January 12, 2018

Predicting rain doesn’t count. Building arks does.

— Warren Buffett

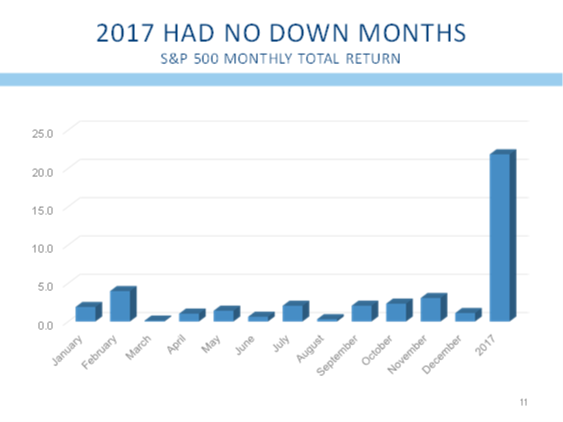

As we look back on the year that just ended, we are struck by the very solid gains posted by equity markets. Admittedly, our investment committee expected double digit returns for 2017, but even we were somewhat surprised by the unrelenting gains. The S&P 500 did not post a single negative month during the year, something that has never happened before (our data goes back to 1926). Performance during the year was dominated by large-capitalization stocks which handily outperformed both small-cap and mid-cap stocks. Growth outperformed value during the year, and technology stocks, one of the more growth-oriented sectors, was the top sector for the year. As clients review their portfolios and reflect on the very solid gains during the past year, we must evaluate the opportunity for the year ahead. Some of the ingredients that led to the strength in 2017 will continue, although there are some headwinds that may limit returns as we embark on a brand new year.

We have consistently looked for three pillars to support equity markets. We would like to see economic growth, earnings growth, and the confidence to invest. When those three things are present, we generally expect equity markets to continue to advance.

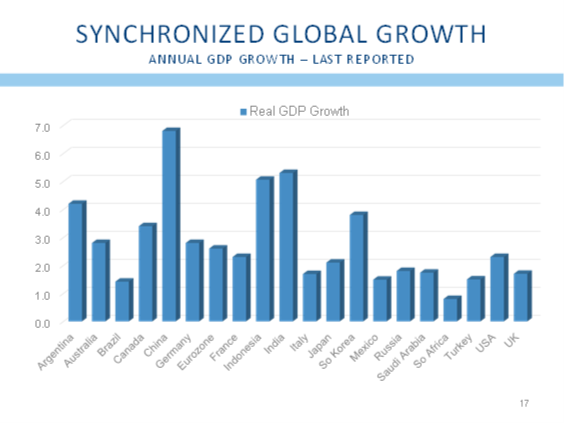

For the first time in a very long time, we are witnessing synchronized global growth. As of the last report, fully all 20 of the Group of 20 nations have economies that are growing. The G-20 comprises a mix of the world’s largest developed and emerging economies, representing roughly two-thirds of the world’s population, approximately 85% of the world’s GDP, and three-quarters of global trade. Even sickly Brazil is emerging from a severe recession and is growing again. This is the first time since the end of the Great Recession that all 20 nations are growing simultaneously. Strong economic growth is the first pillar we look for, and it provides an excellent environment for equity market gains to continue.

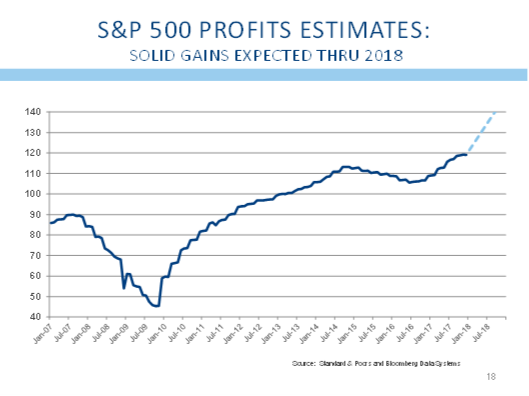

In particular, we look for economic growth to lead to stronger corporate earnings, and results through the past year have shown solid gains in revenues and earnings. Many corporations have also provided positive outlooks for the coming quarters. Further, the recent tax plan passed by congress at the end of the year provides for reduced corporate tax rates, which should lead to additional gains in corporate earnings. Not all companies will benefit equally, but companies in the very highest tax brackets will see their tax burdens lowered, leading to a commensurate increase in reported (that is after-tax) earnings. Reduced taxes, combined with strong economic growth, should lead to excellent gains in corporate earnings. Estimates, including the benefits of lower tax rates, call for S&P 500 earnings to grow by more than 20% in 2018. Earnings growth of this magnitude should lead to higher stock prices over the coming year.

