to hold extra inventories of parts, and this lowered costs and improved margins. What happens when demand increases, even if that demand is temporary? Production cannot be easily increased and potential sales might be lost. It may be that more companies decide to hold some inventory “just-in-case” they are needed.

Perhaps a second source of supply is needed in case an important supplier has some difficulty meeting its obligations. Maybe a company does not want to be fully dependent on China to supply its components. The redesign of supply chains may create important investment opportunities that should be considered for appropriate portfolios.

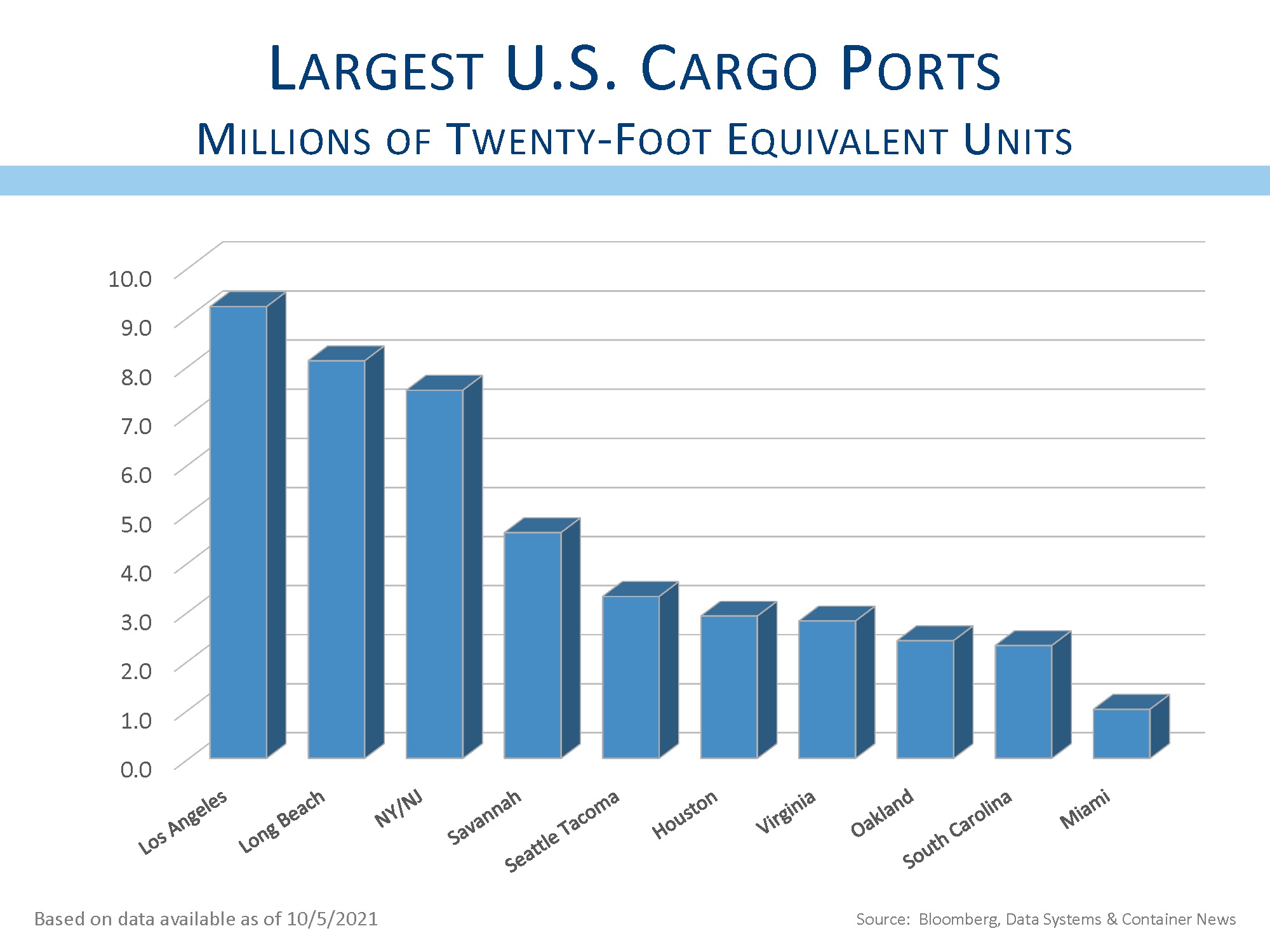

While we are on the subject of supply chains, reports suggest that at least 50 container ships are sitting in the port of Long Beach/Los Angeles, the nation’s busiest, waiting to be unloaded. To avoid delays, some ships have been rerouted to Seattle and others to New York, and now those ports are also reporting bottlenecks.

