January 11, 2021

Running 26 miles is a feat that truly stretches a human being. At the 20-mile mark, someone has said, the race is half over. Almost anyone can run 20 miles, but the last six are the equivalent of 20 more. Here the runner finds himself pushed to the absolute limit. And therefore needs to call on those hidden reserves, to use all the fidelity and courage and endurance he has.”

— George Sheehan, best selling running author

Nearly ten months ago, we began what none of us thought would be a marathon. Yet here we are, at the 20-mile mark, struggling to figure out how to get to the finish line. Healthcare worker spouses of our colleagues have already been inoculated with vaccines that were developed in record time with technologies that barely existed a few short years ago. There is hope for a better year as we look ahead into 2021. We are, however, at that point where fatigue has set in. We miss seeing our family and friends, especially during the holidays, and we are struggling to find the strength and endurance to go the next six months and put this pandemic behind us. Unlike a real marathon, none of us has trained for this event. The good news is that technology permitted many firms to embrace working remotely, and society has quickly adjusted to the new normal. (If you are pressed for time, consider reading only the bold.)

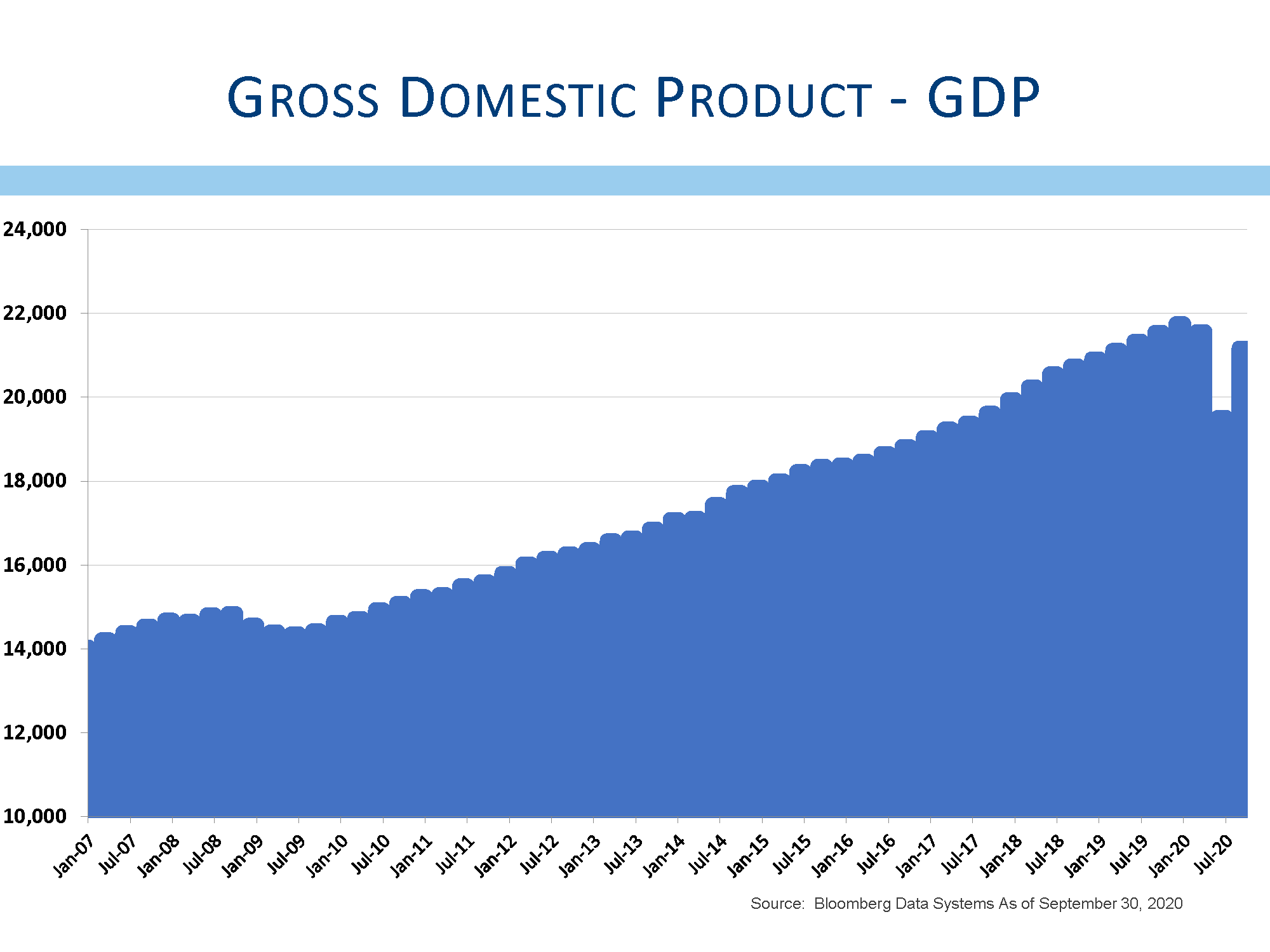

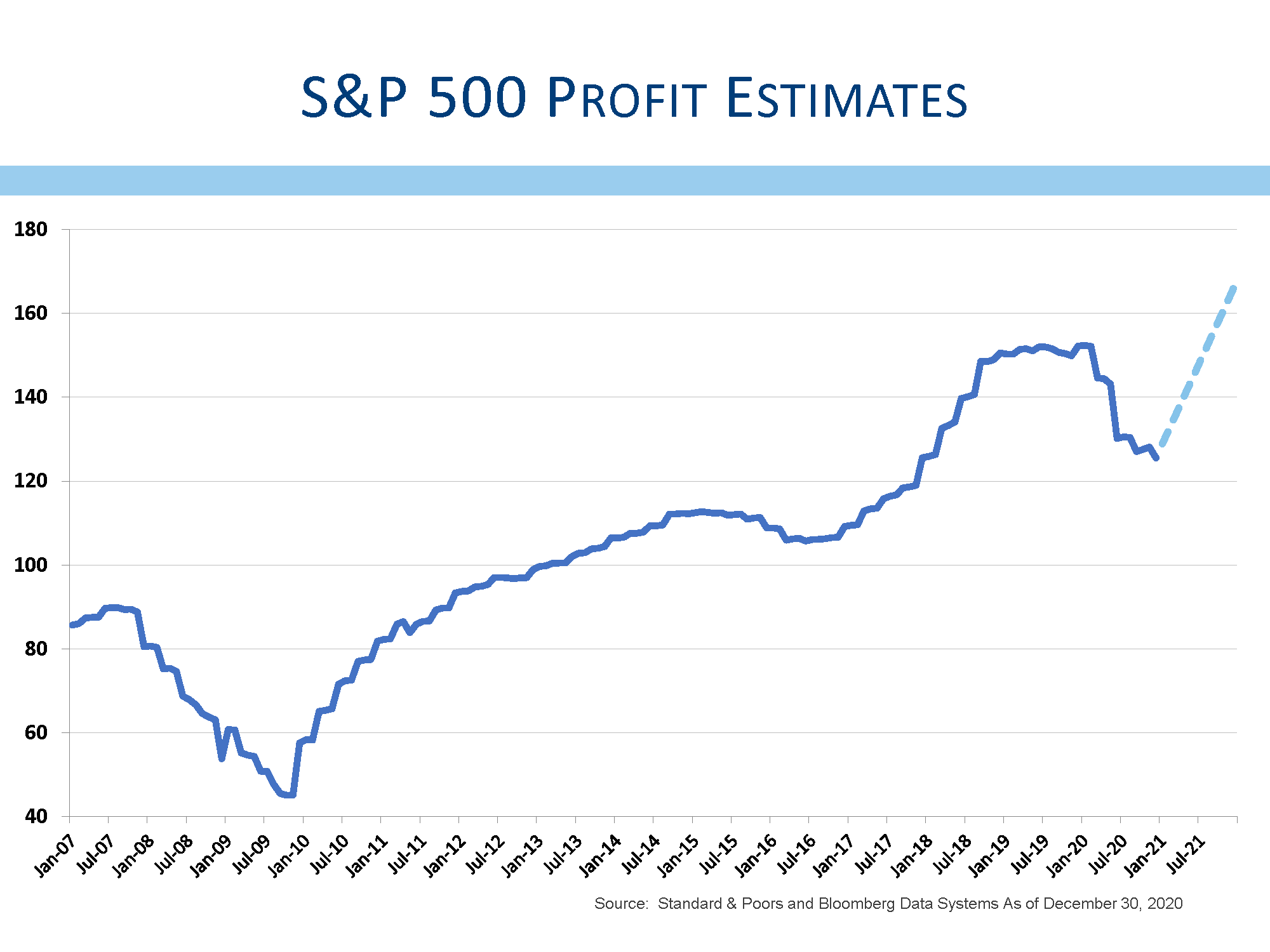

One of the questions we have been asked most frequently is “how can the stock market be doing so well when the economy is in such shambles?” The simple answer is the stock market looks ahead, and the outlook for 2021 remains quite robust. In fact, current estimates of how fast the economy will grow in 2021 suggest it will be one of the strongest years in decades. Yes, it follows the quickest and steepest decline in history, but the stock market has an uncanny ability to ignore the rear-view mirror. GDP, the measure of the total output of goods and services produced by an economy, remains about 3% below the peak attained in the final quarter of 2019 (unadjusted for inflation). This should easily be exceeded before 2021 is over, bringing output to all-time record highs.