The strong economy should also lead to modestly higher interest rates. This would be a natural response to stronger growth. While 10-year U.S. Treasury rates have increased over the past few weeks, these rates actually ended the year slightly lower than they were at the start of 2017. This surprised us last year, but again we anticipate that stronger growth will lead to higher 10-year interest rates as the year progresses.

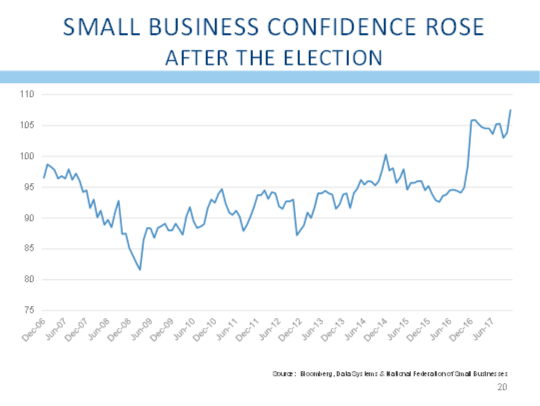

The third pillar we look for is an increase in confidence, and here again the news is quite positive. Consumer confidence, CEO confidence, and small business confidence have all increased dramatically over the past year. Both small business and CEO confidence are responding to the very pro-business stance of the current administration. Additionally, the reduced threat of increased regulation is adding to the positive outlook for corporate America. Consumer confidence is likely responding to the outlook for continued economic growth, combined with the very strong employment gains with the unemployment rate down to a low 4.1%. Expectations are for unemployment to continue to improve, and most estimates suggest the unemployment rate will drop into the mid 3% range as the year progresses, something that hasn’t happened since the end of 1969. Further improvements in the unemployment rate are likely to support continued strength in consumer confidence as the year progresses.

Confidence is important, not just because investors are more likely to invest when confidence is high. Strong confidence will also lead to decisions by corporate chieftains to spend funds on capital projects that will lead to further growth in the future. This has the potential to be a self-fulfilling cycle.

Taken together, strong economic growth, solid gains in corporate earnings, and the confidence to invest provide an excellent backdrop for further gains in the equity market in the coming quarters.

We would be remiss to end this discussion without touching on some potential problems that could also rear their ugly head. While the political environment has generally been pro-business, there are some aspects of the administration’s positions that have the potential to be troubling.

There is talk of the U.S. placing tariffs on the imports of steel and other commodities from China. While the goal of protecting domestic steel producers seems admirable, history reminds us that tariffs are never the way to support a free-market economy. The tariffs put in place after the Great Depression had the effect of delaying the recovery, and many believe it actually caused the economy to double-dip after a recovery had begun. We do not like the idea of tariffs, and we fear that the administration could lead us into a trade war that would reverse the strong progress we see on the three pillars currently supporting stock prices.

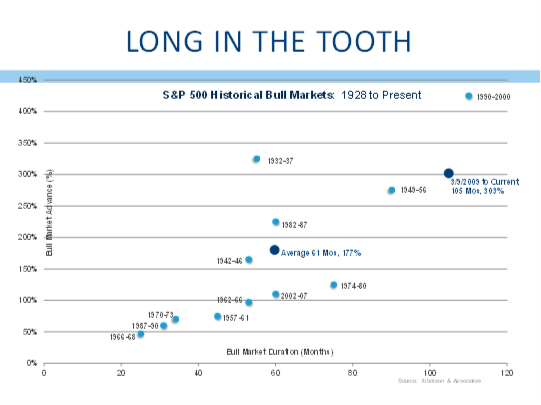

This recovery, currently 105 months long, is the second longest in modern history. The longest recovery, 110 months long, occurred from 1990 to 2000, and the current recovery will overtake that expansion in the middle of this year. Many people worry that this expansion is getting long-in-the-tooth, but, so far, no recovery has ever died of old age. Recoveries typically end when policy mistakes are made and interest rates are increased too aggressively. Some recoveries have also ended from external shocks such as the more than doubling of oil prices that occurred following the oil embargo of 1973. Still, without an external cause, we see no reason to expect the present expansion will end over the coming months.