Ports in Singapore and other global ports typically operate around the clock while the port of Los Angeles does not operate multiple shifts. This will probably have to change, creating an increase in employment for those industries that help move cargo. Logistic companies and freight forwarders may benefit from these changes, and it represents more upside to potential economic growth as we look past the current quarter of this year and into 2022.

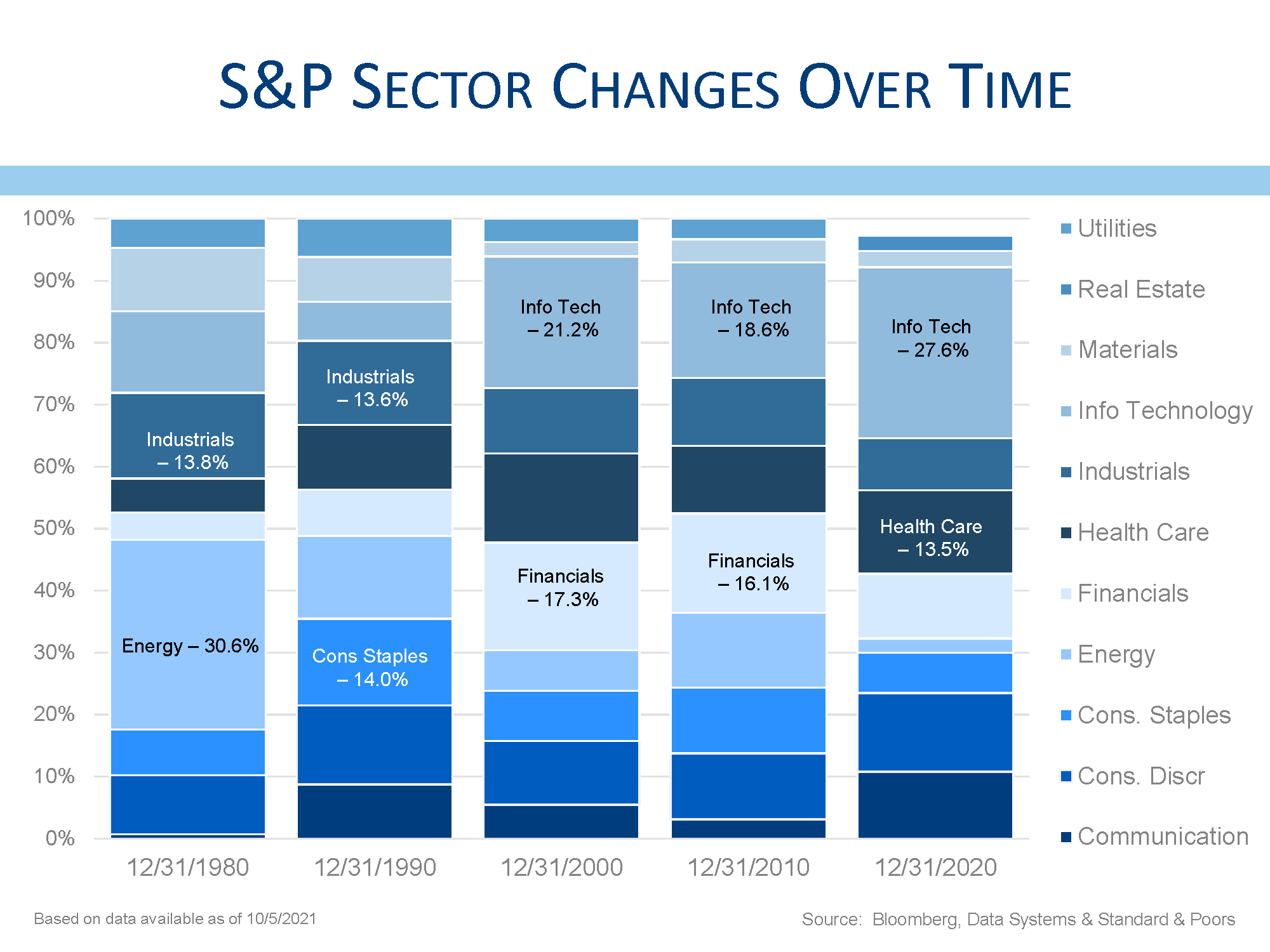

One of the investment themes that continues to play out is the transformation that is occurring in the global energy sector. At the end of 1980, energy represented over 30% of the S&P 500, a larger share than information technology is now. While technology, communication and other sectors have expanded in importance, energy now represents only about 3% of the S&P 500, down 90%.