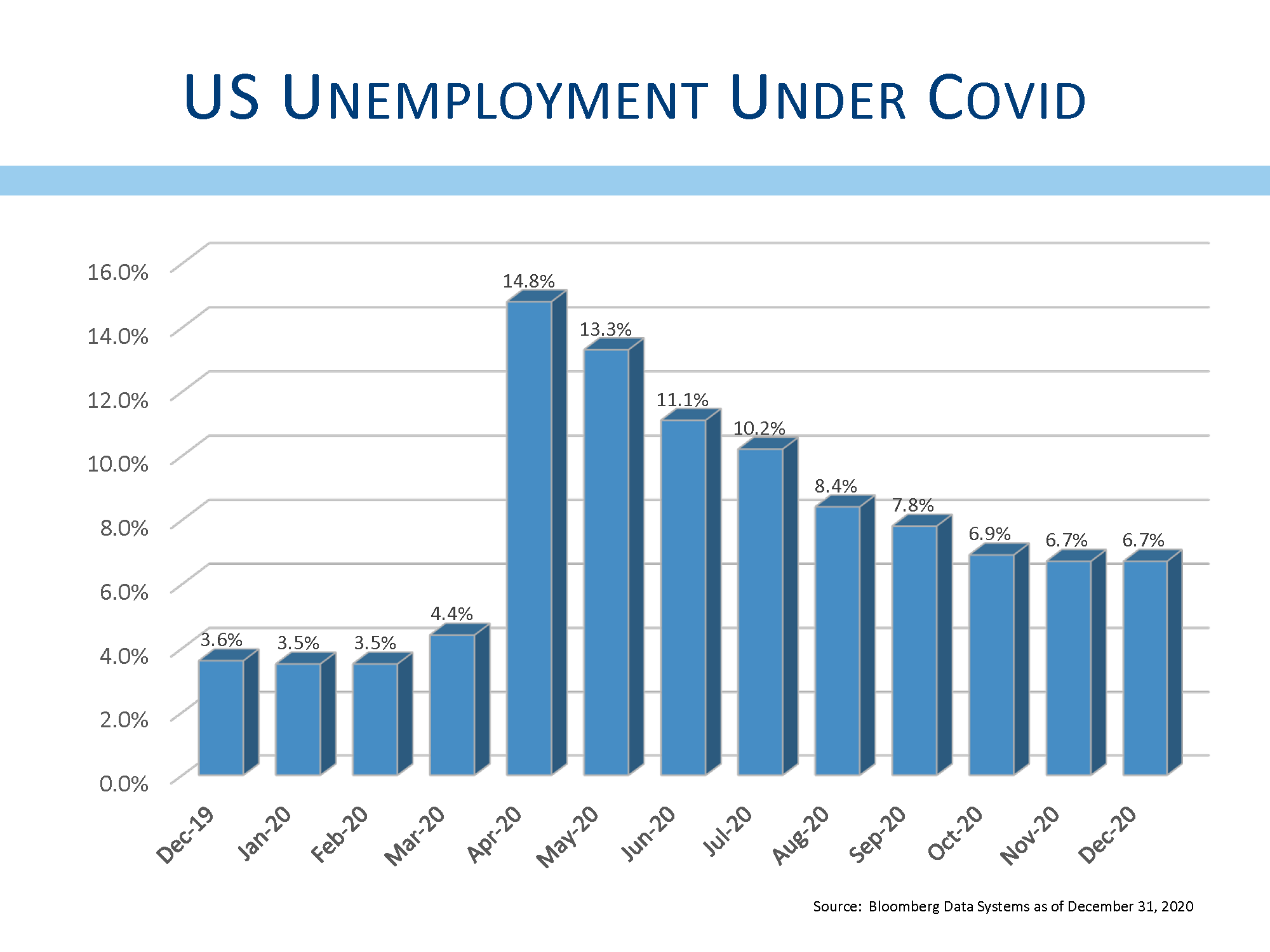

One way to show how much the economy has improved is to look at the unemployment rate. Prior to the lockdown the unemployment rate was holding steady at about 3.5%, a multi-decade low. The pandemic quickly changed that as unemployment shot up to 14.9% last spring. For perspective, the highest unemployment rate during the Great Recession was 10% in October of 2009. The only time the unemployment rate was higher was during the Great Depression when nearly one in four workers found themselves without their desired employment.