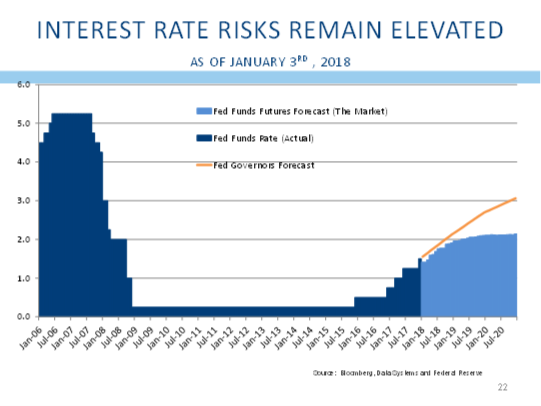

That brings us to the potential for a policy error by the Federal Reserve. The Fed raised interest rates three times in 2017, and they have indicated their intent to raise interest rates three more times in 2018. While some people believe the Fed will only increase rates twice this year, there is certainly the potential for the Fed to increase rates more than the three times they currently see as warranted.

The Fed is likely to be more aggressive about increasing interest rates if inflation were to accelerate. So far, inflation has remained well-contained, but stronger growth and a fairly tight labor market may lead to wage inflation. As we have seen in the past, wage pressures can lead to more systematic inflation as companies must raise prices in order to protect their profit margins as labor costs begin to rise. With the unemployment rate already down to 4.1%, and with further improvements anticipated, many economists worry that wage inflation is right around the corner. Certainly high tech companies are finding it increasingly difficult to find qualified workers, and one way to attract the workers that are needed is to entice them to leave an existing job. That enticement often comes in the form of a larger paycheck.

Should labor cost inflation become more problematic, the Fed may feel compelled to raise interest rates more than the three times they have already telegraphed.

As we mentioned earlier, modestly higher interest rates, by themselves, may reflect an economy that is growing at a healthy clip, and that is not necessarily a bad thing. If, however, markets get spooked by rising inflationary expectations, and interest rates rise more than anticipated, that could portend a significant headwind that equity markets are not yet prepared to face.

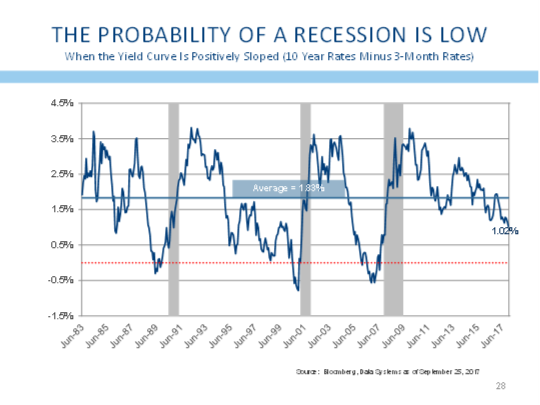

Another interest rate concern comes with the Fed’s intention to raise rates three times in 2018. When interest rates are increased too aggressively, the market may recognize that additional rate increases are unnecessary. When this happens, the Fed raises short-term rates through its policy actions, but longer interest rates may not increase as much, and short-term interest rates can actually exceed longer rates. We call this an inverted yield curve. Policy mistakes by the Fed that lead to inverted yield curves have been an excellent predictor of upcoming recessions. Should the Fed raise rates too much, it often portends a recession, perhaps not this year, but likely soon thereafter.

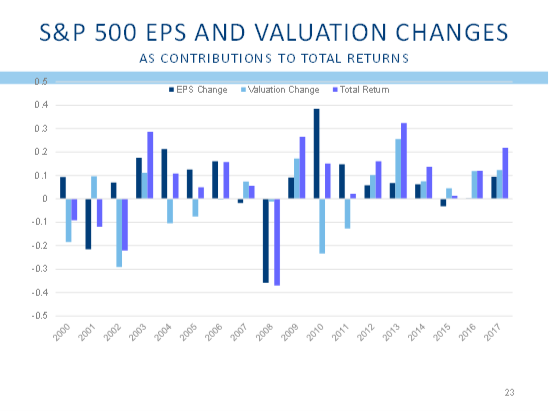

Still another concern that we must keep an eye on is the valuation of the stock market. By most measures, the valuation of the market is above the averages of the past 25 years.

We recognize that valuation measures are one of the worst short-term indicators of the direction of the market. John Maynard Keynes said that “markets can remain irrational a lot longer than you or I can remain solvent.”

Still, it is important to focus on the fact that more than half of the gains in the stock market last year came not from growing corporate earnings but from higher valuations. Over the past six years, nearly three quarters of the gains in the market came from expanded valuations, while only one quarter of the gains came from actually higher corporate earnings.