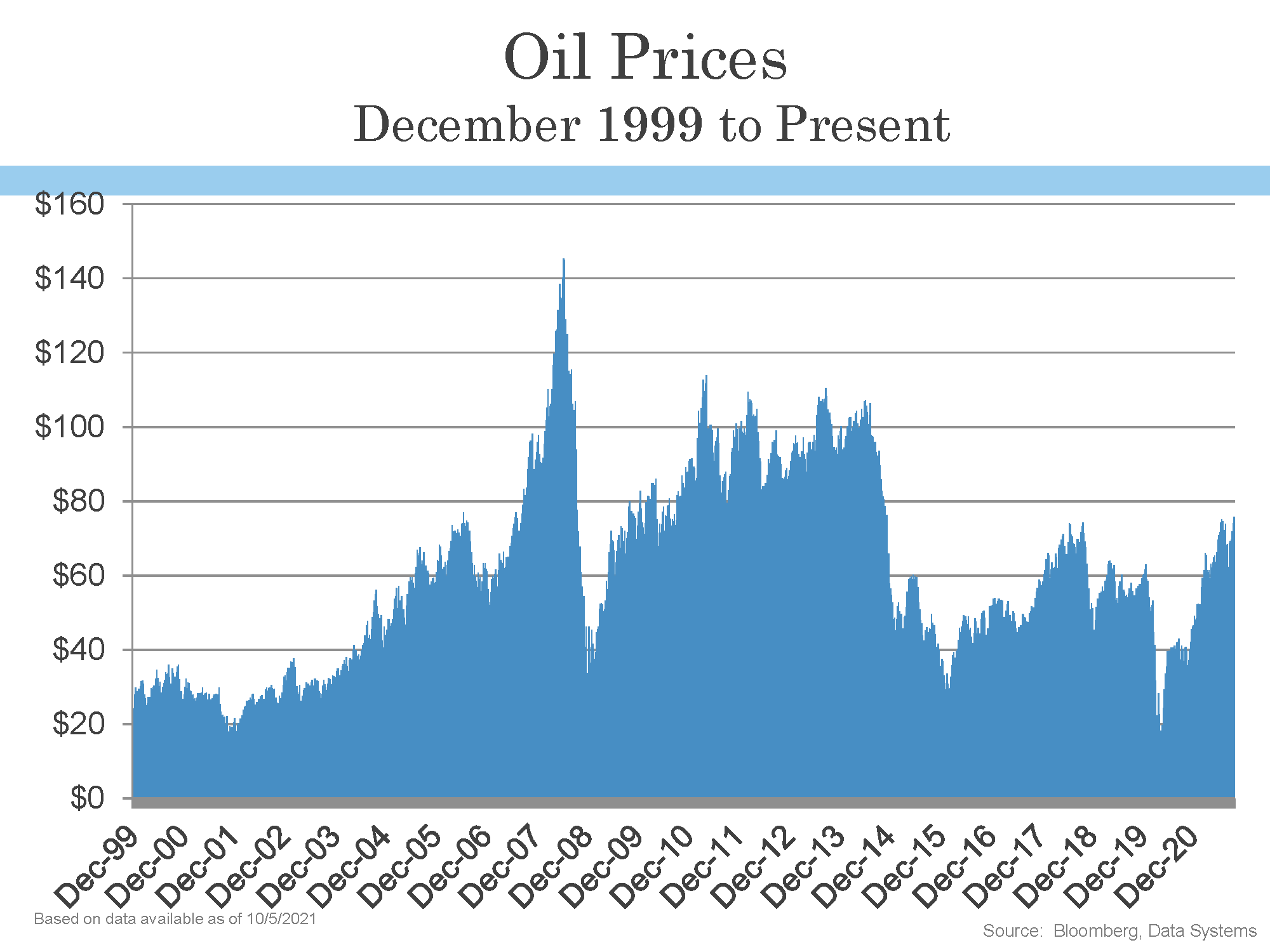

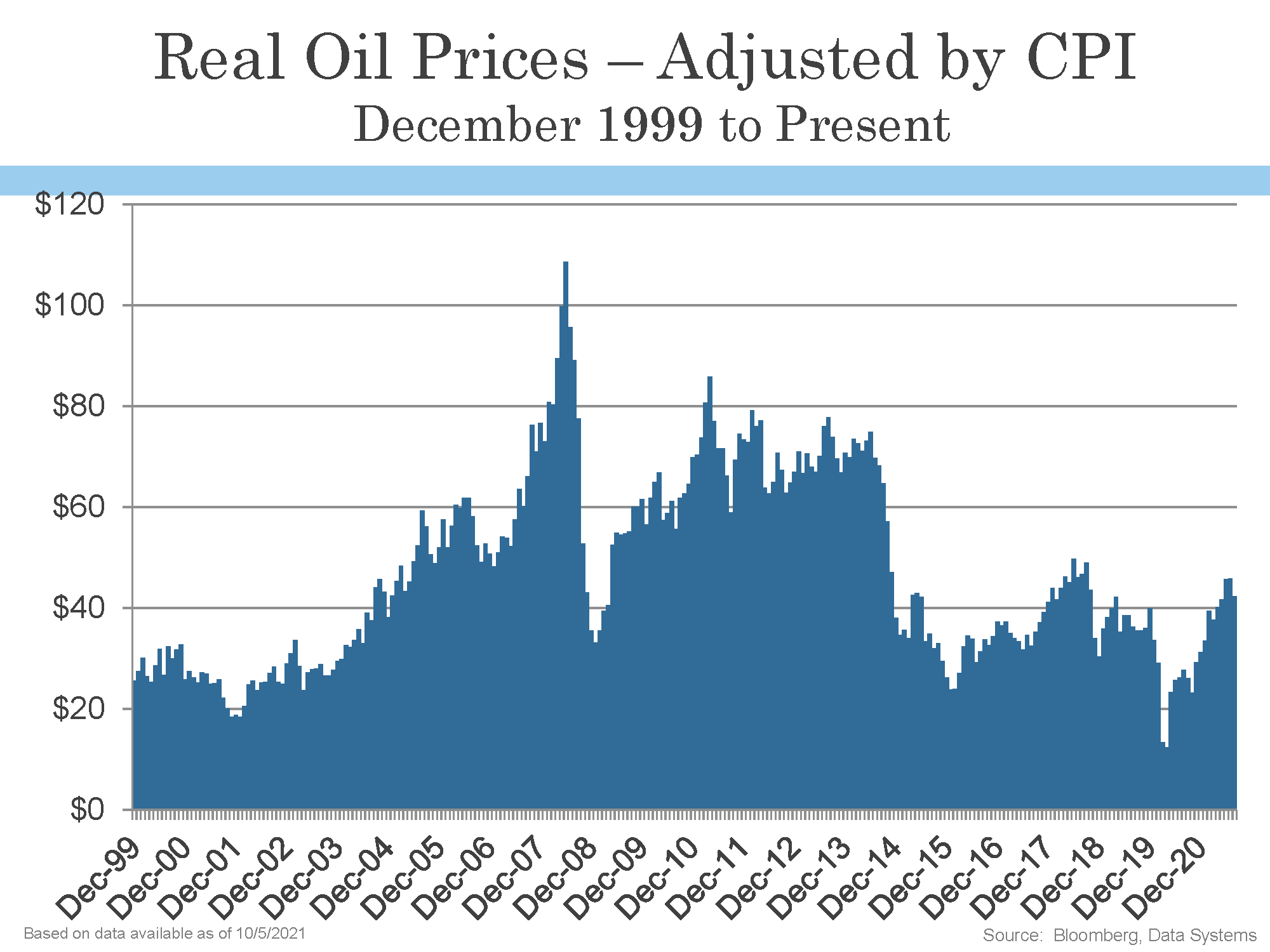

Energy prices peaked in 2008 at about $145 per barrel. Adjusted for inflation, energy prices peaked at about $109. Since that time, oil prices have been under extreme long-term pressure, dropping below $30 per barrel at the height of the pandemic. Prices have nearly doubled since those lows, but prices remain well-below long-term highs.