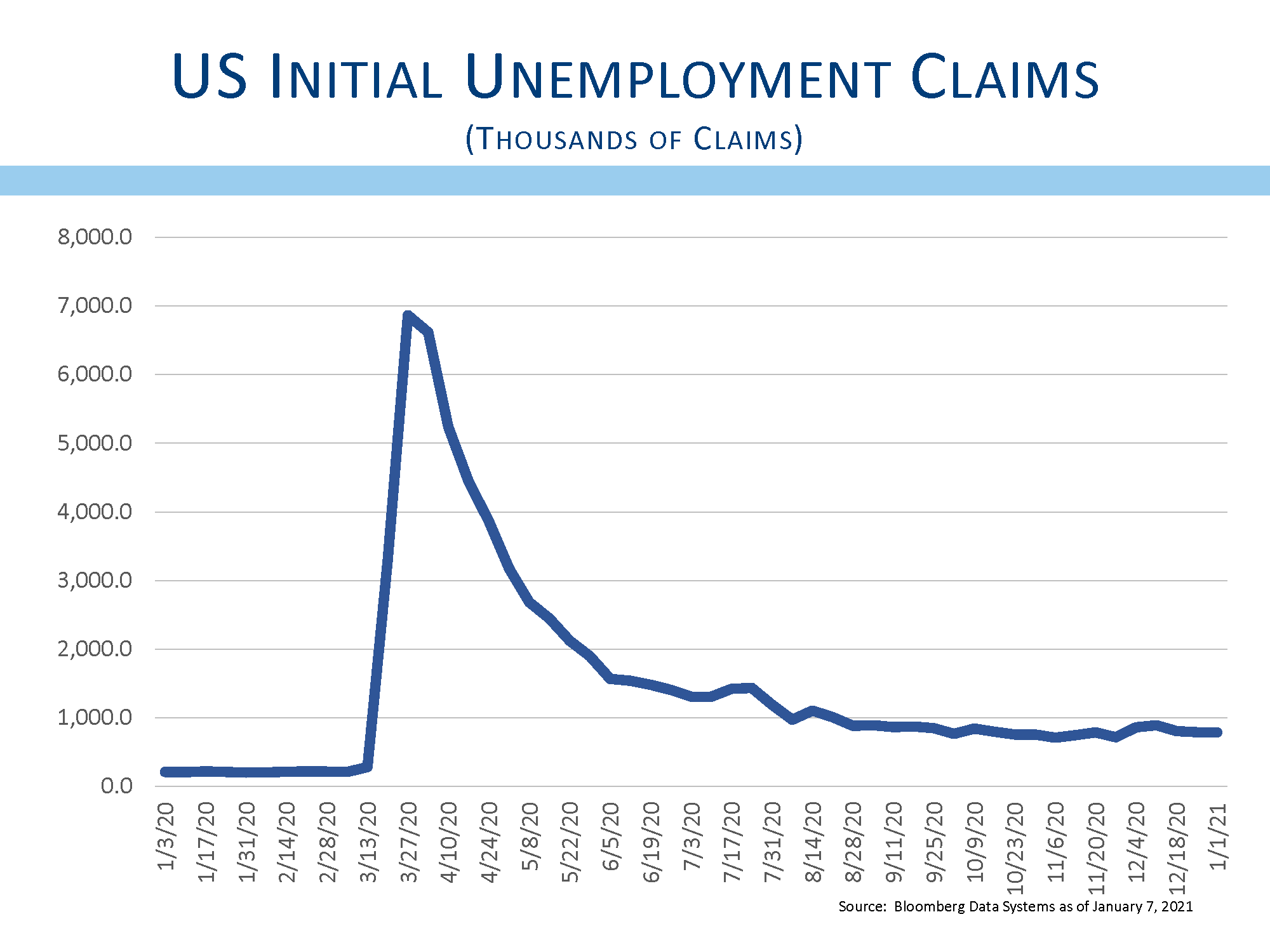

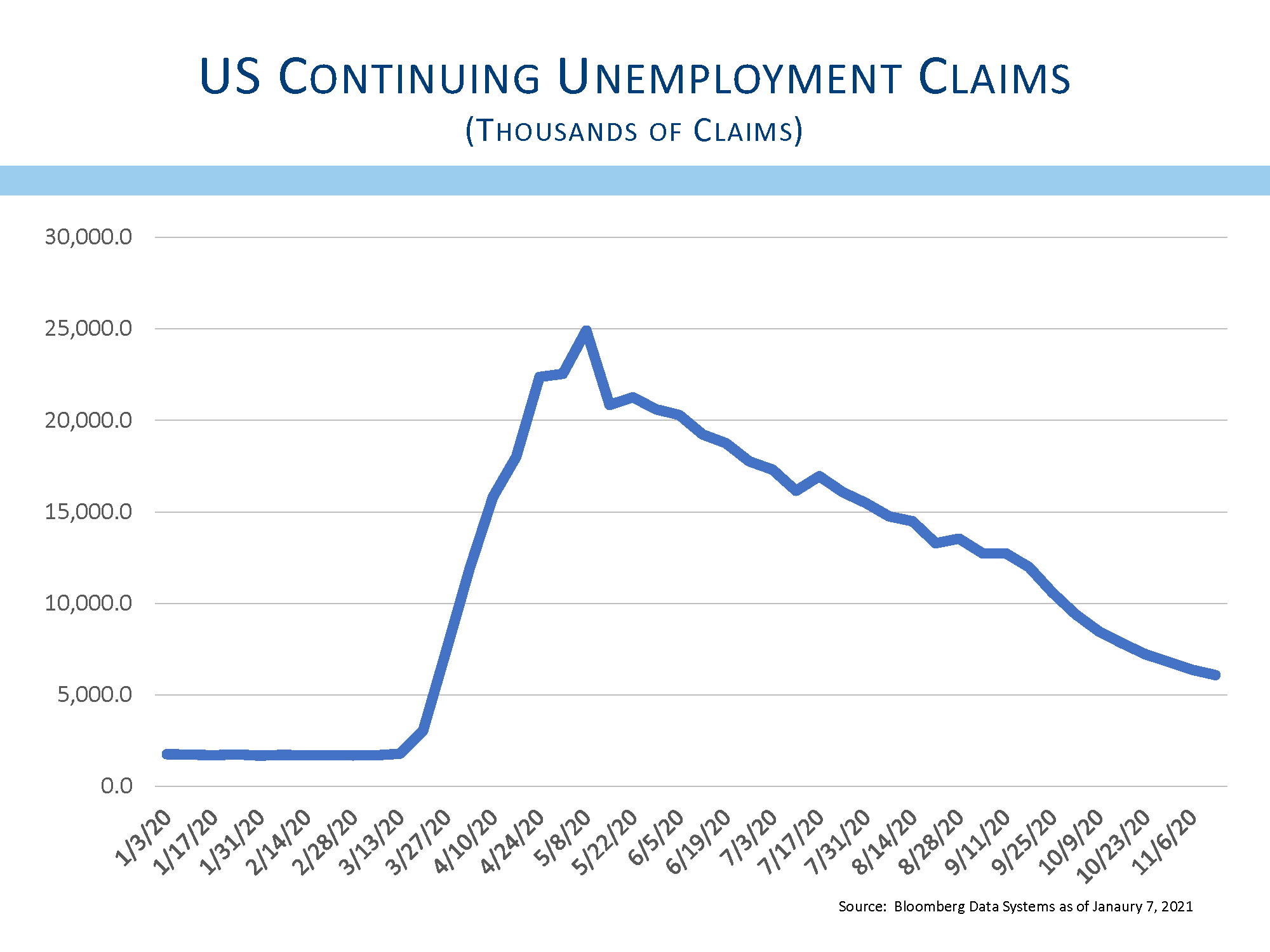

From that April peak, the unemployment rate has steadily declined to 6.7% this past December, just slightly above the 6.3% average unemployment rate over the past 50 years. Yes, 6.7% suggests that many millions remain unemployed as compared with pre-pandemic levels. The improvement, however, from the April nadir remains quite impressive. Even more constructive is the improvement in the number of people collecting unemployment benefits (continuing claims), and the number of people filing new claims for unemployment benefits (initial claims). While the initial claims number has risen modestly during the past several weeks, the improvement in employment is likely to continue as we look through this new year.

Improvements in the economy are likely to continue as we look ahead through 2021, even as the number of covid cases, hospitalizations, and fatalities remains elevated this winter. Vaccinations are coming with two having already received emergency use authorization from the FDA, and several more completing third phase clinical trials for safety over the next few weeks.

The economic recovery is an important investment theme as we look ahead to 2021. There is huge pent-up demand for travel, dining out, and all things that have been so difficult during lockdowns. People will once again be able to go to the mall, do some shopping, catch a movie, and have dinner out. How normal. This pent-up demand should drive a return to profitability for many companies.

We do not mean to dismiss the enormous number of businesses that will be lost through the pandemic. Many entrepreneurs’ life savings will be lost. Successful businesses will find themselves a few too many months away from that recovery and will be forced to close.

Chefs want to cook and other entrepreneurs will step into the void to create new restaurants and businesses. In many ways, the recovery from Covid will create a Phoenix where new businesses will grow from the ashes of businesses lost. Economic growth will be robust as consumers are free to consume and new business formations will create job growth throughout the year.