Valuations can’t keep rising without eventually hitting a wall. We do see the potential for solid corporate earnings gains in the coming year, but it is important to recognize that some of those gains may be absorbed by valuations reverting to more normal or average levels. This may limit the upside for the market in 2018.

Finally, we also worry about investor sentiment. Many people have called this “the most hated bull market in history.” Following two dramatic sell-offs in a single decade, the dot.com bust and the Great Recession, many investors have shunned the stock market, even as the economy has continued to improve from the early 2009 lows. More recently, it seems that the number of bullish investors has increased dramatically. The number of stocks that are participating in the rally has expanded dramatically, and bullish sentiment seems to be ruling the day. There are very few investors who are skeptical, and it is generally the case that retail investors are nervous near market bottoms, and euphoric at market tops. The lack of skepticism is something that causes us some concern.

While there is plenty to worry about, there are things we don’t worry about. We don’t worry about who has the bigger button or the smaller hands. We find no need to worry about the meme for the current 24-hour news cycle, or who is testifying in front of which committee. The reason is that we do not see these things having a detrimental impact on corporate profits. So far, the market has made the same determination. When geopolitical risks have an impact on profitability, we will certainly adjust portfolios accordingly, but until then we must stick to the facts as we see them.

From that perspective, the growing economy and expanding corporate profits will likely overcome the doubts we have expressed, and we anticipate that the market will likely be higher by the end of the year that has just begun.

We spend significant resources looking for signs that risks are building, even as those signs may not be visible at this time. We evaluate data from many resources, including Fed reports, purchasing manager’s reports, credit statistics, investor sentiment, market action, and many others. Deterioration of credit market indicators, in particular, were prevalent prior to the beginning of the Great Recession, and we remain vigilant to the idea that risks may be building, even as the outward appearance is one of sustainable growth.

Our read of the data does not give us reason to be raising concern at this time. If anything, the recent read of the data suggests the global economy may be strengthening. That does not prevent the market from having a temporary correction, and it does not guaranty that growth in corporate earnings will lead to a commensurate increase in stock prices. The data remains positive, and so does our bias.

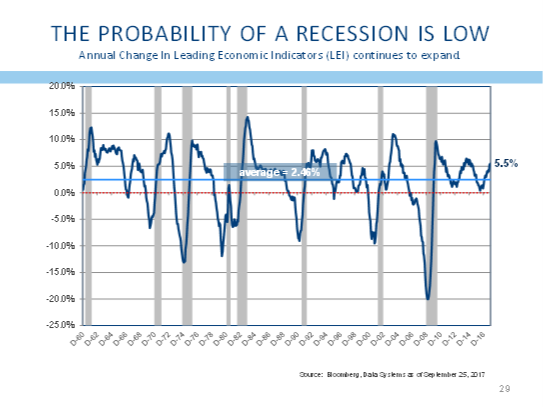

While we acknowledge that the stock market may be overdue for a correction, we must also be cognizant of the fact that the most painful bear markets are almost always accompanied by recessions. In this regard, the data is very positive.

We have two indicators that have been very successful at forecasting when a recession is on the horizon. The first indicator, as we discussed above, is to see if the Fed has made a policy decision that has caused the yield curve to invert. An inverted yield curve typically means that a recession will follow, and the lead time for that indicator is between three and six quarters. While the yield curve has flattened over the past year, it is no where near inverted, and that suggest no recession is likely in 2018.

Another exceptional indicator of the timing of the next recession is the rate of change of the government’s index of Leading Economic Indicators (LEI). This composite of 10 different indicators has done a wonderful job of forecasting recessions. When the indicator is down as compared with the value one year ago, then a recession is likely on the horizon. This indicator also suggests that a recession is unlikely as we look ahead through 2018.

Stock returns are likely to be positive, although returns may not be as robust as they were in the year that just ended. Small and medium sized companies may benefit from the lower tax rates, and we would not be surprised to see smaller companies outperform their larger siblings.

Returns in the fixed income markets are likely to be much more modest and may struggle to be positive for the year, especially if the Fed raises rates as they have promised. High yield bonds are likely to be the best performing fixed income asset, especially if the economy remains on track.

International markets appear attractive as growth is strong, and valuations are significantly less stretched than domestic measures.

Overall, we expect a reasonably positive year for investors in the year ahead.

From all of us at L&S Advisors, we send our most heartfelt wishes to you and your family for a New Year that brings good health, fine friends, much happiness, and abundant prosperity.

As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have any questions or comments regarding your investment portfolio.

Bennett Gross CFA, CAIA

President

Disclosure

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2016. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.