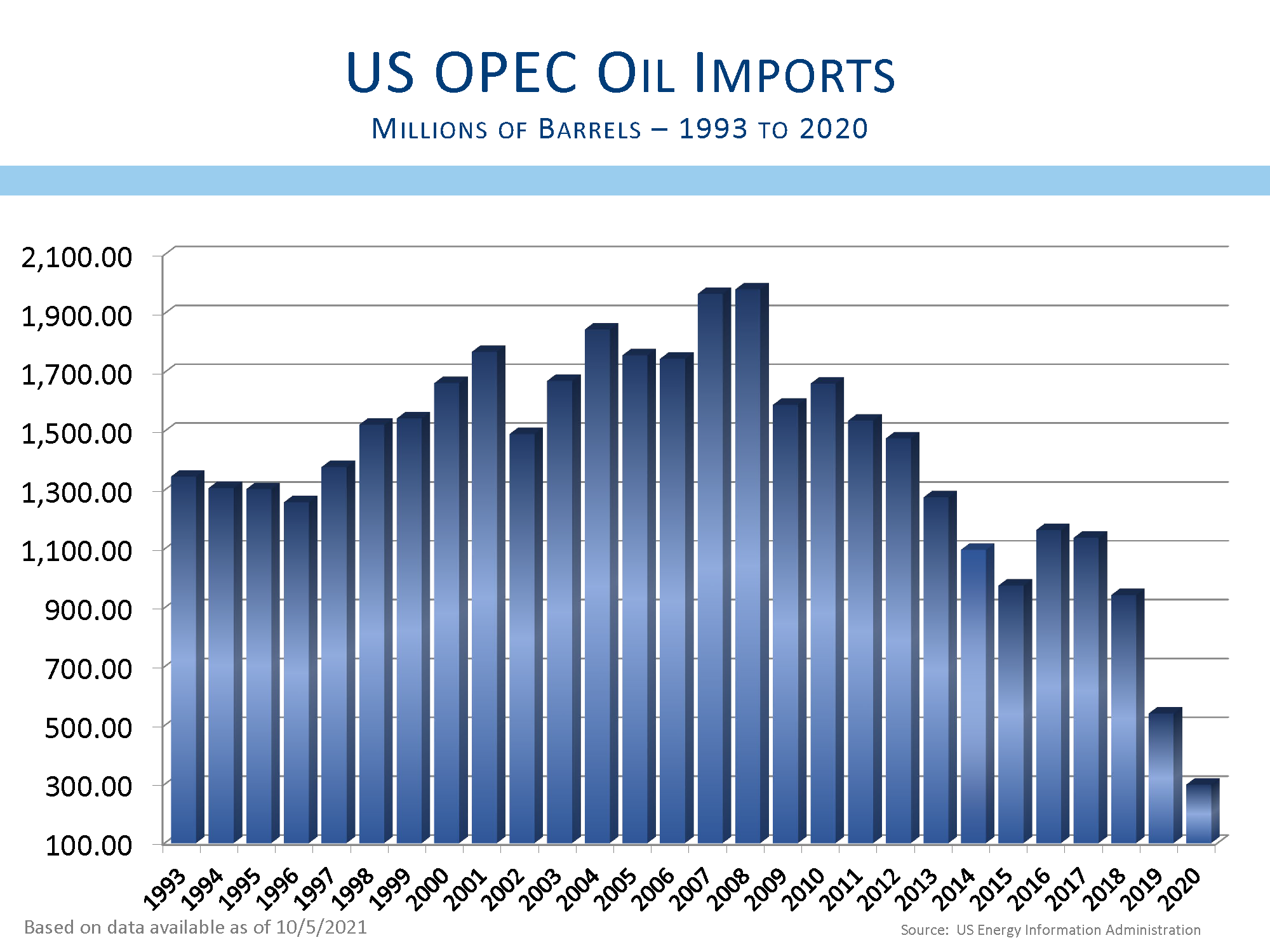

Oil markets are in the midst of several long-term changes. The first change that took place over the last decade or so has been driven by technological innovation. The technology to extract oil through the fracturing of shale formations (called fracking) has led to dramatic increases in the supplies of crude and natural gas. From a huge energy importer, the U.S. is now one of the world’s largest oil producers, and we now export significant volumes of oil. Oil is no different from any commodity, and higher production leads to lower prices.

Frackers had been operating under the belief that higher production was preferred even if profitability suffered. Over the last year or so, frackers have started to focus more on profits and less on levels of production, and that has led to more limited supplies and greater profitability. More rational production schedules have driven up profits and also prices, and that has led to more inflationary pressures. Does it seem likely that oil prices will double again over the next 12 months? Prices are already near 7-year highs. If oil prices remain at the current levels, not going up any higher, then the inflationary pressures from higher energy prices are likely to dissipate as we look ahead to 2022. This is also another reason why inflationary pressures may be transitory.