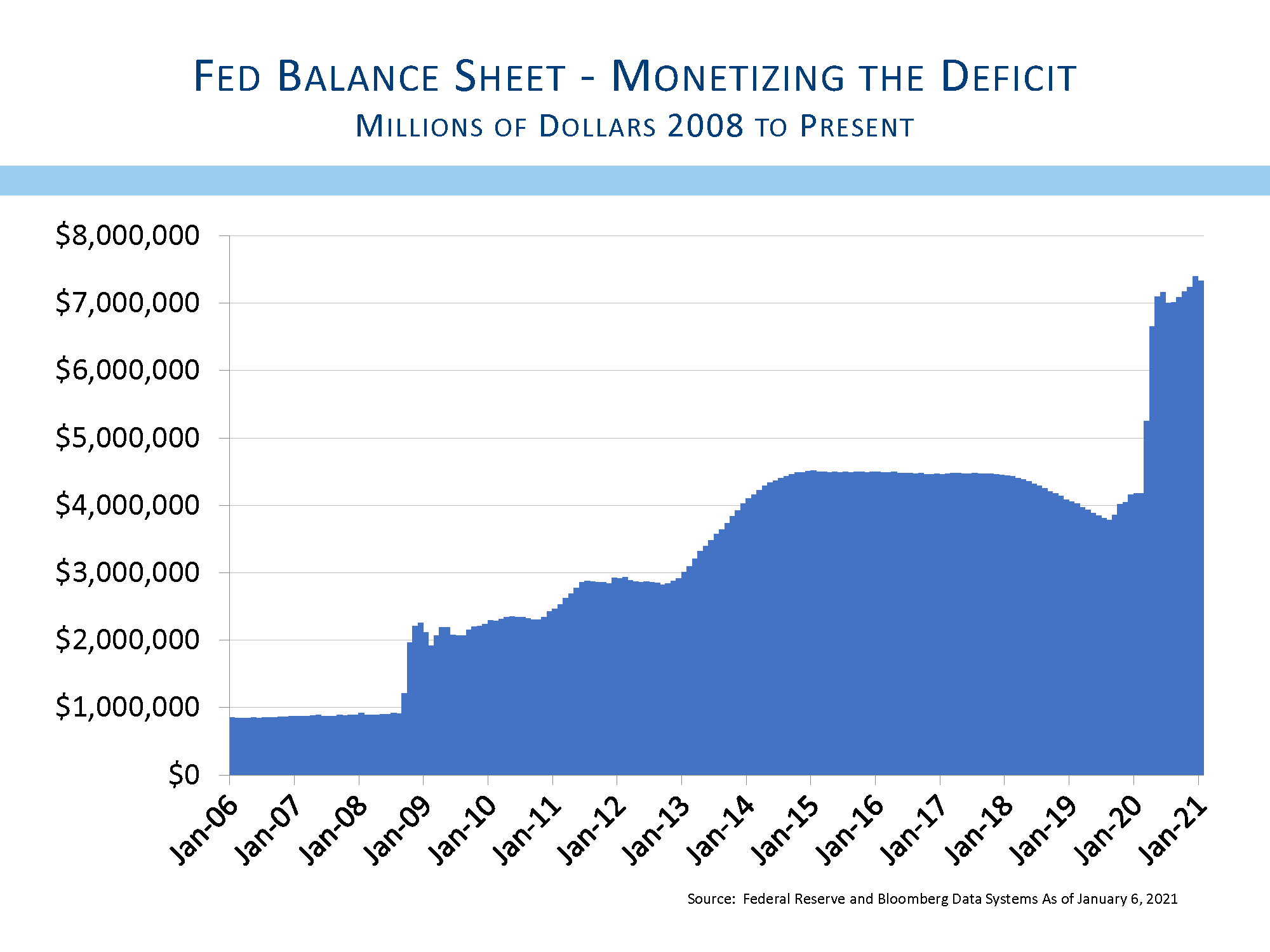

The prospects for an improving economy will continue to drive corporate earnings higher, helping support the stock market. We would, however, be remiss not to mention the effect of the extraordinary monetary stimulus that the Fed has been pumping into the system.

As businesses began to shutter and as the outlook seemed dire, credit markets began to freeze. Businesses were unable to raise funds, and with uncertainty increasing daily, it seemed likely that the health care crisis would become another financial crisis. Taking a page from the steps taken a decade earlier during the Great Recession, the Fed opened the spigots. They pumped money into the system and continue pumping to this day.

The Fed has been successful in making sure the health care crisis did not also become a financial crisis. They did a masterful job of providing liquidity to the system. While there are some risks of inflation from their policies,(we wrote about the inflation risks extensively in last quarter’s report so we will avoid boring you further) one of the biggest unintended consequences of their action is that this enormous amount of money had to find a home. The Fed has been buying government bonds and other instruments to the tune of about $100 billion a month (yes one hundred billion dollars a month is not a typo), and this has pushed interest rates down and made bonds less attractive.

Investors seeking attractive opportunities have found the stock market. One strategist suggested “There Is No Alternative” and dubbed stocks a “TINA” market, as money has flooded into the stock market. While the coming economic recovery is critical for the continued success of the stock market, the impact of the Fed’s extreme pool of liquidity should not be underestimated. Stock prices have clearly benefitted from the Fed’s actions, and Fed commentary suggests this environment is unlikely to change anytime soon.

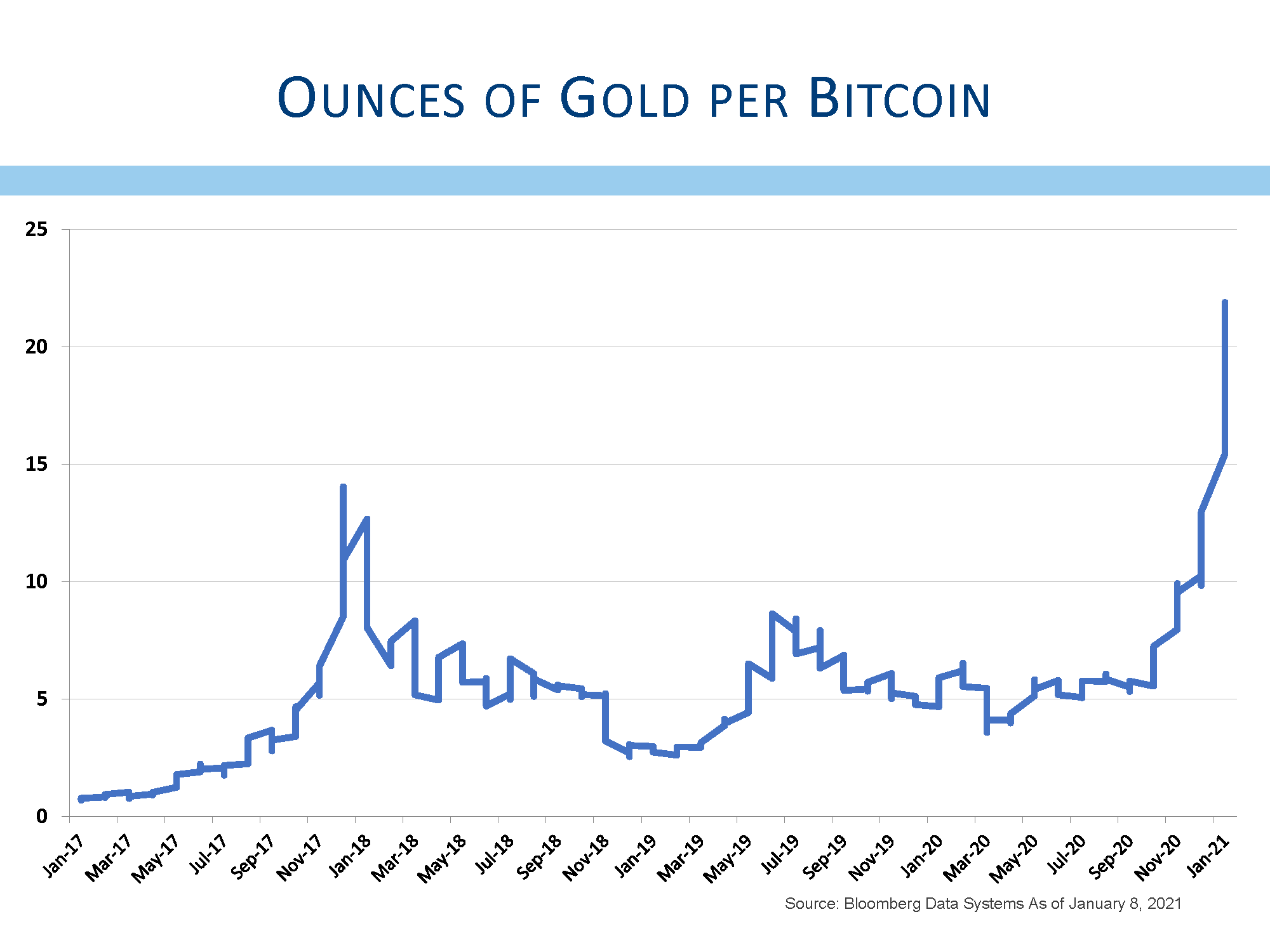

Like any policy, there are always unintended consequences of the Fed’s actions. It is entirely possible that the stock market has gotten ahead of the fundamentals and the potential earnings recovery expected for the year to come. There are also significant signs of excess speculation that should make investors a little nervous. One example of the places where we see excess speculation is the price of Bitcoin.

Bitcoin is being portrayed as a “store of value,” and a hedge against the inflationary risks of significant budget deficits. Some of us struggle with the idea that Bitcoin is a store of value, especially considering the enormous gains seen over the past few months. Even compared with gold, which is typically seen as a global hedge against worthless paper currencies, the price of Bitcoin seems to represent more speculation than actual utility as a cash substitute. Speculation is a sign of a market that is too frothy—too far from the fundamental values.