It is important to consider the changes in demand for any commodity when considering the future price. With more people working from home, the need for oil and gasoline for commuting has declined. Some jobs will move to a more hybrid structure, with employees in the office some days per week and working from home other days. Many companies are reluctant to require workers return to the office five days a week. A more flexible work schedule is seen as a competitive advantage, attracting the best and brightest who embrace the flexibility of working from multiple locations. The reduction in commuting, and the lower need for oil and gas may represent a permanent destruction of demand for oil and gasoline.

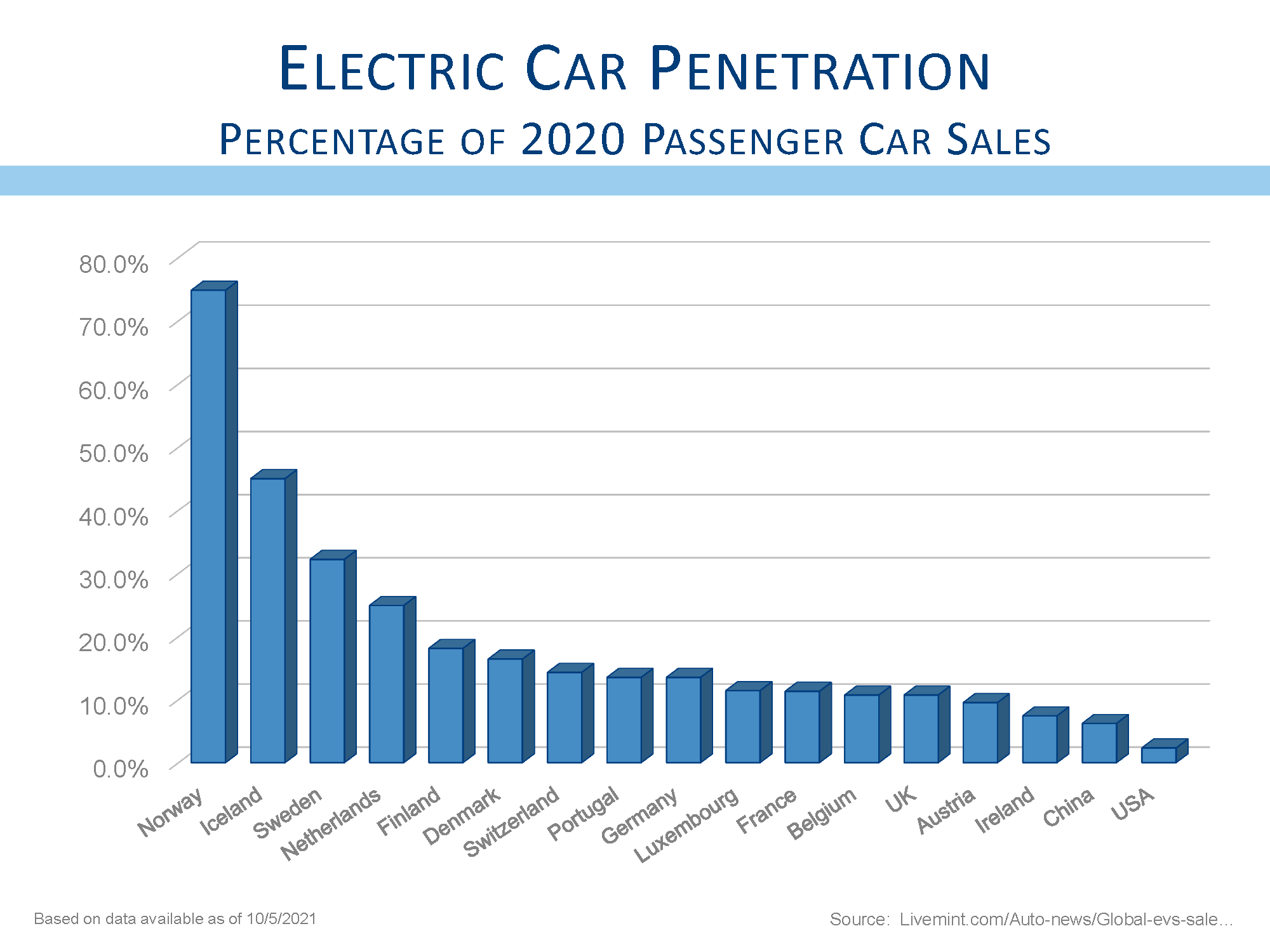

No discussion of the changes in the energy landscape would be complete without a discussion of the electrification of vehicles. My wife has been an ardent believer that her car should create the lowest carbon footprint possible. She owned the second Prius delivered in Los Angeles, and has since owned a plug-in hybrid, a hydrogen powered car, and is now the proud owner of an electric car. She calls my car “the big polluter,” and has sent our son and me to the car show every year with the task of reporting back to her on all the electrical cars available for purchase. For many years that report was woefully short. She was nearly two decades ahead of the times, but now the choice of electric cars is expanding exponentially.