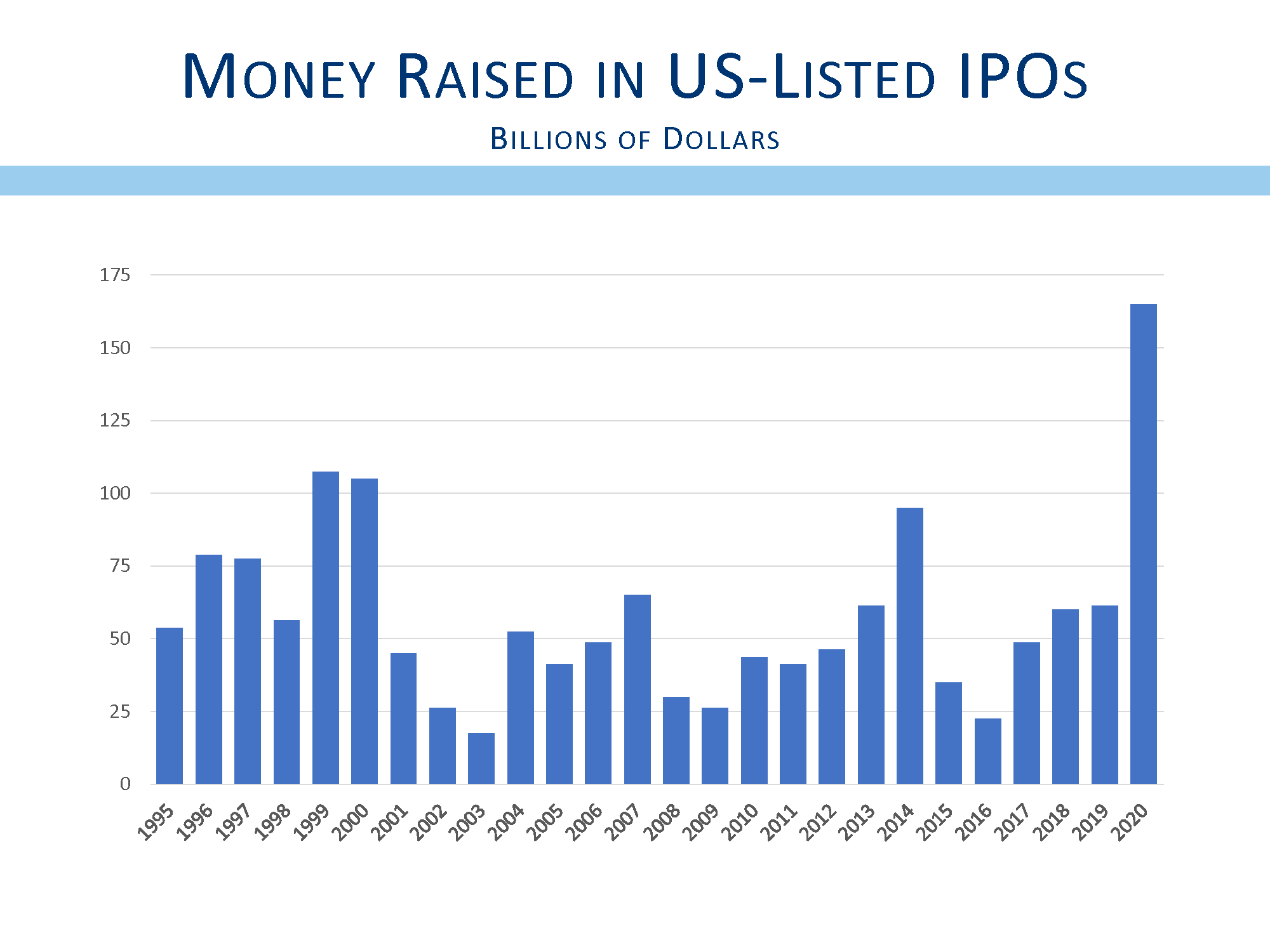

Another sign of speculation is the number of IPOs (Initial Public Offerings) being sold to investors. The amount of money raised in IPOs in 2020 is the largest in history, even larger than the peak of the internet bubble in 1999-2000. Even more disconcerting is the amount of money being raised in blank check companies. These Special Purpose Acquisition Companies (SPACs) raise money with the intent of buying something in the future. Buying what you may ask? That is a good question. While some SPACs have a focus, such as robotics or biotechnology, the vast majority allow management to buy any business they deem worthy. Investing in the IPO for AirBnB represents an investment in a hospitality company you may have used, but investing in a SPAC suggests you are investing in an unnamed opportunity of the managers’ choosing some time in the future. Nearly half of the funds raised in IPOs in 2020 went into SPACs. That seems like the very classic definition of speculation.

Speaking of the IPO for AirBnB, another sign of excess speculation is when IPOs begin trading far above the price that the company and investment bankers set for the security. AirBnB opened up 215% above the price set by their bankers. At current prices, the stock of AirBnB is worth more than the combined market capitalizations of Mariott, Hyatt, Hilton, Wyndam, and Choice Hotels. Yes, their business models are different. AirBnB does not build or own brick and mortar lodging facilities, and AirBnB is certainly growing faster than those old-line hotel chains, but what is the right value for a lodging service provider that might make money two years from now? AirBnB currently trades at about 20X revenue. At its peak in March of 1999, Amazon.com traded at more than 45X sales, so perhaps AirBnB is attractive. Without passing any judgement on the specific value of AirBnB, we are simply suggesting that there are signs of excess speculation that might not be a healthy sign for investors.

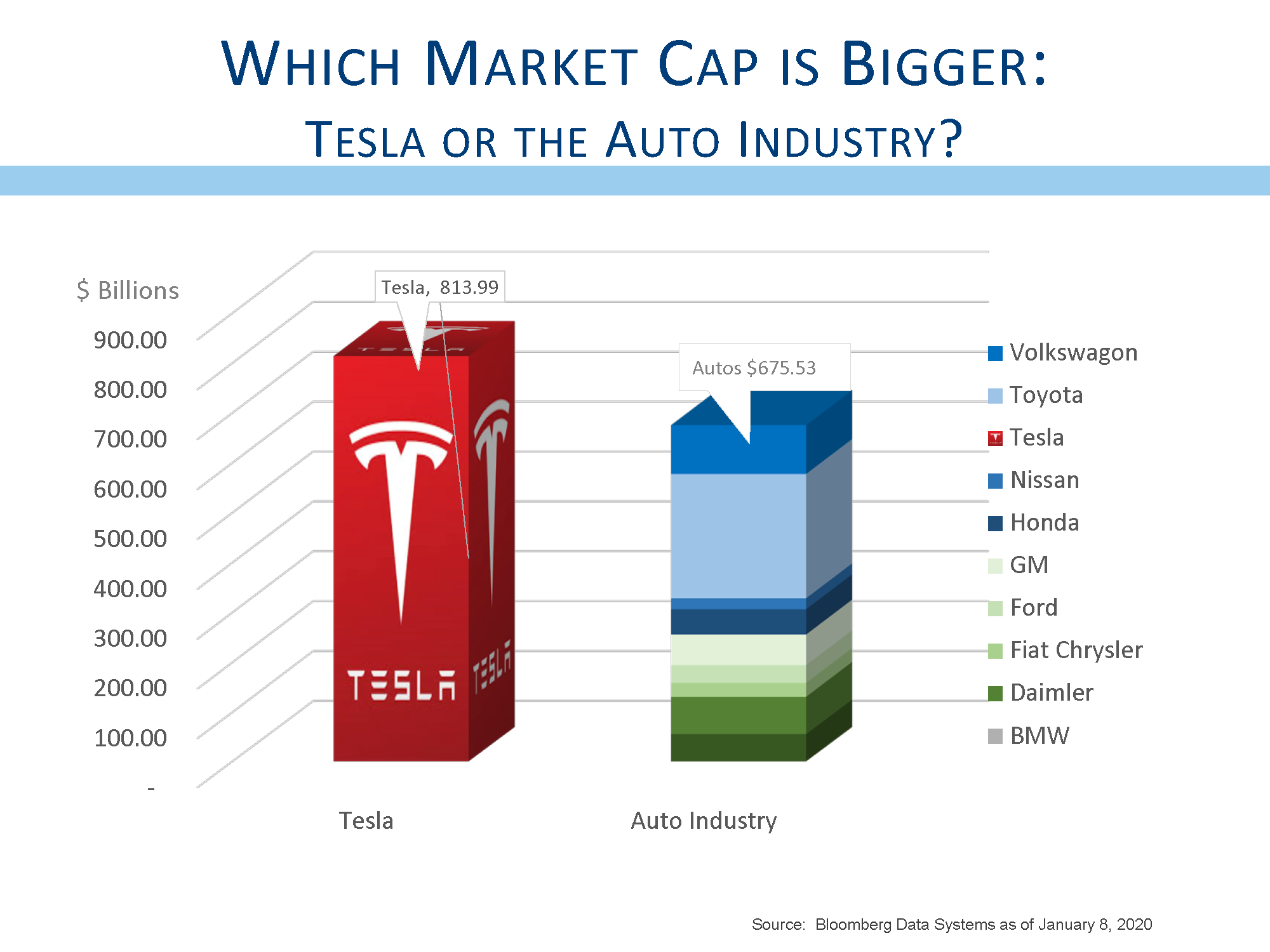

We have studied other examples of companies that seem expensive relative to their peers. One of the easiest to pick-on is Tesla (for full disclosure I am a happy owner of a Model 3 sedan). Tesla is an extraordinary company with an excellent product, leading technology, a visionary leader, and an enviable growth rate. Despite these characteristics, should Tesla’s stock be worth more than the combined value of BMW, Daimler, Fiat Chrysler, Ford, General Motors, Honda, Nissan, Toyota and Volkswagen? This troubles us.