Cadillac, Ford Chevrolet, Volvo and others have provided a timetable to eliminate all internal combustion engine (ICE) cars. The switch to electric cars is coming, and BMW, Mercedes, Volkswagen and others have new cars available that were designed as electric cars rather than existing cars that have been retrofitted with an electric powertrain. Volkswagen, coming off their diesel scandal, has embraced electric as the powertrain of choice, and there are reports that their new ID-4 electric SUV is selling above the sticker price. The Ford F-150 pick-up truck, the most popular vehicle in the country, has an electric offering available next year, and the company has more than 100,000 pre-orders. Even the biggest polluter of them all, Hummer, is now available as an electric car. Change is coming.

With change comes opportunity and also adversity. Toyota has embraced the hybrid drivetrain and is now behind in the push to full electrification. New car companies have sprung up to challenge the existing manufacturers following the trail blazed by Tesla. Lucid recently delivered its first electric luxury sedan, and Rivian has recently delivered its first electric pick-up truck. Some of these companies may represent significant investment opportunities while others are likely to be acquired by existing companies.

The U.S. Post Office has placed an order for its first fleet of electric delivery trucks. Amazon and UPS are also working on the electrification of their fleets. The logistics of a fleet of delivery trucks or busses is very different. Currently the bus fleet can be refueled with a few diesel pumps, taking a couple of minutes for each vehicle to be filled. Even with super-chargers, electric vehicles need at least an hour to be re-fueled. A few rechargers will not be sufficient to refuel an entire fleet. Nearly every vehicle will needs its own recharger. The fleet storage lot, with tens or hundreds of vehicles and a similar number of chargers, will need to draw an incredible amount of electricity. It is possible that a small electric sub-station will need to be built next door to the fleet parking lot in order to provide sufficient power to recharge all vehicles every night.

Which new car companies will be the survivors and which will become the next Tesla? Who supplies the recharging stations, and who provides the electrical equipment to build the new substation? This is another example of thematic investing. Focusing on the winners of electrification of transportation provides the potential for finding many investment ideas that will see their businesses expand for many years to come.