These examples of speculation do not necessarily suggest a market that is vulnerable, but it does suggest some individual stocks may be particularly risky. It may be that the best performing stocks of 2020 will not be the companies that lead the market in 2021. Savvy stock-picking will be necessary to find companies that can benefit from the anticipated economic recovery and still represent reasonable value for investors.

At the beginning of each year, we poll our portfolio managers and investment committee members for their outlook on the year ahead. It is interesting to review those prognostications one year later to see who was insightful and who was delirious. We ask our committee to forecast stock prices and interest rates. We ask for people to pick their best sector or industry, and also to pick the single stock that they expect to truly shine during the year. We also ask our staff to consider what surprises might present themselves during the year. The idea behind surprises to have people think outside-the-box, and consider those unlikely things that could actually happen. Like a fire drill, it helps to prepare for the unexpected.

Obviously, no one even remotely expected a pandemic. Several members thought growth would be quite slow, but only one portfolio manager suggested that the surprise for 2020 would be a recession. (A bottle of his favorite Irish whiskey is headed his way.) Our estimate for stock appreciation was too low, while our forecast for higher interest rates was way off. A couple of people worried about a spike in oil prices, while others made thoughtful arguments that the US dollar would weaken (it did).

One of the surprises discussed the prospects for a trade deal with China. It was easy to forget that we were in the midst of a trade war prior to the onset of the pandemic. President Trump had put tariffs on goods imported from China, and we were working to complete trade negotiations with China to prevent further escalation of the war. The trade war seems like a lifetime ago, and it is interesting how quickly our focus was drawn away from one of the most important issues that dominated the news less than one year ago.

China is the second largest economy in the world, and it is imperative that we develop a trade policy that recognizes the economic position of China. We are hopeful that the New administration will make progress in our relations with China.

As I complete writing this letter, I am watching live coverage of the violent protest in our Nation’s capital. Nothing could be more discouraging. No matter your political allegiance, we can all agree that violence and terrorism will not lead to a better country and it will not lead to a better economy.

In fact, quite the contrary. The message of this letter has been to reinforce the belief that 2021 will be better. As more people get vaccinated, the economy will strengthen and corporate earnings will recover.

If domestic violence becomes more commonplace, consumers will fear going out in public, and the prospects for a better economy could easily go up in terrorist smoke. This represents a risk that we thought was fairly unlikely, but after today, we must take more seriously. For the sake of all of us, we hope today’s violence represents a singular and unusual action.

Everyone at L&S continues to work tirelessly to make sure that we meet or exceed your needs. Please do not hesitate to contact us with your questions and concerns. This has been a very difficult time, something that none of us could have foreseen a few short months ago. We remain confident that American ingenuity will beat this unfortunate illness. Stay well, stay safe, and stay sane. Happy New Year one and all.

Bennett Gross CFA, CAIA

President

L&S Advisors, Inc. (“L&S”) is a privately owned corporation headquartered in Los Angeles, CA. L&S was originally founded in 1979 and dissolved in 1996. The two founders, Sy Lippman and Ralph R. Scott, continued managing portfolios together and reformed the corporation in May 2006. The firm registered as an investment adviser with the U.S. Securities and Exchange commission in June 2006. L&S performance results prior to the reformation of the firm were achieved by the portfolio managers at a prior entity and have been linked to the performance history of L&S. The firm is defined as all accounts exclusively managed by L&S from 10/31/2005, as well as accounts managed in conjunction with other, external advisors via the Wells Fargo DMA investment program for the periods 05/02/2014, through the present time.

L&S claims compliance with the Global Investment Performance Standards (GIPS®). L&S has been independently verified by Ashland Partners & Company LLP for the periods October 31, 2005 through December 31, 2015 and ACA Performance Services for the periods January 1, 2016 to December 31, 2019. Upon a request to Sy Lippman at slippman@lsadvisors.com, L&S can provide the L&S Advisors GIPS Annual Disclosure Presentation which provides a GIPS compliant presentation as well as a list of all composite descriptions. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

L&S is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is notice filed in various states. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that L&S or any person associated with L&S has achieved a certain level of skill or training. L&S may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. Information in this newsletter is provided for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. Any communications with prospective clients residing in states or international jurisdictions where L&S and its advisory affiliates are not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Opinions expressed herein are subject to change without notice. L&S has exercised reasonable professional care in preparing this information, which has been obtained from sources we believe to be reliable; however, L&S has not independently verified, or attested to, the accuracy or authenticity of the information. L&S shall not be liable to customers or anyone else for the inaccuracy or non-authenticity of the information or for any errors of omission in content regardless of the cause of such inaccuracy, non-authenticity, error, or omission, except to the extent arising from the sole gross negligence of L&S. In no event shall L&S be liable for consequential damages.

The S&P 500 index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment. The composition of L&S’ strategies generally differs significantly from the securities that comprise the index due to L&S’ active investment process and other variables. L&S does not, and makes no attempt to, mirror performance of the index in the aggregate, and the volatility of L&S’ strategies may be materially different from that of the referenced indices.

L&S’ current disclosure statement as set forth in ADV 2 of Form ADV as well as our Privacy Notice is available for your review upon request.