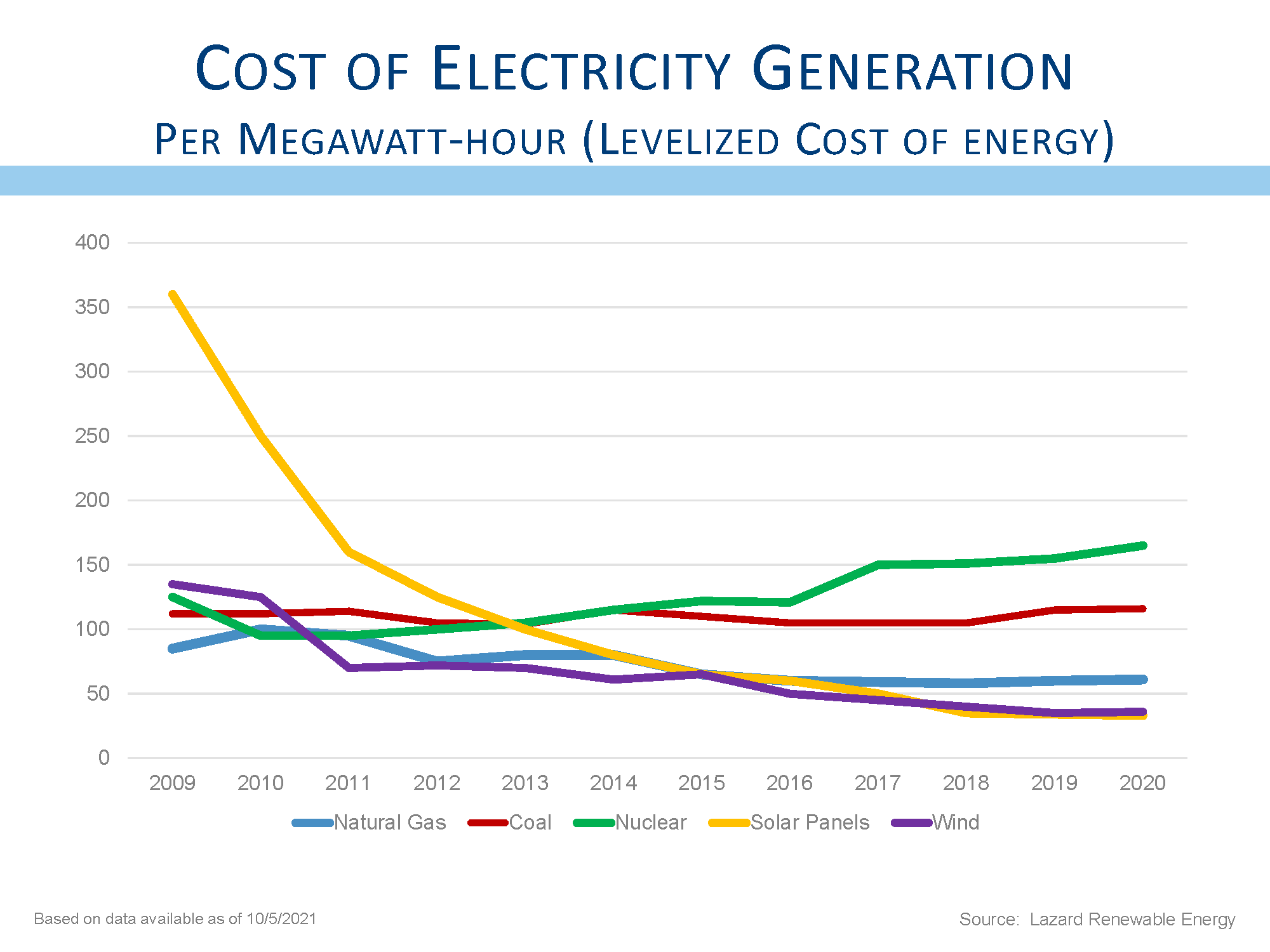

The electrification of transportation will also put added pressure to upgrade our electrical grid. How we deliver power to the end user is based on technology that is nearly 100 years old. Producing electricity with wind and solar is now cheaper than producing electricity with fossil fuels. Yes, the wind stops blowing and the sun stops shining. We will continue to need natural gas powered electricity generation to make up for when the cheapest sources of electricity temporarily stop producing.

The grid needs to be smart enough to switch over instantaneously when a cloud passes in front of the sun. Further, the above-ground electrical wires need to be replaced with wires in the ground. Many wildfires in California have been caused by wind severing electrical cables. Hurricanes in the South take out electric wires with uncanny predictability. Upgrades to the electric grid are another investment theme that represents an attractive opportunity for investors over the next several years.

Investment themes help us focus our attention on where we hope to find attractive investment opportunities. It is one of the ways we seek to add value as we invest the funds you have entrusted to us.

As the number of Covid cases continues to decline, we expect the economic recovery theme to play a more important role in the fourth quarter performance, just as it did in the second quarter. Perhaps even more importantly is that this theme is playing out globally. European countries are now significantly ahead of the U.S. in the percentage of people who are fully vaccinated. Asian nations are also doing a better job vaccinating their populations. The coming economic recovery will not just be about stronger economic growth in America but will be about stronger economic growth everywhere.

The Fed, recognizing the improving economic outlook, may start to remove some of the extraordinary accommodation they added to the system to prevent the healthcare crisis from becoming a financial crisis. Still, it is likely that interest rates will stay fairly low for the foreseeable future. Central bankers across the world are likely to continue to be very accommodative and not rush to raise interest rates and risk hindering economic growth.

Corporate earnings are growing at an exceptional pace, and imagine how strong growth can be as supply shortages start to resolve. Imagine an economy producing 17 million cars per year or more. Imagine the opening up of international travel. Imagine a world where we can manage any minor outbreaks of Covid, where the economy continues to hum, and corporate earnings continue to expand. Imagine finding some attractive themes to invest in. While valuations are high, we continue to believe the opportunities outweigh the risks.

Everyone at L&S continues to work tirelessly to make sure that we meet or exceed your needs and objectives. If you have any questions or concerns, or if your investment objectives have changed in any way, please contact us. Stay well, stay safe, and stay sane.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015, and ACA Performance Services for the periods from January 1, 2016 to December 31, 2020. Upon request to Sy Lippman at slippman@lsadvisors.com. L&S can provide the L&S Advisors GIPS Report which provides a GIPS compliant presentation as well as a list of all composite descriptions. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.